Back

Gururaj Bhat

Will you join my mis... • 1y

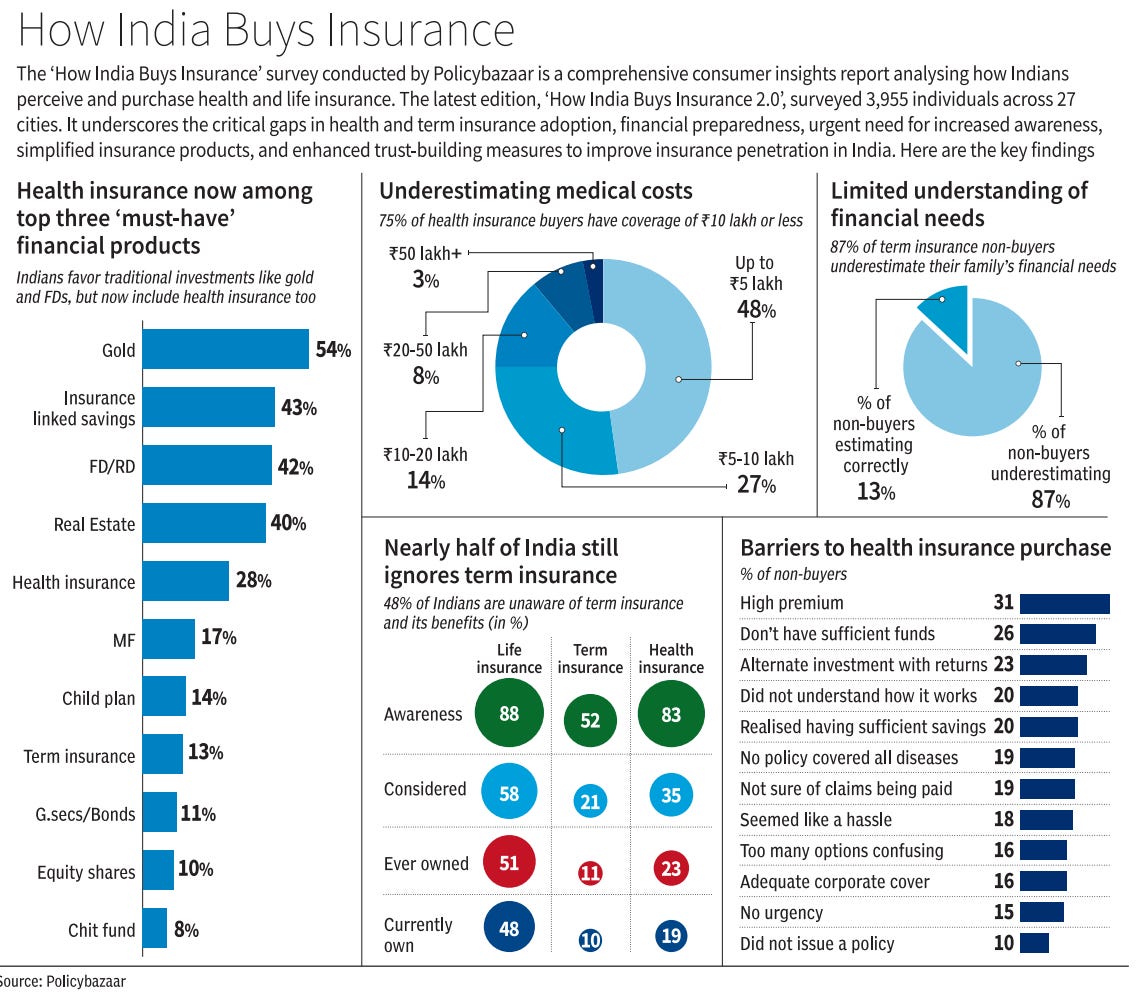

Many people are saying that you should invest on yourself and think of investing after achieving some next level. Well, that's not going to happen if you are not disciplined. So build the discipline of investing at the early age and you will live with a abundance in your entire career. Earlier you start your investments is better for you. I am a financial advisor and here are my suggestion to new employees. 1. Ensure to take health insurance to your parents if they do not have one already. Never ever ever ignite this and regret paying hospital bill from your savings 2. You are now the bread winner of your family. They have the expectations from your parents. Ensure to cover your life with term insurance that gives a good lump amount to your dependents in case of any unfortunate event to your life. 3. Now that you covered your risks, written on building your wealth. Mutual funds are the best long term investments where you don't have to worry about where and how to invest.

Replies (2)

More like this

Recommendations from Medial

vishal Kumar

Hey I am on Medial • 1y

Just out of curiosity, Is there any super app which is simple yet gives u a dashboard for everything such as your CIBIL, FAMILY HEALTH INSU, TERM INSURANCE, VEHICLE INSURANCE, YOUR TERM DEPOSITS INFO ETC...and Gives you a combined score in term of ho

See MoreKiran aiwale

The business solutio... • 9m

Bajaj Allianz Life insurance Term insurance 1. *Affordable premiums*: Lower premiums compared to whole life insurance. 2. *High coverage*: Provides a high death benefit to ensure financial security for loved ones. 3. *Flexibility*: Choose term le

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)