Back

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

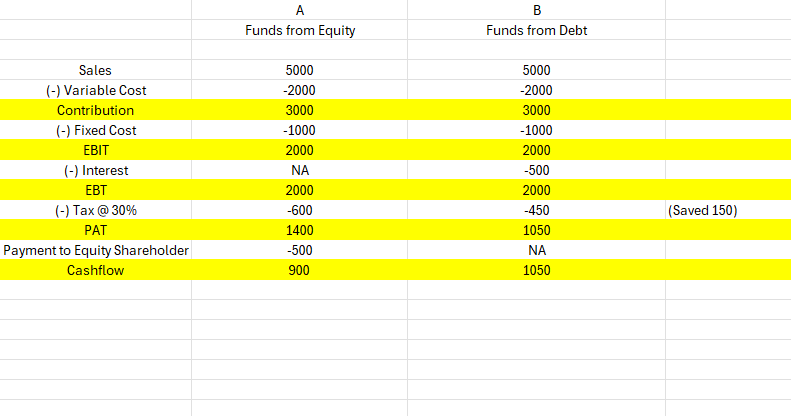

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

VIJAY PANJWANI

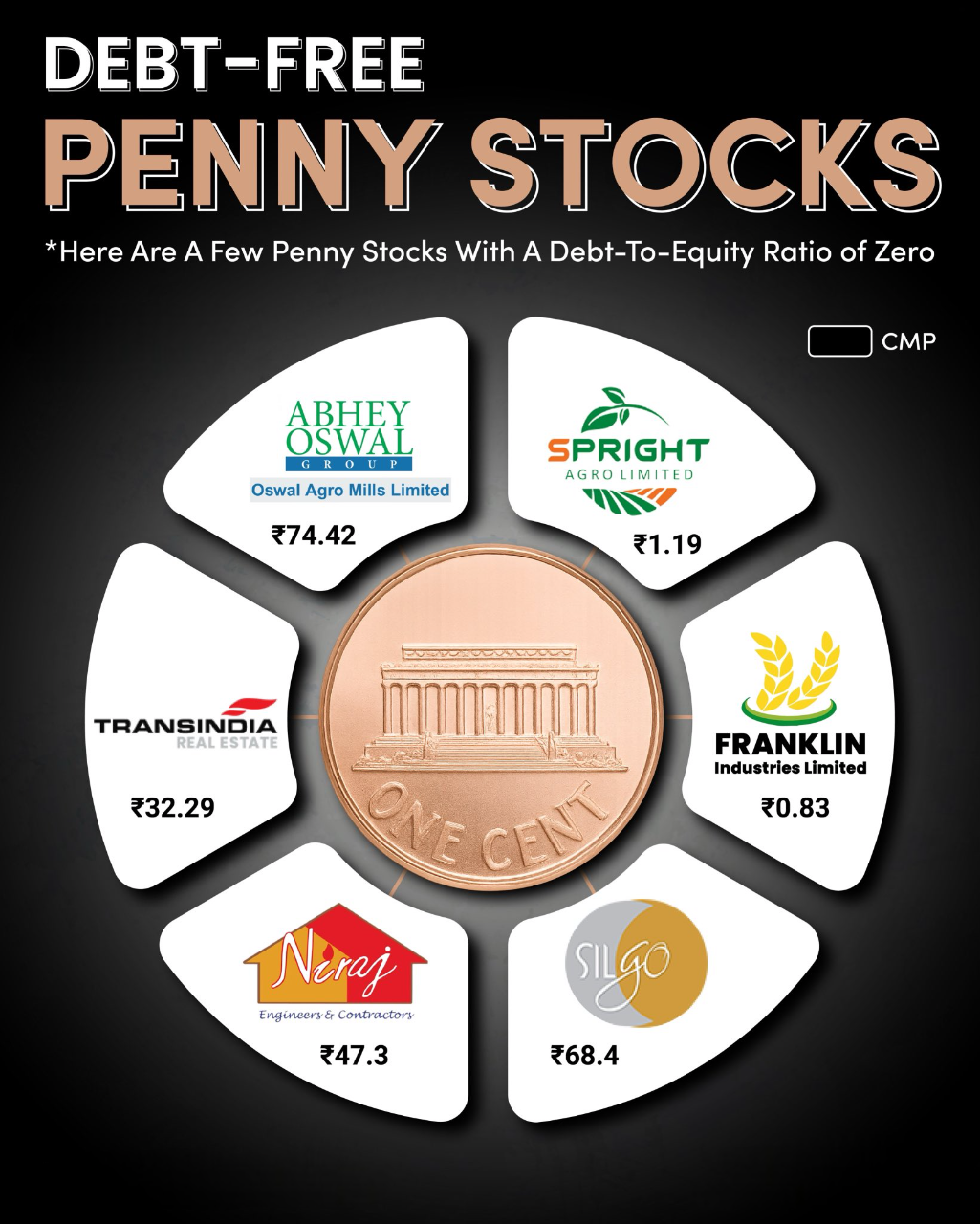

Learning is a key to... • 4m

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)