Back

More like this

Recommendations from Medial

Vatan Pandey

Founder & CEO @Zyber... • 10m

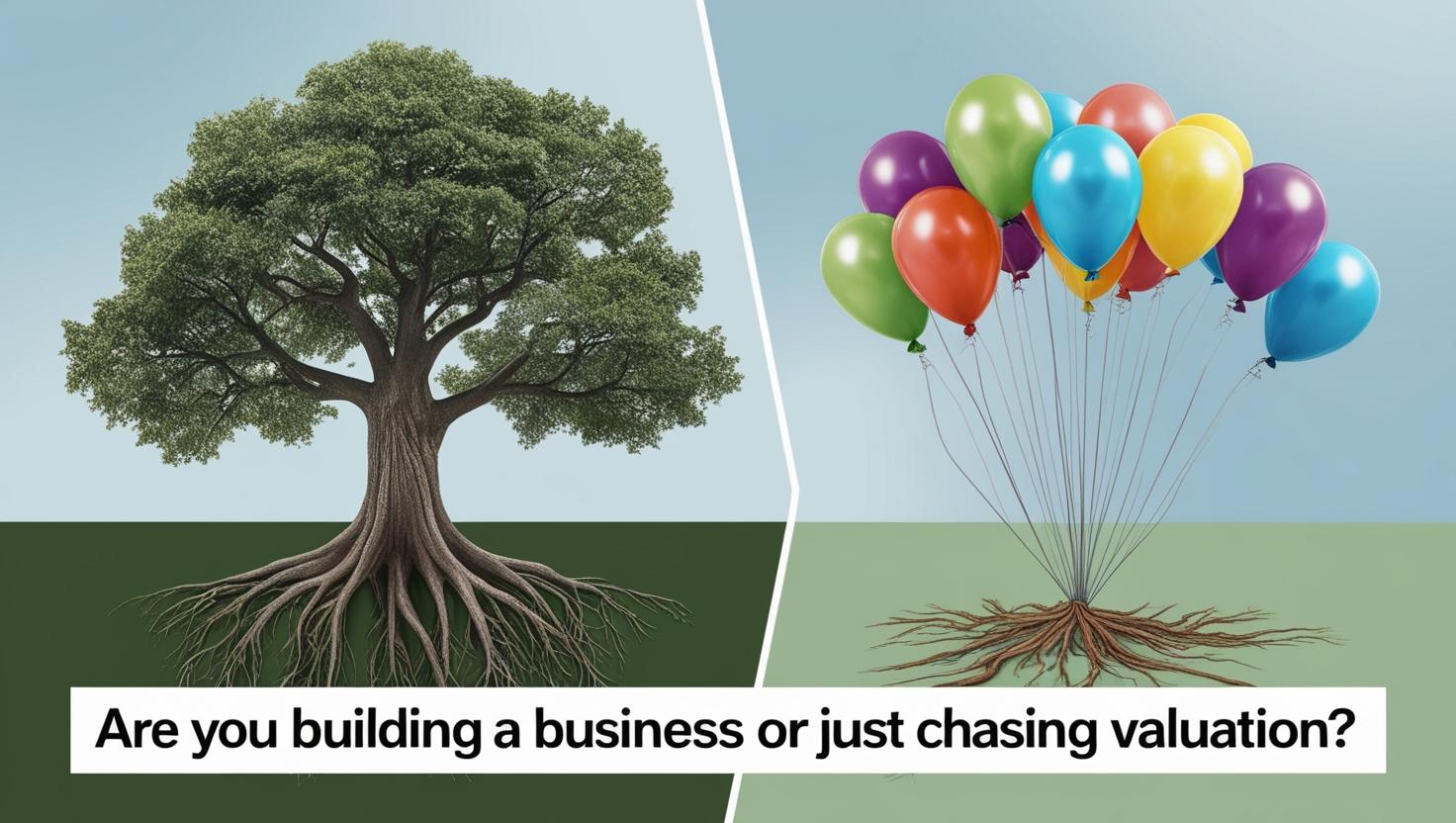

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Meet Khunt

Live the life to the... • 7m

give me an idea validation of "An app that shows to the patient through an 3D model that how the decease they have is actual look like and also show that how the medicine will work to the body and timestamps of the result during the complete course o

See MoreRohan Saha

Founder - Burn Inves... • 8m

There is some buzz in the market about a possible merger between HDFC and ICICI Bank honestly I don’t see it happening. Both are massive well established institutions on solid ground, rumors like these pop up all the time people will say anything but

See MoreGarvitesh Dadhich

ENTREPRENEUR • 10m

🚀 Calling All Web Developers! We’ve got a solid business idea with huge potential, and we’re currently looking for a talented web developer to come on board. If you're passionate about building innovative platforms and want to be part of something b

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actu

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)