Back

PRATHAM

•

Medial • 1y

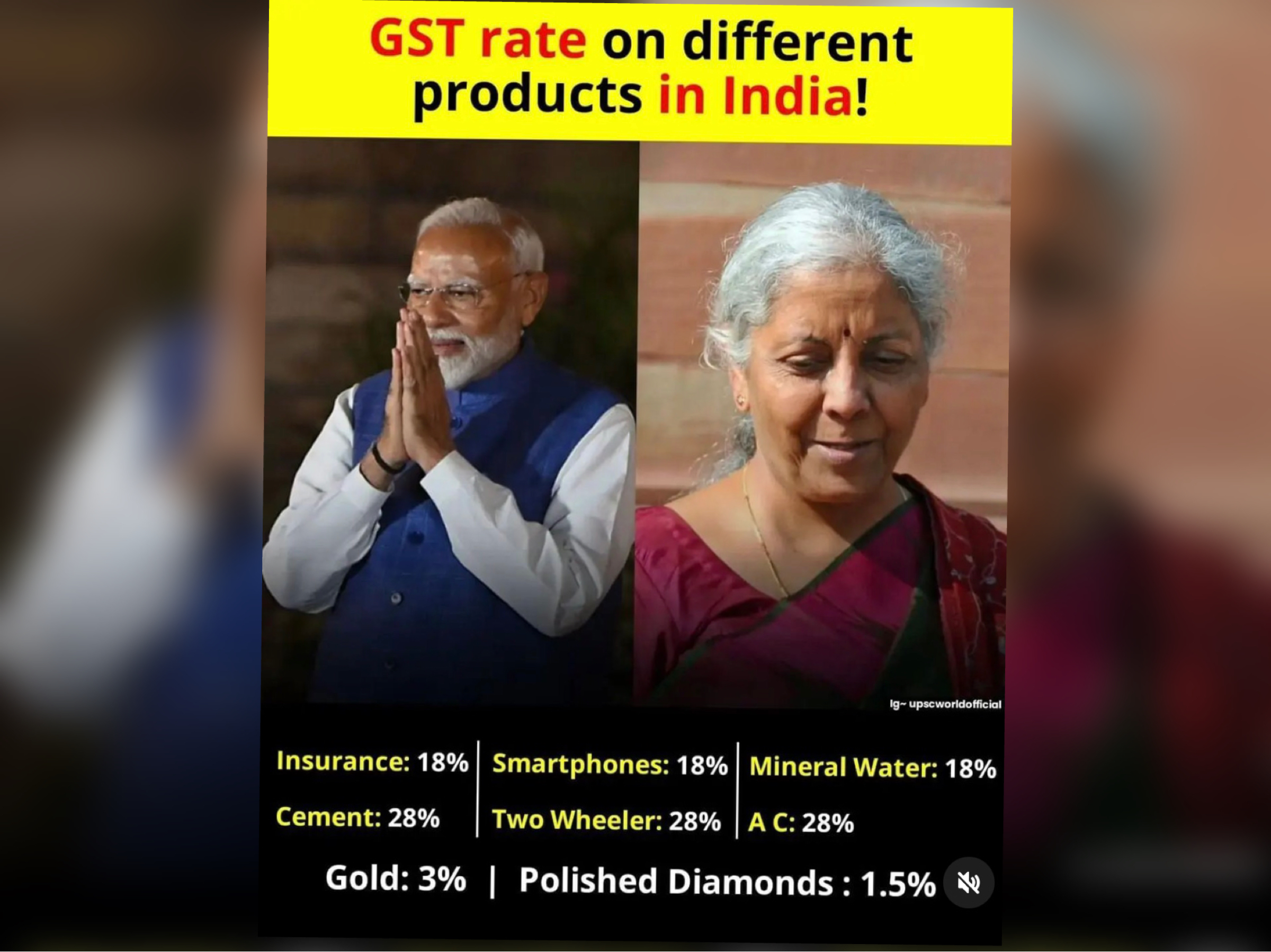

Wah! Ab to sab chez me tax lagado! What's wrong man! It's just not fair, already the per capita income is low and then high income tax and other taxes and now this! This is how India will become $5 trillion economy

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See More1 Reply

5

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)