Back

Anonymous 4

Hey I am on Medial • 1y

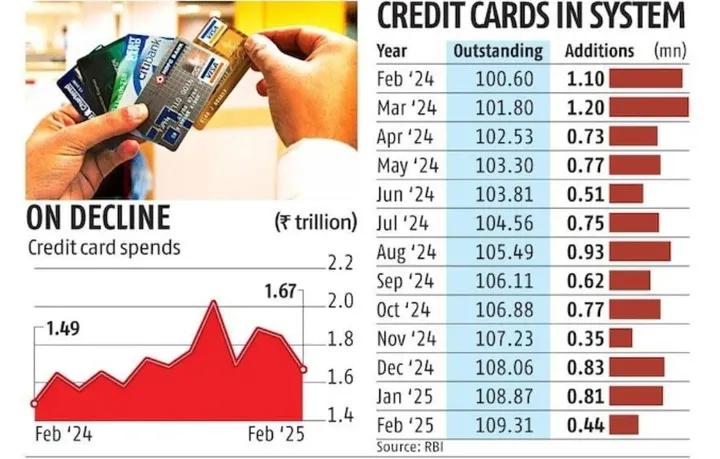

There are several reasons one is startups actually getting a lot of success really quickly in this sector, riped up since the use of UPI and credit card UPI, volumes will increase 10 folds.

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreAatif dehalvi

Hey I am on Medial • 12m

Business Idea: Enabling Credit Card Discounts and Cashback for Non-Credit Card Users In today’s digital shopping era, e-commerce platforms like Flipkart, Amazon, and others frequently offer discounts and cashback deals, especially for customers using

See MoreAccount Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)