Back

Nujhat Ara

Hey I am on Medial • 1y

I want to link the delivery of goods in the traditional business industry to eliminate the Hectism involved in booking of loads side by side also solving ways of bill that in reality the case of with gst and nom gst products so that the people can just uber/ ola their products to r8 time, place and trust. Interested people dm me.

More like this

Recommendations from Medial

Saisha Bansode

Founder of Maa Mitti... • 11m

Hii This side Saisha, from the city of Hyderabad. I'm working on the transition of non -stick and aluminium cookware to earthenware of the products. Let me know if anyone is interested in the idea. My aim is to promote the use of sustainable product

See MoreDinesh H

Mission to Quit 9 to... • 8m

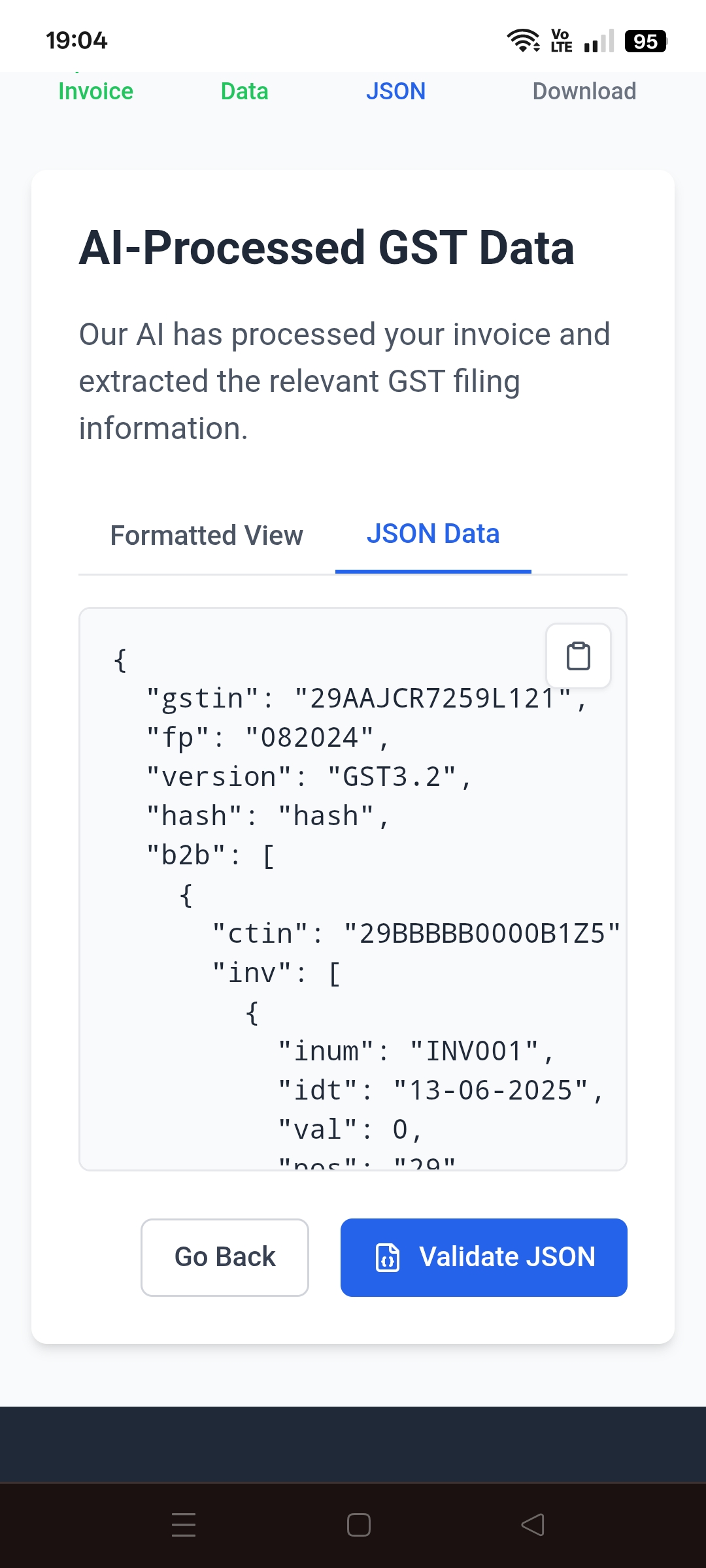

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MoreAshutosh Mishra

Chartered Accountant • 1y

When I posted the poll yesterday for GST, I thought 20-30 people at max would vote and will see accordingly. But 100 people have voted so far. By this I have felt that people know GST through headlines i.e tax collection, GST notices to different co

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)