Back

Harsh Dwivedi

•

Medial • 1y

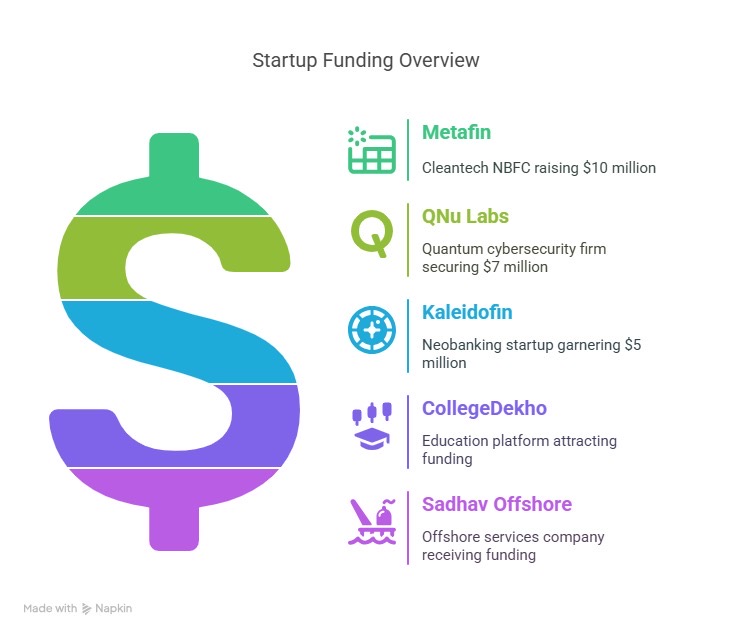

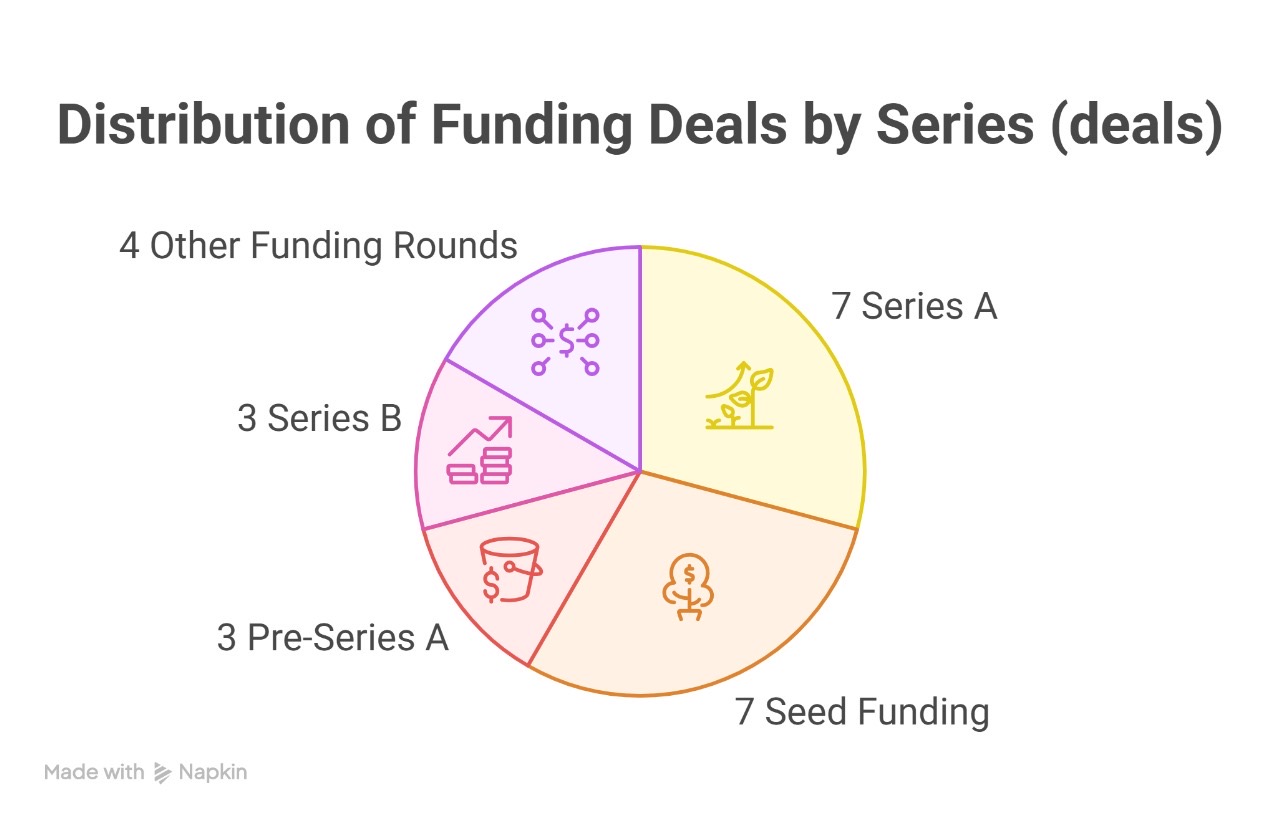

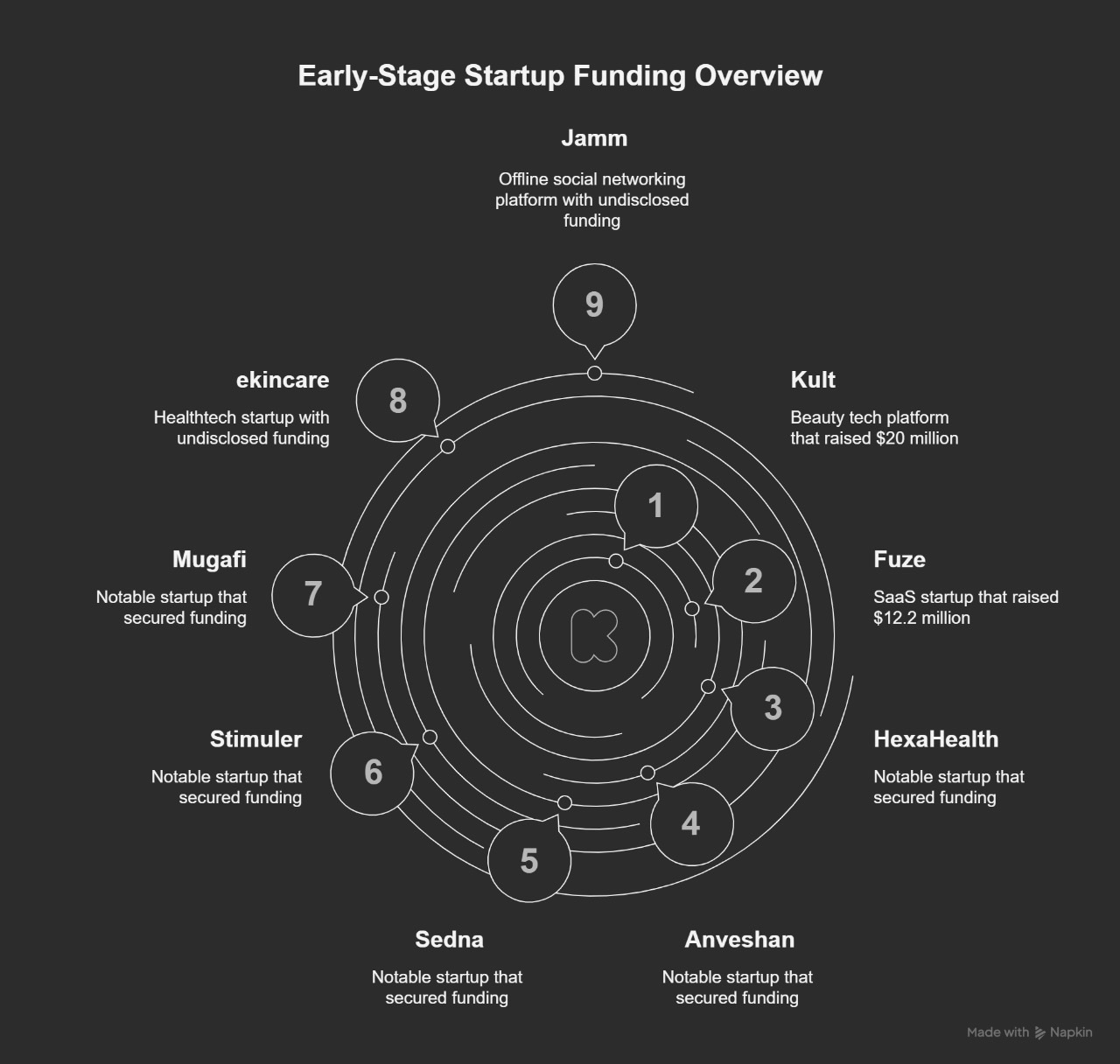

Top News of the Week: 1. Funding: - On a weekly basis, startup funding surged 170% to $906.7 million as compared to around $336.45 million raised during the previous week. - 41 Indian startups raised around $906.7 million in funding this week. These deals count 10 growth-stage deals and 22 early-stage deals. Moreover, eight early-stage and one growth-stage startup kept their transaction details undisclosed. - 10 startups raised $857.4 million in funding this week. Quick commerce company Zepto grabbed the limelight with its $665 million funding. Ummeed Housing Finance, which provides housing and secured small ticket business loans, followed with its $76 million funding. - Microlending platform Aye Finance, craft beer maker Bira 91, and fintech firm Slice also made it to the top five with $30 million, $25 million, and $20 million fundraises, respectively. D2C men’s apparel brand WROGN, small financing company Shivalik Small Finance Bank, Dvara KGFS, Aviom Housing Finance, and Jupiter’s NBFC arm Amica Finance are next on the list. - 22 early-stage startups secured funding worth $49.3 million during the week. AI sales operating system OrbitShift spearheaded the list followed by healthtech platform Alyve Health, agriculture machinery company Balwaan Krishi, D2C fashion brand focused on custom-made The Pant Project, and SME-focused digital lending platform Supermoney. The list of early-stage startups also includes eight startups that kept the funding amount undisclosed: TaxGenie (Regime Tax Solution), Landeed, Praan, ThriveCo, Fanisko, Nirwana.ai, Lazy Cocktails & Co, and LEO1. 2. Top hirings and Layoffs: - Flipkart: Cleartrip, Flipkart’s travel booking unit, has appointed Anuj Rathi as its new Chief Business and Growth Officer. - Vidyakul: Edtech startup Vidyakul has promoted Akhil Hari Angira to Co-founder and Chief Business Officer. He will oversee strategic partnerships, business growth, and expansion into underserved areas. - Paytm: Paytm roped in Rajeev Krishnamuralilal Agarwal as a new non-executive independent director, Neeraj Arora stepped down from the same position. Agarwal brings experience from companies like U GRO Capital and Star Health, while Arora is the founder of Halloapp and previously held positions at Meta and Google. - Silk product B2B marketplace ReshaMandi seems to be in deep trouble. After failing to secure Series B funding, the company has reportedly laid off 80% of its workforce and is significantly scaling down operations. It’s over Rs 300 crore debt leads to legal challenges and potential insolvency. 3. Acquisitions: - Ananta Capital’s beauty and wellness arm, Guardian, has acquired a 55% stake in D2C personal care startup Anveya Living, with plans to increase its stake further. Anveya Living, which owns the brands ThriveCo, Curlvana, and Anveya, will use the investment to launch new products and expand globally. - Online travel aggregator Yatra Online has agreed to buy out its partner’s stake in the joint venture Adventure and Nature Network Private Limited (ANN), which operates in adventure tourism. Yatra Online will increase its stake in ANN from 50% to 99%, making ANN a subsidiary of Yatra Online. 4. Other Developments: - AI-powered comic creation platform Dashtoon, with offices in India, is in late-stage talks to raise $10-12 million from a mix of new and existing investors. - HealthTech startup HealthPresso is aiming to secure $1 million in pre-Series A funding, capitalizing on strong investor interest in its AI engine and distribution network. - B2B SaaS platform Whatfix is on the verge of a $100-150 million funding round led by Warburg Pincus. - Edtech giant Unacademy is reportedly in discussions for a historic merger with K12 Techno, the operator behind Orchids International Schools. This potential 50/50 merger could be the first major consolidation in the edtech space, which has faced a funding slowdown in recent years. Notably, Unacademy previously invested in Orchid Schools and both companies share an investor. - Logistics firm Ecom Express is also reportedly in advanced talks with existing investors Warburg Pincus, CDC Group, and Partners Group to raise Rs 350-400 crore. The discussions are nearing completion, and this funding round could elevate Ecom Express’s valuation to over $1 billion, potentially making it the latest entrant to India’s unicorn club. - Pocket FM partners with ElevenLabs to convert scripts into audio - Awfis nears Rs 900 Cr income in FY24; losses contract 62% - Ola Electric gets SEBI nod for $660 Mn IPO - Financial Intelligence Unit imposes Rs 18.82 Cr penalty on Binance - VC firms General Catalyst and Venture Highway merge to focus on India - CCI approves WeWork Inc exit from Indian co-working space - Ixigo’s market cap spikes nearly 80% from the pre-IPO round - Zomato, Paytm confirm acquisition talks for movie, ticketing business - Flipkart-backed Blackbuck converts into a public company - Peak XV tops the chart of Hurun India Future Unicorn Index 2024 - Delhivery, Xpressbees looking to enter quick commerce space - OYO gets approval from shareholders to raise Rs 417 Cr.

Replies (7)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Account Deleted

Hey I am on Medial • 10m

Between March 31 and April 5, Indian startups brought in a total of $144.4 million across 22 deals. That’s just a slight bump around 0.5% - compared to the $143.7 million raised by 16 startups the week before. Among the investors, Peak XV Partners, Y

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)