Back

Acevolt

ENGIPRENEUR's • 1y

Now a days Indian stock market performs a strange it's gave a approx 5.00 percent return in one month even most of the companies PE ratio is not good . What u think it is a bubble ? It's a best time to invest or exit the market ?

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

Today's startups that are going public through their IPOs have a PE ratio that, even if observed currently, is 100x or even 300x higher than the market average, despite the market sentiment being poor right now. It's unclear how these companies will

See MoreAryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreAarihant Aaryan

Prev- Founder & CEO ... • 1y

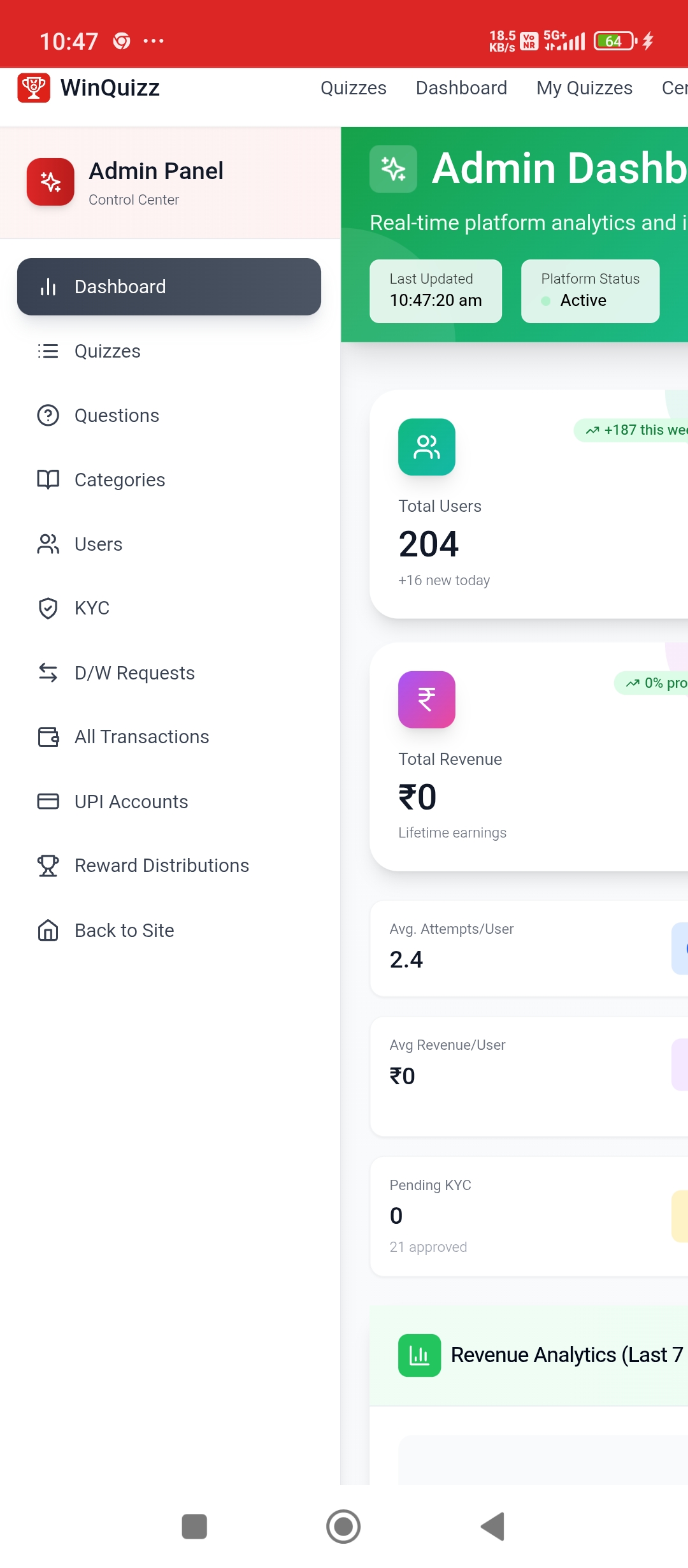

If you're building a consumer app, there are 2 levers that'll make your app successful 1. > 2.5% + Install to paid user ratio 2. Solid retention, most apps are trading apps- user performs an activity and never comes back but great businesses are a

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)