Back

Anonymous

Hey I am on Medial • 1y

What is — Anti-Dilution Provision An anti-dilution provision is a contractual clause that protects investors from losing their ownership percentage if new shares are issued at a lower price than their initial investment. This provision ensures that investors can purchase additional shares at the lower price to maintain their ownership stake. Example: Imagine you invested in a startup and bought 1,000 shares at $100 per share, totaling an investment of $100,000. Now, the company is raising funds again and issues 1,000 shares at $80 per share.With an anti-dilution provision, your investment is protected. This means you would have the right to purchase additional shares at the $80 price to maintain your ownership percentage and ensure your investment value doesn’t decrease. This helps investors avoid having their stake diluted when new shares are issued at a lower price.

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

Starting a startup is exciting, but understanding the shareholder agreement (SHA) is crucial. Today, let's focus on Dilution. What is dilution? Imagine you and a friend each own half a pizza (50% each). If you bring another friend in and share more

See More

Jeet Sarkar

Technology, Developm... • 1y

Nazara Technologies Ltd, a Mumbai-based mobile gaming and sports media company, has issued shares worth Rs 100 crore to Nithin Kamath and Nikhil Kamath, the founders of Zerodha. The move is part of a broader investment in which Nazara allocated 28.

See Moreplanify

pre-IPO shares, ESOP... • 21d

Unlisted shares of SBI Mutual Fund represent ownership in the AMC before it becomes publicly traded. These shares are exchanged privately, often among long-term investors and institutions. visit here:- https://www.planify.in/research-report/sbi-mutua

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

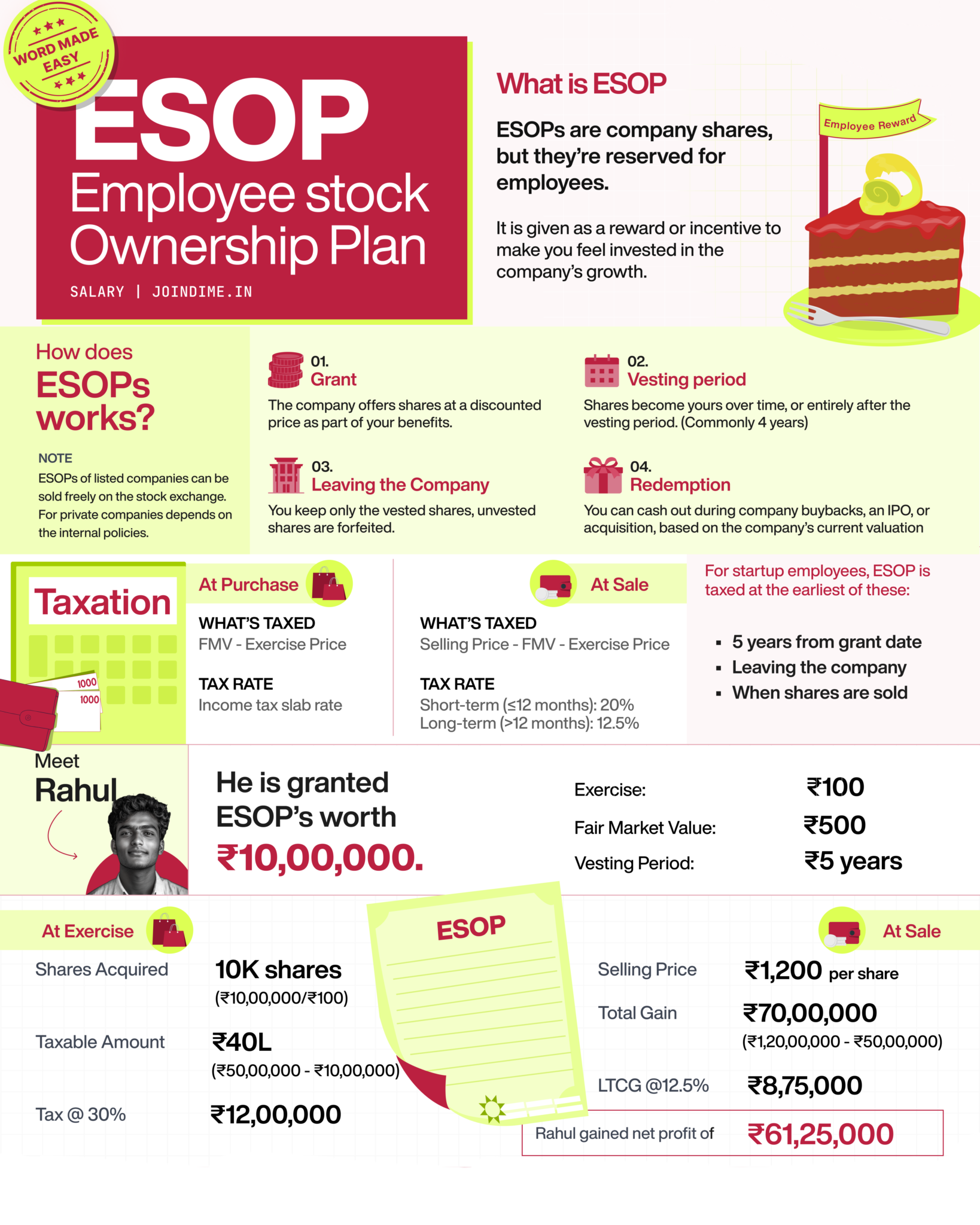

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

financialnews

Founder And CEO Of F... • 1y

Breakout stocks to buy or sell: Sumeet Bagadia recommends five shares to buy today.. Shares to buy today DCM Shriram | Buy in cash at ₹1,255 | Target price: ₹1,320 | Stop loss: ₹1,210 Century Enka | Buy in cash at ₹709.4 | Target price: ₹750 | Stop

See Morefinancialnews

Founder And CEO Of F... • 1y

Waaree Energies shares make strong debut, list at ₹2,500 on NSE, up 66.3% over IPO price . . Shares of Waaree Energies made a strong on the bourses on Monday, October 28, listing at ₹2,500 on NSE, a premium of 66.33 percent to the issue price of ₹1,5

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)