Back

Havish Gupta

Figuring Out • 1y

NVIDIA's annual net income for 2024 increased to $29.76B, a 581% increase from 2023's $4.368B. That's amazing!

More like this

Recommendations from Medial

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Meta (Facebook's parent company) reported strong Q1 2024 results, with revenue up 27% year-over-year to $36.46 billion and net income up 117% to $12.37 billion. However, the company issued a light Q2 revenue forecast and announced higher capital expe

See More

TREND talks

History always repea... • 1y

🚀 Funding winter over? India’s tech startup ecosystem outshines China, Germany with $11.3 billion raised in 2024 🌎 💰 During H2 2024, the technology sector raised $5.32 billion across 540 rounds marking an 8 percent increase from H2 2023's $4.92

See More

Kimiko

Startups | AI | info... • 9m

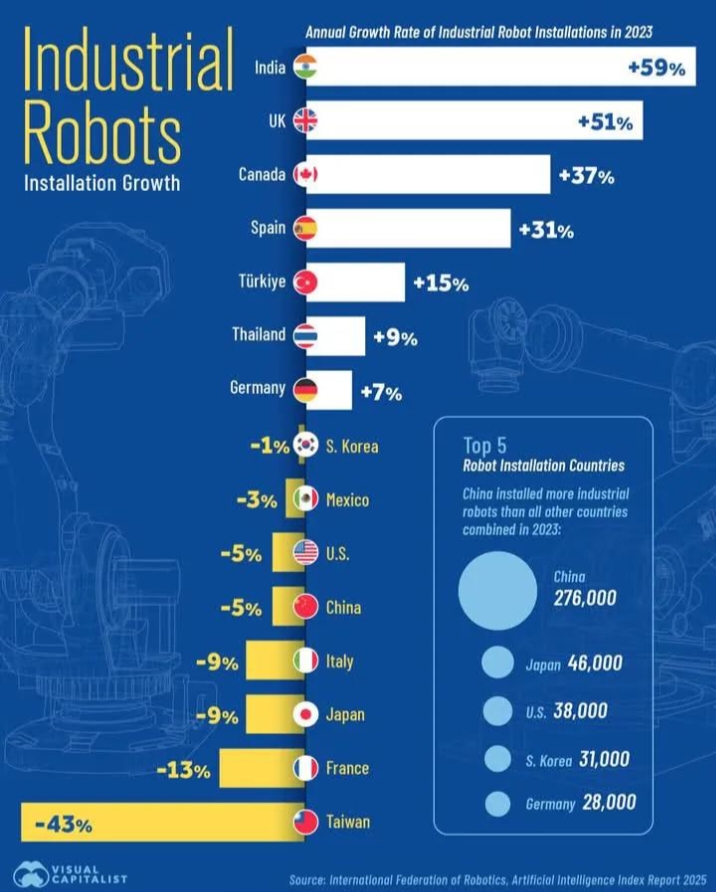

India now ranks 7th globally in annual robot installations .. Globally, there were nearly 4.3 Million operational industrial robots in 2023, with China installing 276,300 that year alone. While , India has seen the fastest annual growth in industri

See More

brijesh Patel

Founder | Venture Pa... • 2m

I am reading *VC/PE report* by *EY India*. Performance of *India* in *2024* vs *2023* 1. In *2024*, the total deal count was at *1,352* deals, a notable *54%* increase from *880* deals in *2023*. 2. Start-up segment was the *volume leader* with

See MoreAshish Singh

Finding my self 😶�... • 1y

The Indian startup ecosystem showed significant growth from 2023 to 2024. Total funding increased by 20%, reaching $12 billion in 2024, compared to $10 billion in 2023, marking a recovery from the previous year's downturn12. Notably, six new unicorns

See More

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)