Back

Aryan Raj

Building @Prescribal... • 1y

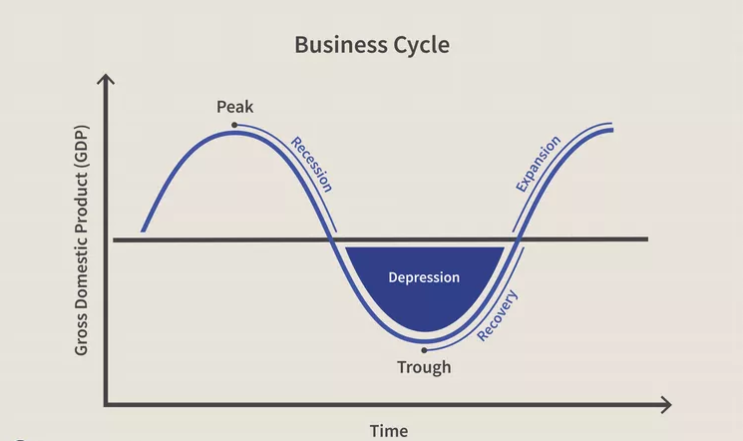

That's why Profitability and keeping cash flow is necessary in business specially in those with longer business cycle.... For solution these steps can be followed - 1. Cutting all unnecessary expenses 2. Asking for some funds to sustain current operations from family or friends (it's not bad in crucial times) 3. Focusing more on growing organic marketing , that really helps a lot 4. Suspending rapid expansion and managing current one to make it profitable....

Replies (2)

More like this

Recommendations from Medial

Sanjay Kadali

•

Health Catalyst • 4m

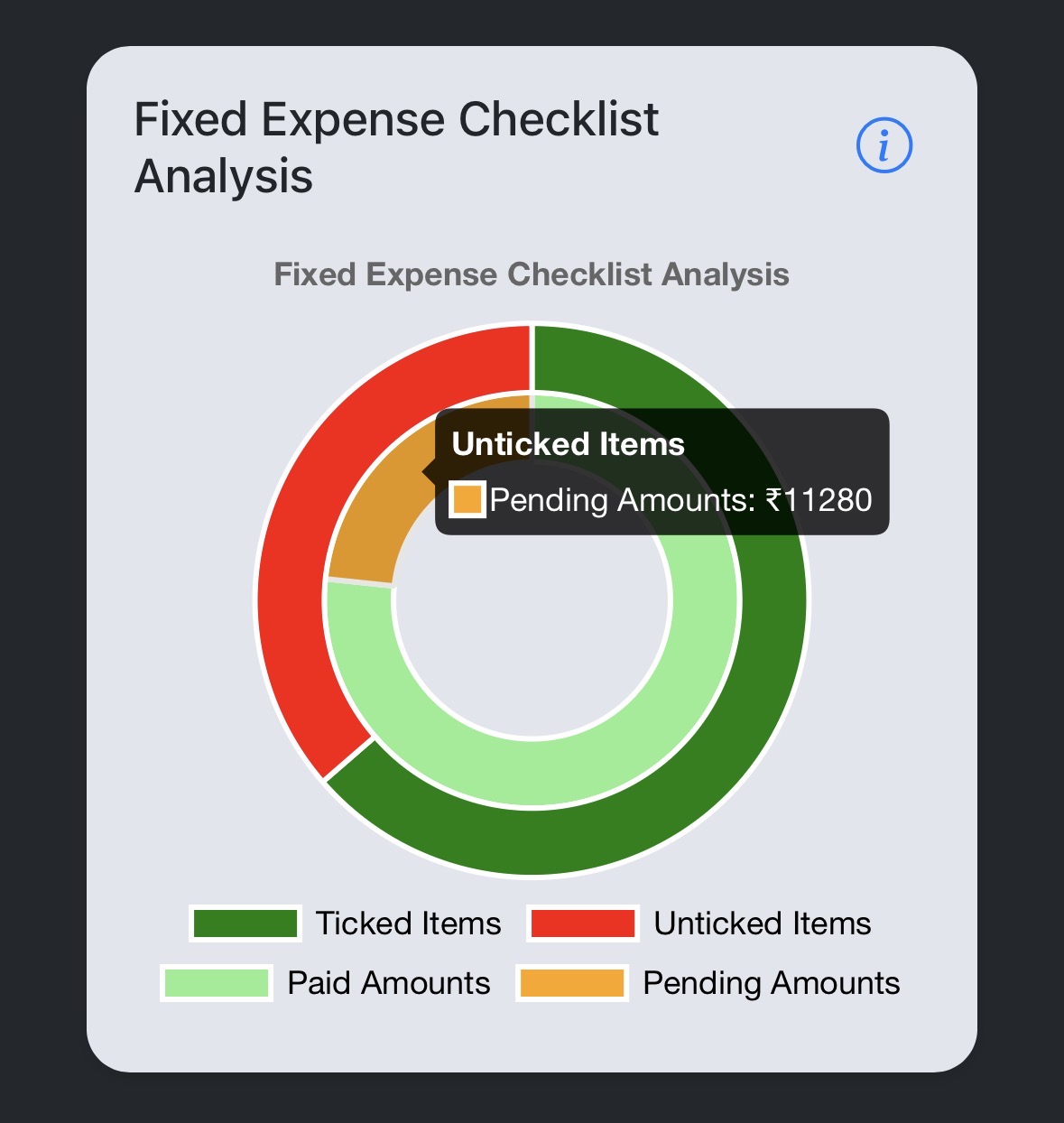

Finding it tough to manage your fixed expenses? Here at Pennywise app, we have simplified the solution with a Donut Chart visual - it showcases the items that have been paid and whatever that is pending for the current month cycle. We are actively

See More

Dr Saurav singh

Doctor by profession... • 12m

In India, the rapid rise of restaurants, street food stalls (thelas), and tea shops (chai tapris) is driven by several key factors: 1. Easy Licensing & Low Entry Barriers – Compared to other businesses, setting up a small food venture often requires

See MoreSANDIP NAGARIYA

Compliance Professio... • 11m

now a days credit swipe business is very rapidly increasing specially in city...as of now this model as b2b portal and working style...want to create b2c model at very low capital through use of current b2b model and once it will work than create own

See MoreVedant SD

Finance Geek | Conte... • 1y

PepperTap: A Startup's Rapid Rise and Fall PepperTap, an online grocery delivery startup in Gurgaon, experienced a meteoric rise but abruptly shut down within two years due to: * Overexpansion: Rapid growth without a sustainable foundation. * Fina

See MorePoosarla Sai Karthik

Tech guy with a busi... • 9m

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actu

See MoreDownload the medial app to read full posts, comements and news.