Back

Anonymous

Hey I am on Medial • 1y

A SAFE (Simple Agreement for Future Equity) is an agreement between an investor and a company that provides rights to the investor for future equity without determining a specific price per share at the time of the initial investment. It is a flexible funding mechanism commonly used by startups to avoid complex valuations during early funding rounds. Example:Let's say your startup needs to raise capital quickly, but there is uncertainty around the company's current valuation. You use a SAFE agreement to attract investors. Here’s how it works:No Interest or Maturity Date: Unlike a convertible note, a SAFE doesn’t accrue interest or have a repayment date. Future Equity: The investor will receive equity when the company holds a priced round in the future.Valuation Cap or Discount: Often, a SAFE includes a valuation cap or a discount, giving the investor a beneficial price per share when the SAFE converts to equity.

More like this

Recommendations from Medial

Nikhil Raj Singh

Entrepreneur | Build... • 11m

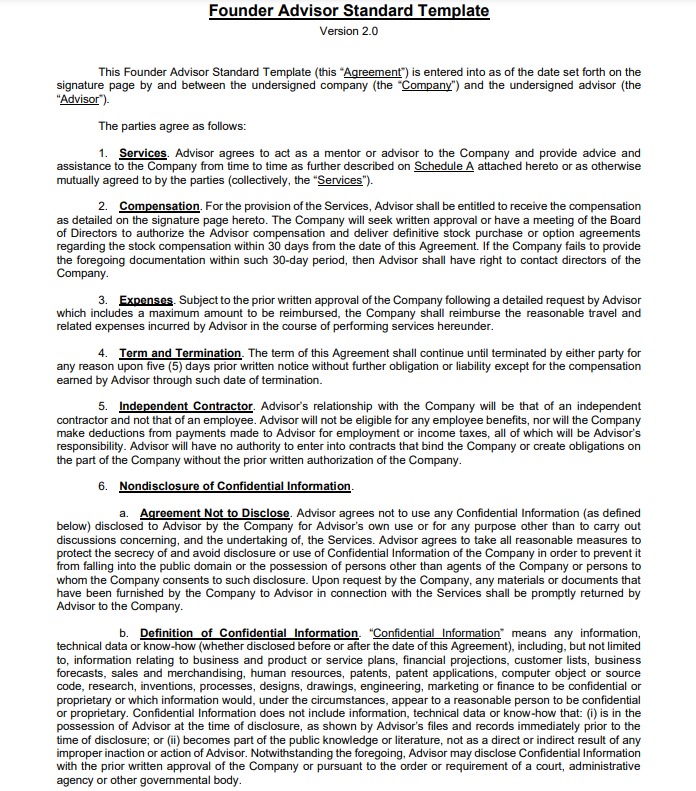

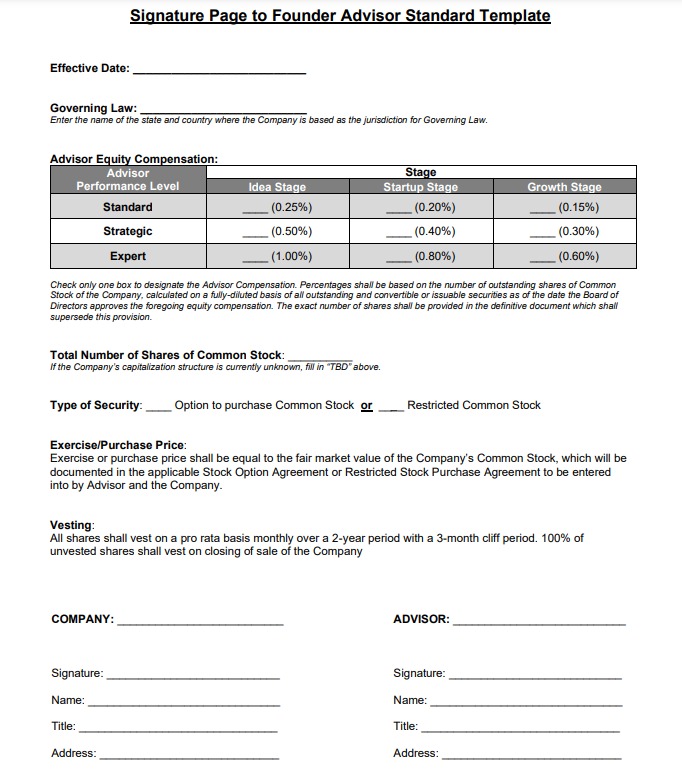

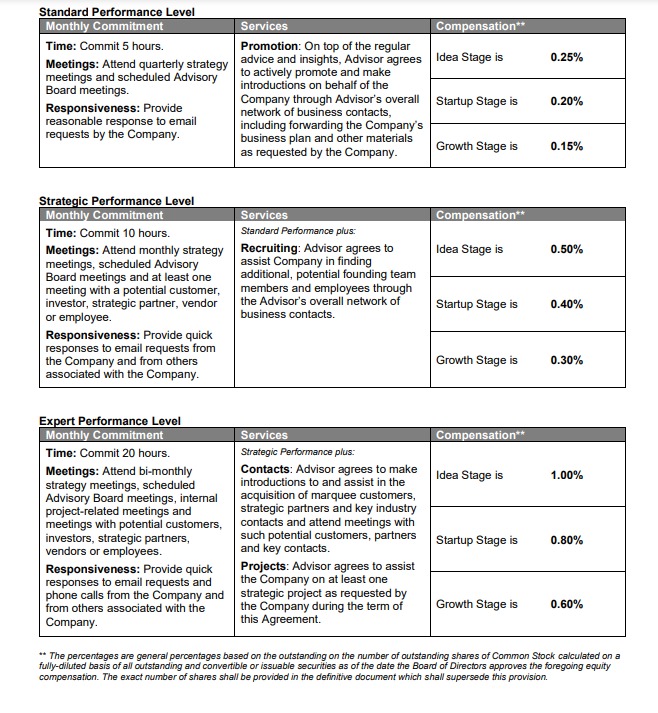

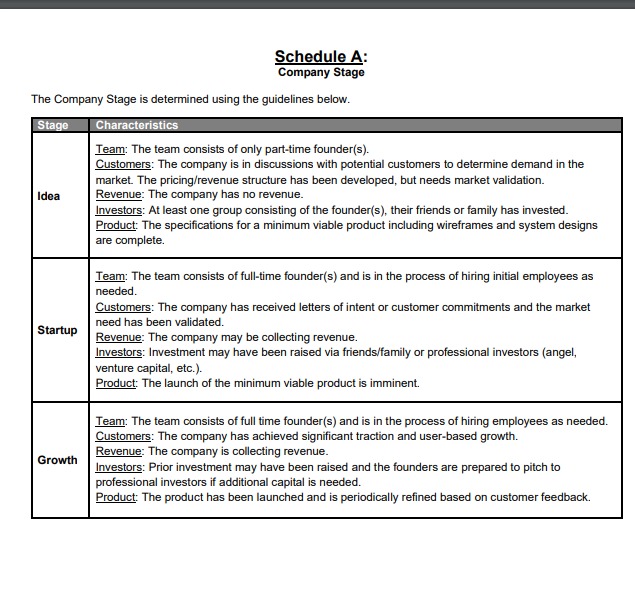

🚀 Startup Founders, Don’t Skip This! 🚀 Advisors add value. But a clear agreement keeps everything aligned—roles, equity, time, and expectations. Avoid future headaches, set things straight from day one. ✅ Download a free Founder-Advisor Agreement

See More

satyam singhal

Entrepreneur I Busin... • 11m

AI is changing the game—meet No Cap 🚀 No Cap isn’t your average angel investor—she’s the world’s first AI angel investor. She’s already funded her first startup, wiring $100k in just minutes after hearing the pitch. But No Cap doesn’t stop at writi

See MoreSaurabh Singhavi

Assisting Early-Stag... • 11m

The Hidden Power of the Cap Table! I have seen many entreprenueurs struggling with their cap table just before the funding round and at that point, its not easy to cleanup the mess! Cap Table is the DNA of your startup’s ownership and if you’re not

See More

financialnews

Founder And CEO Of F... • 1y

“Nifty Smallcap Stocks: 50% Trading 20-42% Below 52-Week Highs – Investor Strategies” “Dalal Street Small-Cap Stocks: Investor Interest Wanes Amid Weak Earnings, Geopolitical Tensions, and Profit-Taking” Investor interest in small-cap stocks on Dala

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)