Back

Havish Gupta

Figuring Out • 1y

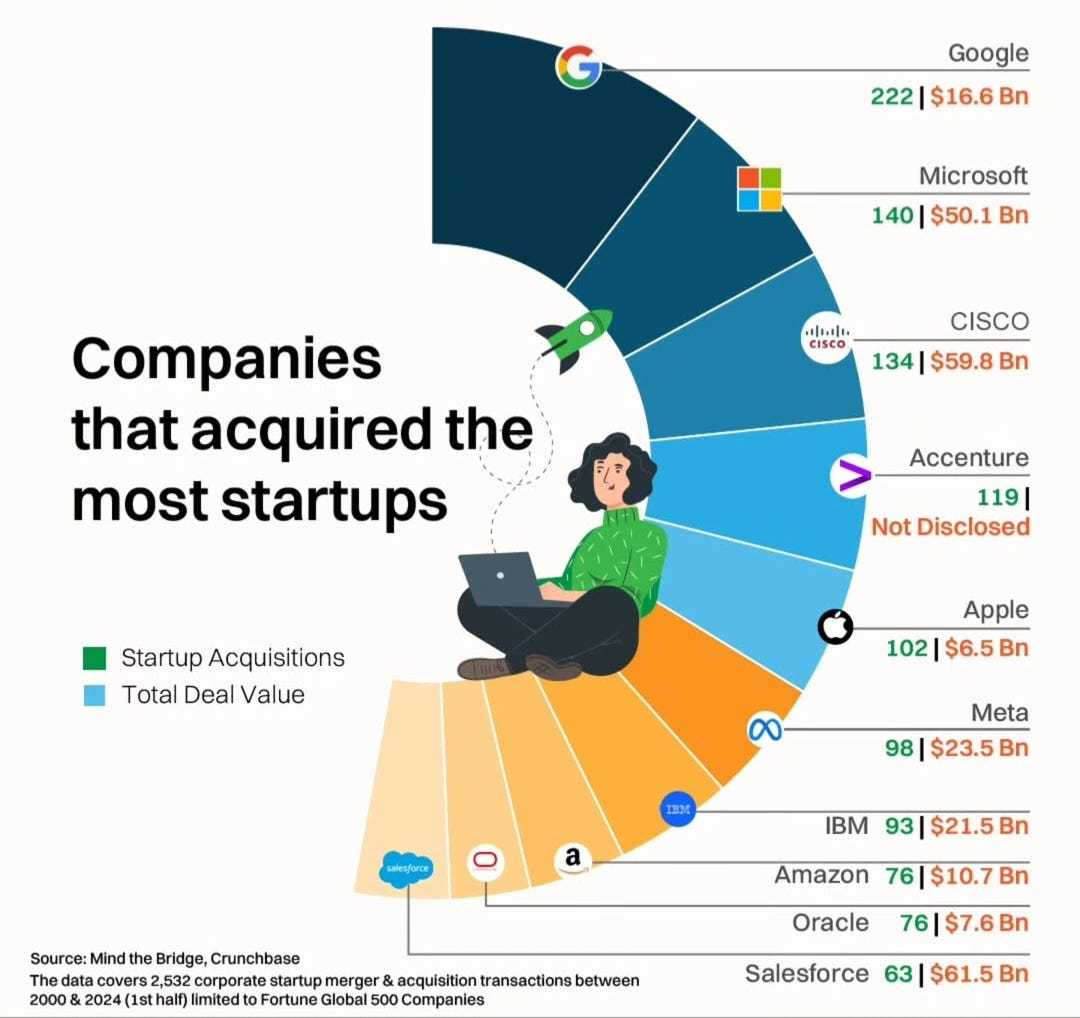

So these investment giant got huge powers as they in some way can control startups and their valuation.

Replies (1)

More like this

Recommendations from Medial

Paras Mandhani

Perpetually Intrigue... • 1y

Coming from a non-metropolitan city, I always felt there is a huge gap between startups targeting devloped cities and these untapped market. Only few known startups are able to penetrate in these market and able to perform. Rest of them , either did

See MoreHimesh Jain

Chasing for infinity • 1y

Play to earn games started as a revolution and going on as a disaster. What's the point of these games they are giving players literally pennies, some good ones are there but they require huge investment. And why these games don't have a good gam

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Unlock the secrets to effectively valuing your startup with our quick guide on the **10 Startup Valuation Models**! This video dives into essential valuation techniques, from the **Discounted Cash Flow** (DCF) method to the **User-Based Valuation**,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)