Back

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

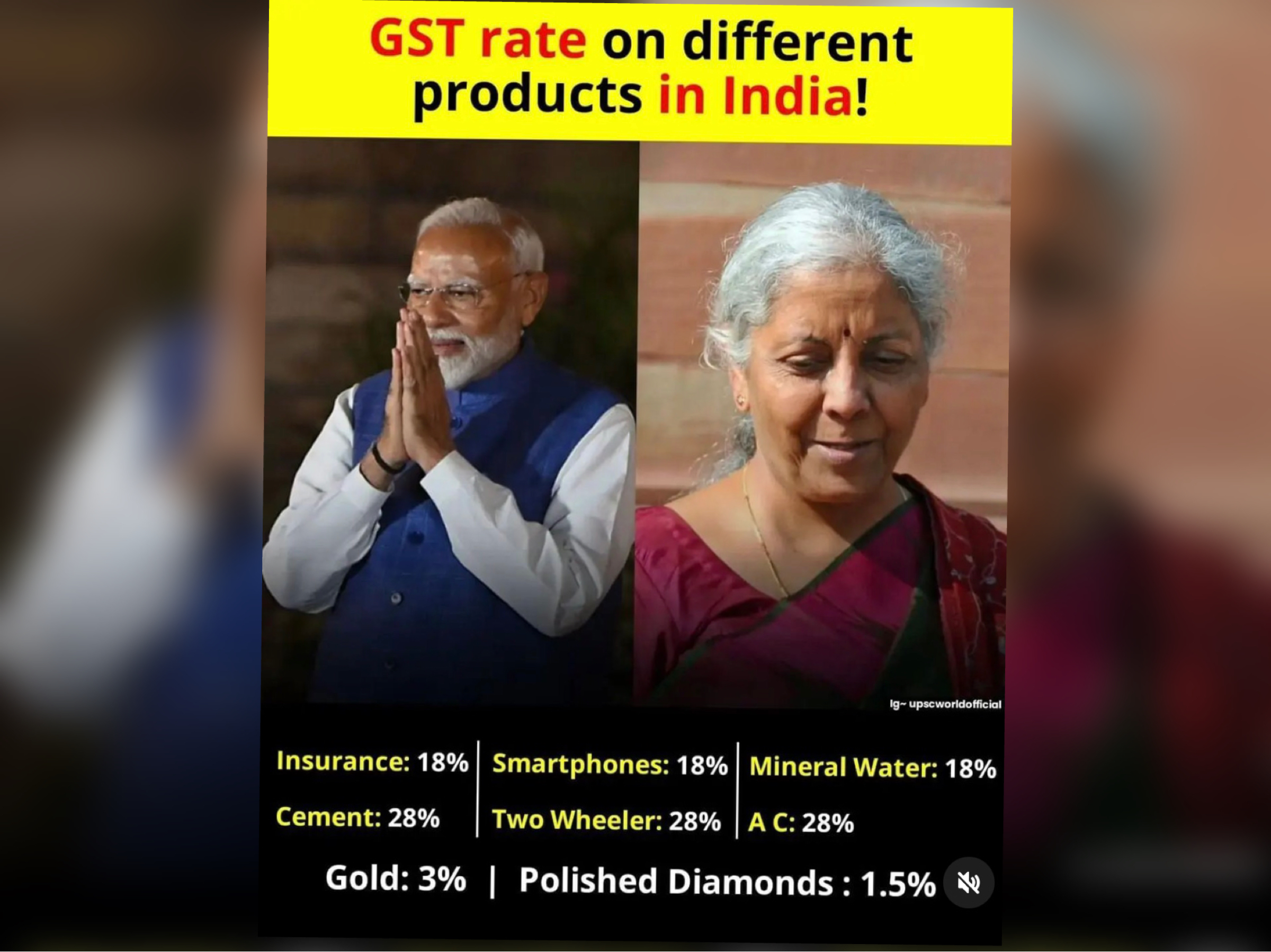

Keep the repo rate we understand that inflation is dangerous but this kind of High gst is just unacceptable everyone will get affected by this

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAnonymous

Hey I am on Medial • 1y

⚠️Big Warning India's retail inflation surged to all time high, breaching the RBI's tolerance limit of 6%. This sharp increase, primarily driven by soaring food prices, has dampened hopes for an early rate cut by the RBI. X Food inflation reached 9.

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreAtharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See MoreRootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)