Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

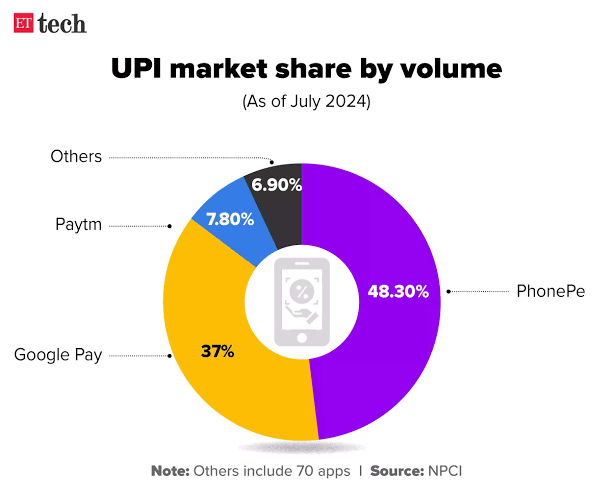

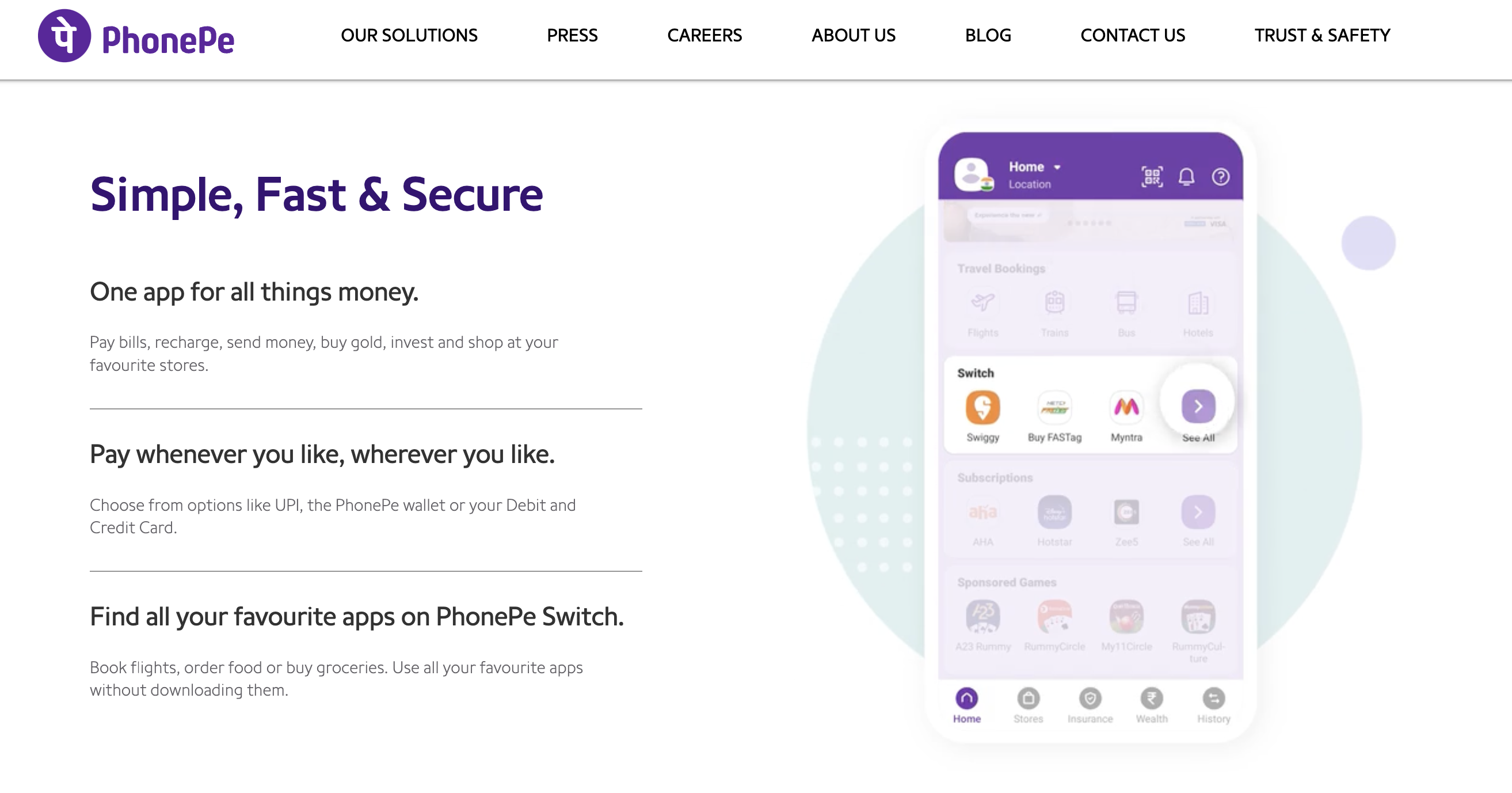

Walmart owned UPI payment giant PhonePe to enter Indian share market soon! Currently very basic proccess of IPO (Initial public offering) works are going on from PhonePe side. When PhonePe gets complete approval from SEBI, They share their complete

See More

1 Reply

2

14

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)