Back

Mahendra Lochhab

Content creator • 1y

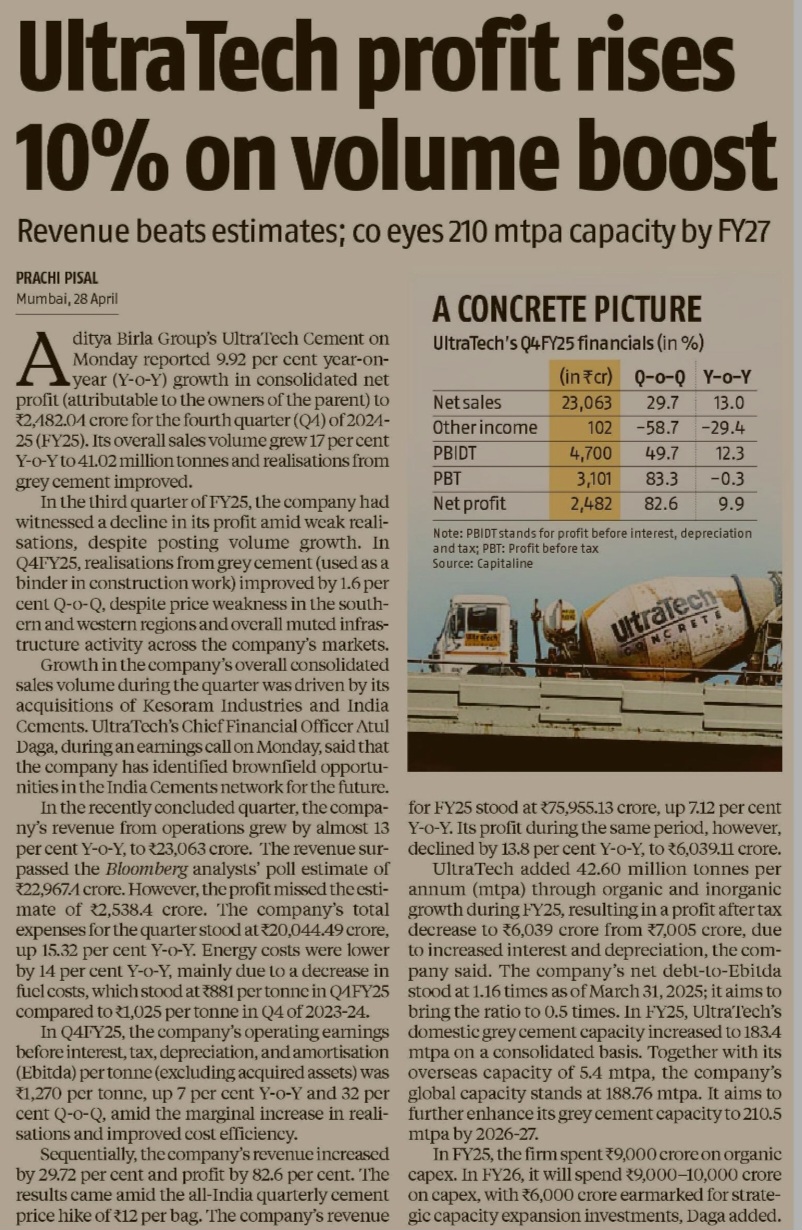

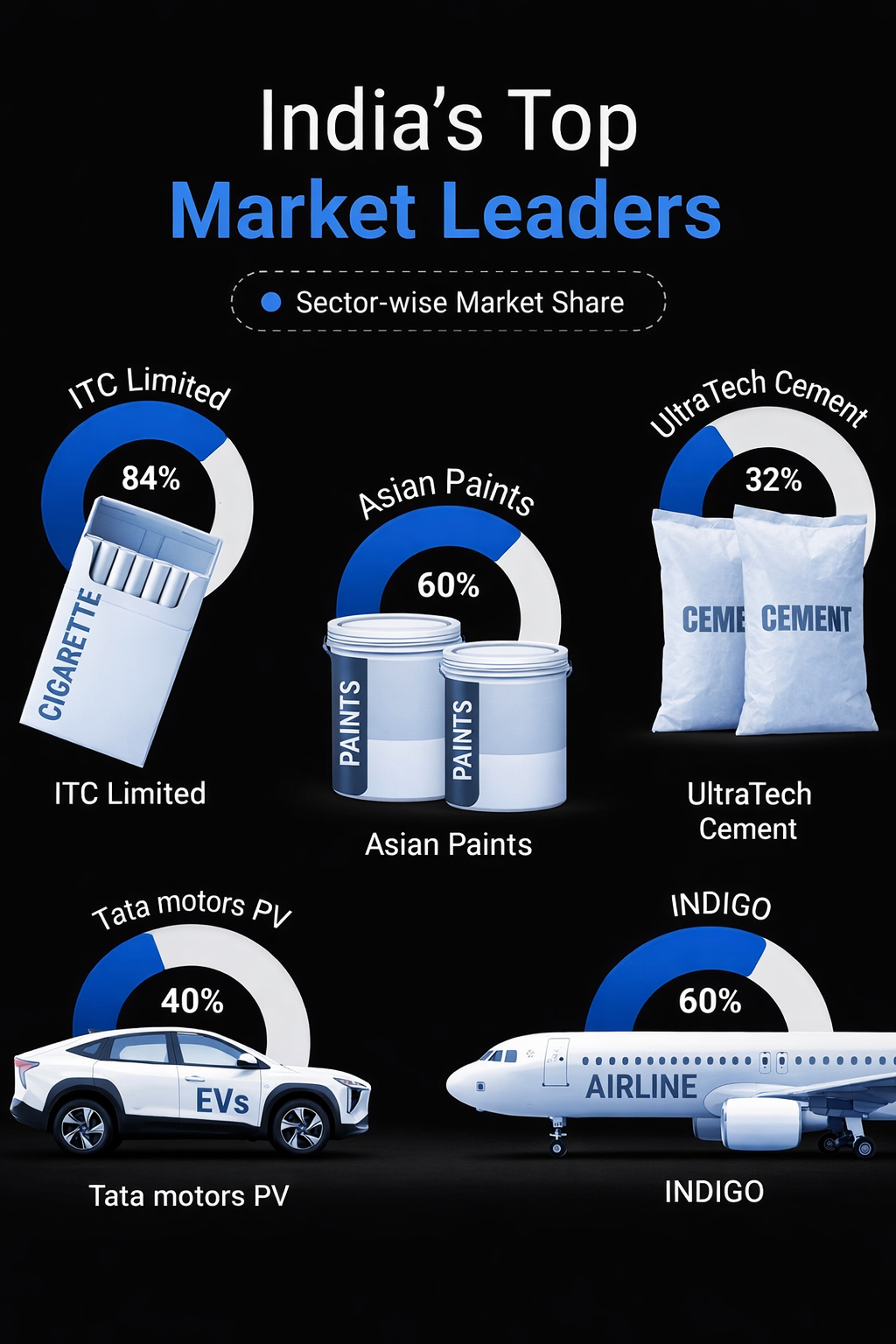

The Aditya Birla Group has achieved a market valuation of $100 billion. The group's portfolio includes UltraTech Cement, Grasim, Hindalco, Aditya Birla Capital, Aditya Birla Sun Life AMC, Vodafone Idea, Aditya Birla Fashion & Retail, TCNS Clothing, Aditya Birla Money, Century Textiles, Century Enka and Pilani Investments, which collectively have a market valuation of Rs 8,51,460.25 crore on the BSE. Grasim's market valuation has doubled in the last 3 years to more than $19 billion. Hindalco's market cap has also doubled in the last 2 years. Vodafone Idea's market cap has tripled in just 1 year. UltraTech Cement contributes nearly 35% to the total valuation of the Aditya Birla Group.

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

Aditya Birla Group Surpasses $100 Billion Mark Portfolio: 1.UltraTech Cement 2.Grasim 3.Hindalco 4.Aditya Birla Capital 5.Aditya Birla Sun Life AMC 6.Vodafone Idea 7.Aditya Birla Fashion and Retail 8.TCNS Clothing 9.Aditya Birla Money 10.Century Te

See More

Brigade Gateway

Where Luxury Meets L... • 3m

Aditya Birla Realty Delivers Power-Packed Q2 FY26 with 111% Booking Boom Aditya Birla Realty has delivered a power-packed performance in Q2 FY26, recording a remarkable 111% surge in bookings. The growth is largely fueled by the overwhelming response

See MoreAnonymous

Hey I am on Medial • 1y

Indian billionaire Kumar Mangalam Birla is investing $50 million to build a new chemical plant in the heart of the US oil-refining region as his Aditya Birla Group expands its North American footprint. The project will involve a “state-of-the-art a

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)