Back

Looper

If nothing goes righ... • 1y

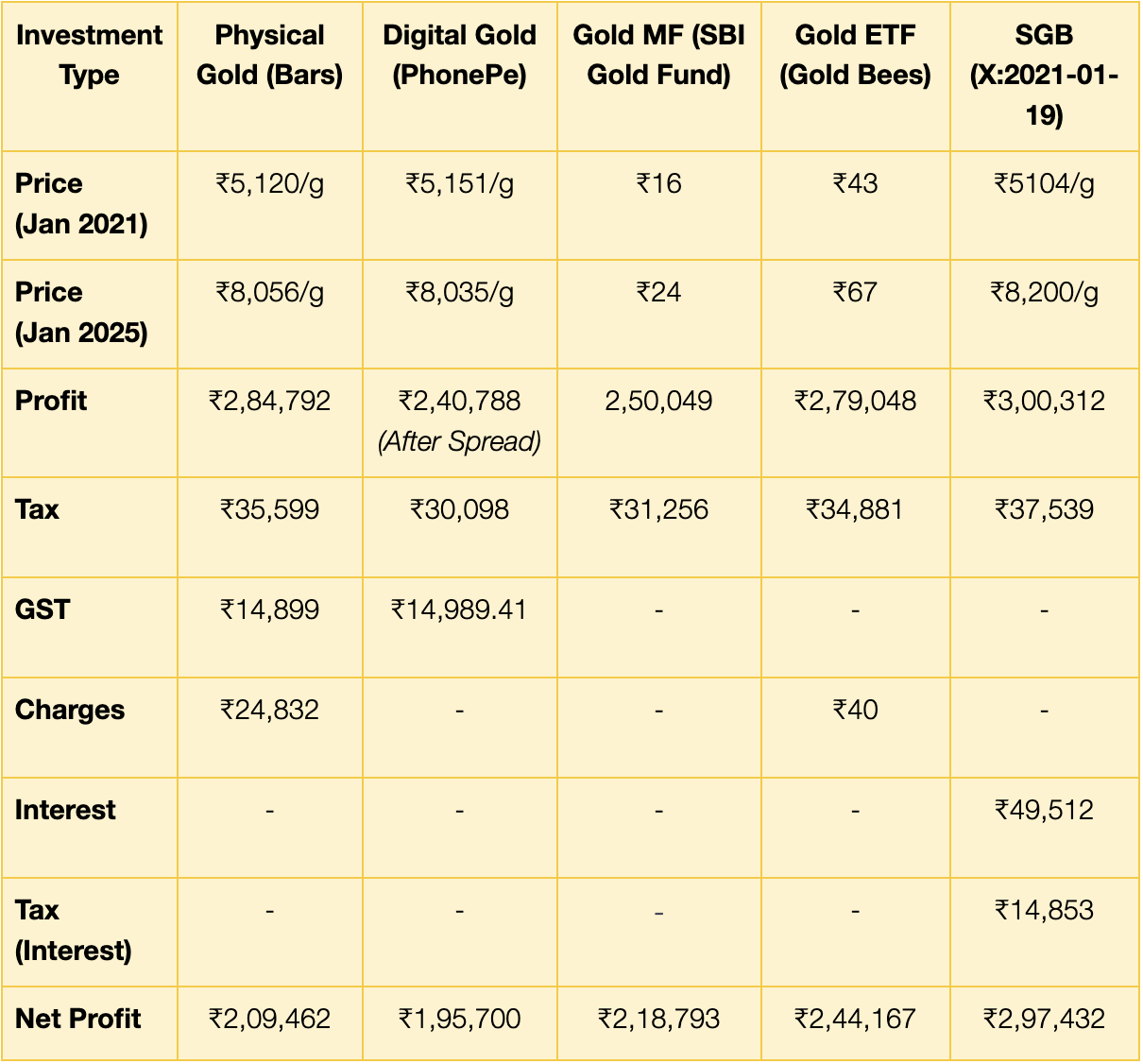

After covid there is literally some boom in some sectors of startups and the mostly impacted one is fintech. People get to know that you can earn by investing, trading and many people who had misconceptions about stock markets even started opening trading and demat accounts. All fintech entrepreneurs made a specific niche businesses on this. Gold saving apps, loan apps, investment tips apps and much more. Currently it is cluttered as hell. People don't know where to invest, which apps to download and all. Also the way fintech apps attract consumers with false conceptions of returns and people will never know what really happening until they withdraw what they invested. They are not showing hidden taxes, charges and all which you will never know until you are some CA or MBA guy atleast. Mainly some gold investment apps, loan apps are huge scam. They are not showing what exactly happening in the name of hidden tax. so people be careful and know exactly what happening in behind.

Replies (5)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Cards Wala

One stop shop for ev... • 3m

#SEBI has cautioned that Digital Gold apps doesn't come under its purview. All the people 'investing' via these apps, you are on your own if something happens. Anyways this is the worst form in which you can invest in Gold. Even physical gold is mu

See More

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See Morevijay gondliya

Hey I am on Medial • 1y

we have diamond and jewelry business we see with time gold loan and banking system is good to make money we want to start nidhi company for gold loan or nbfc for business expansion anybody come and investment with us 100 % profitable business patel

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)