Back

Shashank Vishwakarma

Be creative every ti... • 1y

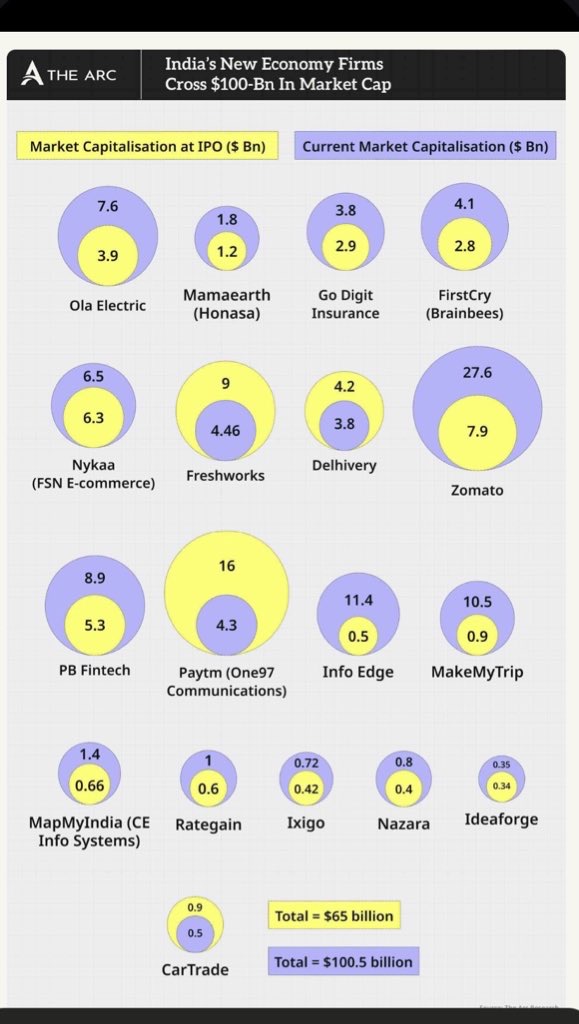

Will OLA survive in NSE ? It is already a loss making company. Zomato listed there company after they become profitable. And you know the story about Paytm.

Replies (1)

More like this

Recommendations from Medial

Business karo India

Business karo India ... • 8m

Do you agree **Two types of startups dominate India today:** 1. **Profit-focused startups** – They grow steadily, solve real problems, and build sustainable models. 2. **Valuation-focused startups** – They chase funding, burn cash on discounts, an

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

I think current Indian startup don't have guts to fulfill their promises like other foreign brands Blinkit Big basket Zomato swiggyy Ola Hood Paytm Etc...... Some are promising 10 min delivery , ( ai ) , ev , sequrity , anonymous chating , any s

See MoreAccount Deleted

Hey I am on Medial • 2y

Do you think that Zomato Will Become $100 Billion Company By 2030 As Deepinder Goyal Said that?! Their full focus on Blinkit and Hyperpure Business? According to me , Zomato Will become $100 Billion Dollars Company by because Mostly people buy onli

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)