Back

Anonymous 3

Hey I am on Medial • 1y

Atleast she didn't use the patients credit card so that banks don't loose their money 😂

Replies (1)

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

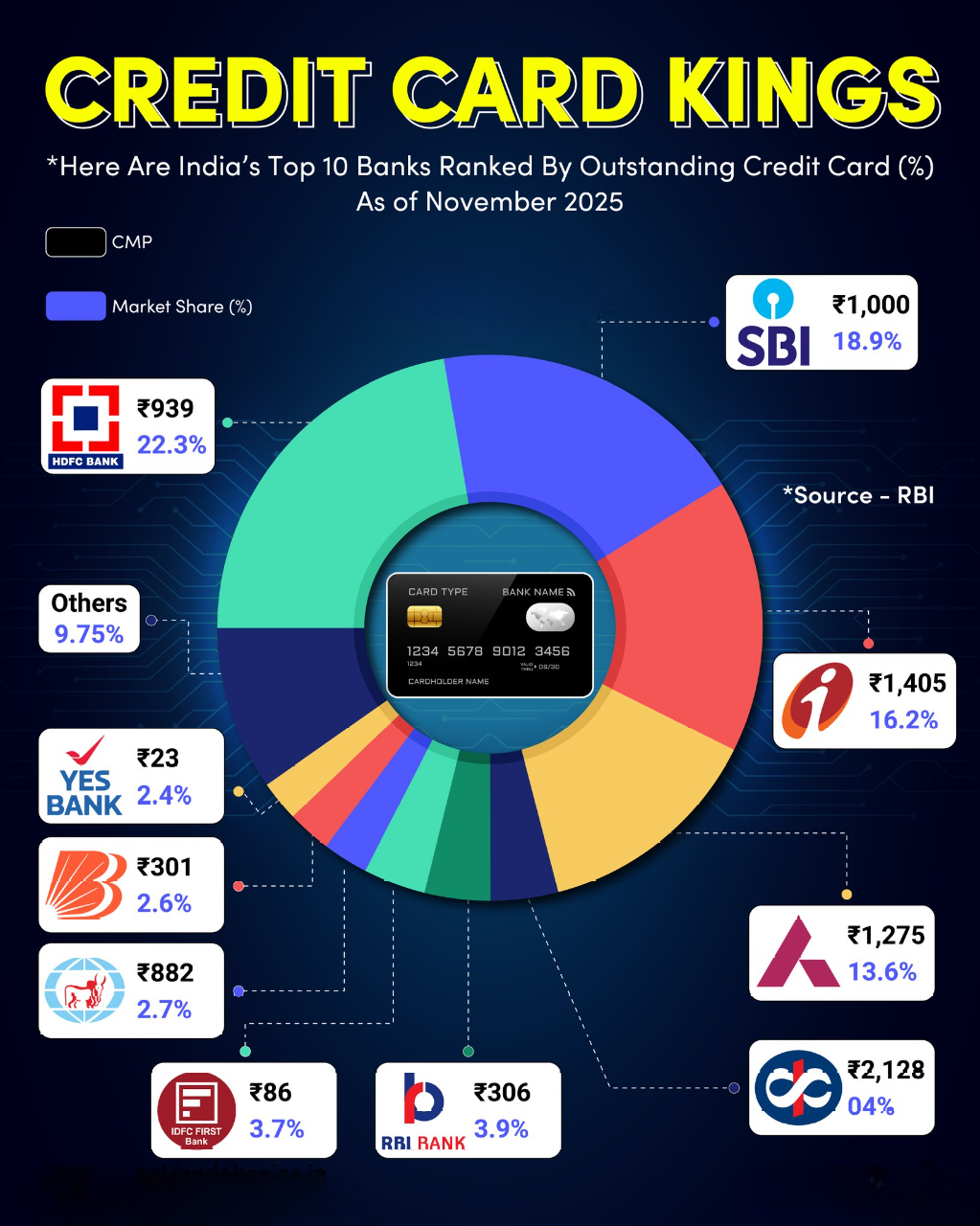

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreBasavaraja V

Software Engineer • 1y

Many people want to make big purchases online but don't have a credit card. At the same time, some credit card holders have unused credit limits. ConnectCred solves this problem by allowing shoppers to make purchases through a service that connects t

See More

Aatif dehalvi

Hey I am on Medial • 11m

Business Idea: Enabling Credit Card Discounts and Cashback for Non-Credit Card Users In today’s digital shopping era, e-commerce platforms like Flipkart, Amazon, and others frequently offer discounts and cashback deals, especially for customers using

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)