Back

Anonymous 1

Hey I am on Medial • 1y

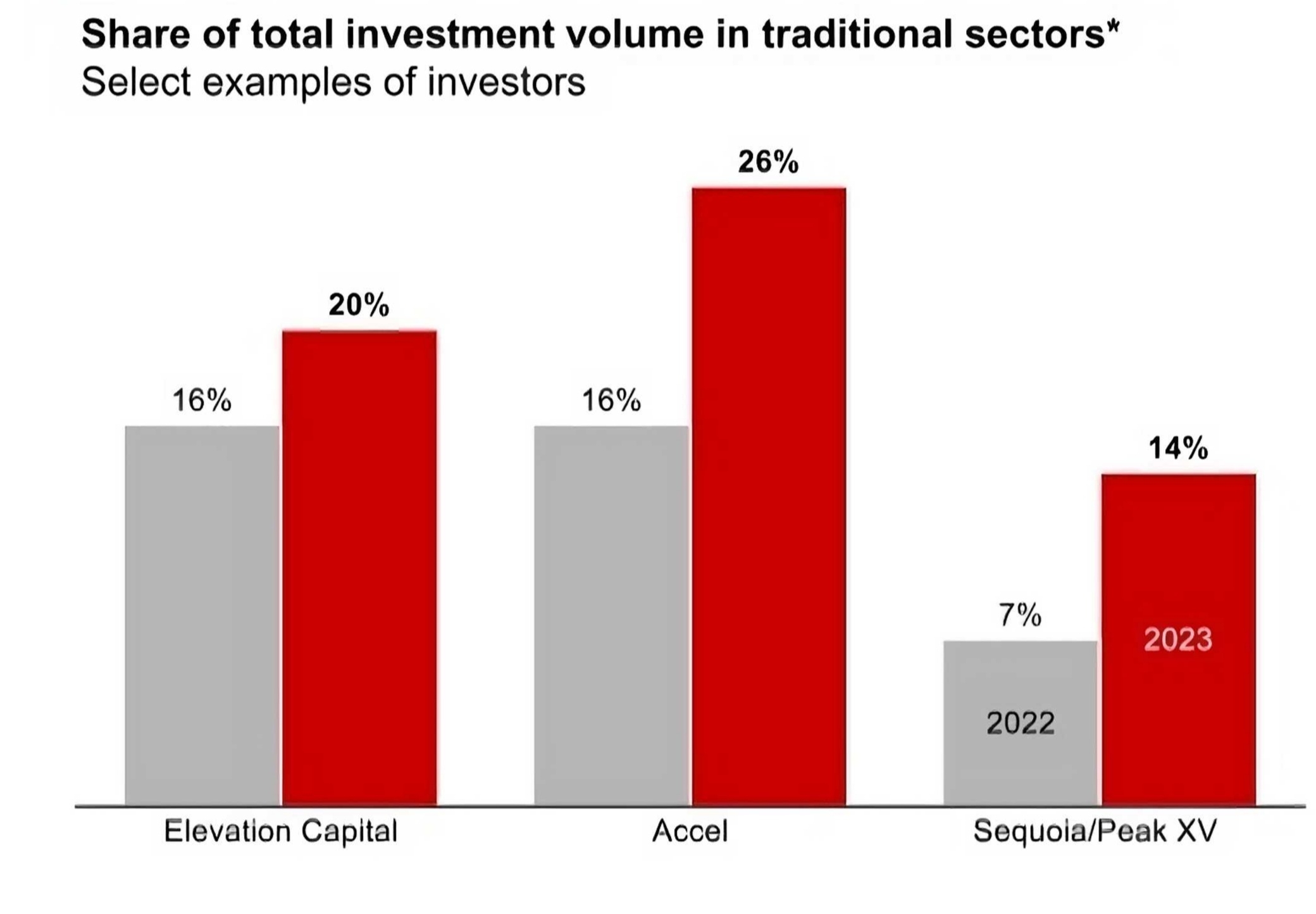

The venture capital landscape has matured...a LOT, and investors are becoming more selective in their investment strategies. This has led to a shift towards traditional sectors with strong fundamental tailwinds, such as banking, financial services, and insurance (BFSI), healthcare, electric mobility, and generative artificial intelligence (AI), these sectors are to bet for the long term, not answerable now. Multiples are huge in these sectors.

Replies (1)

More like this

Recommendations from Medial

Ashwani Singh

Hey I am on Medial • 1y

Generative AI in Media and Entertainment: Companies like Runway are pushing the boundaries of generative video models. Their latest tool, Gen-2, produces high-quality short video clips that are catching the attention of major studios such as Paramoun

See MoreVamshi Yadav

•

SucSEED Ventures • 10m

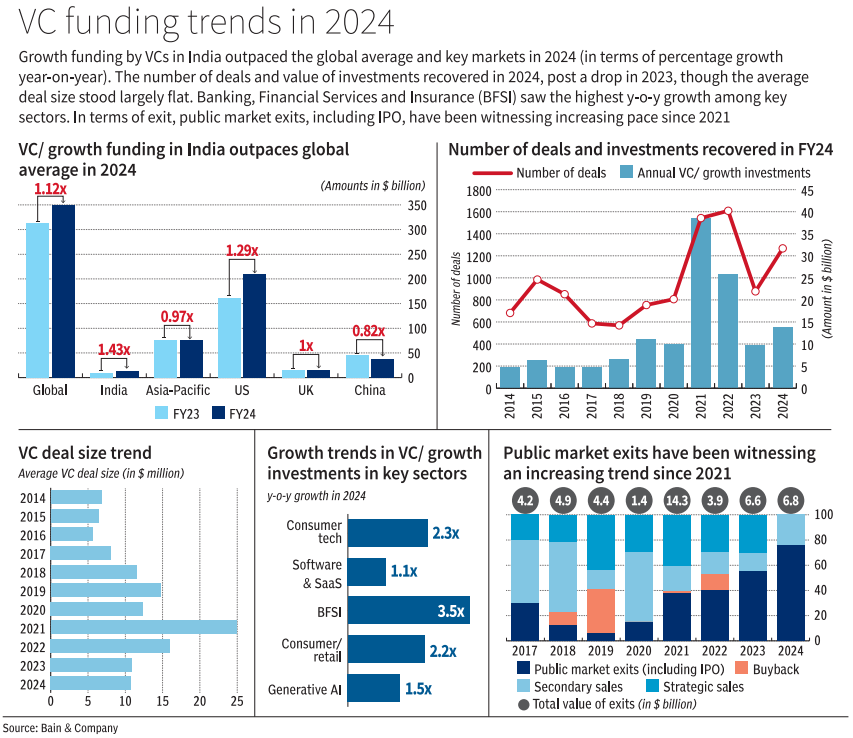

India led global VC growth in 2024, outpacing major markets with 1.43x growth. Investments gained momentum with BFSI (3.5x growth), Consumer Tech (2.3x), and Generative AI (1.5x) attracting the most capital. Public market exits have been rising since

See More

Chandan Kushwaha

Your Path to Financi... • 1y

🚀 Discover the Top Generative AI Tools in 2024! 🚀 Generative AI is transforming creativity, automation, and data processing. Learn about the top AI tools like Gemini Pro, OpenAI, LangChain, and Pinecone that are reshaping industries by automating

See MorePrakeerth Jisha Madhu Prakash

Founder and CEO ELDI... • 1y

Here are the five most growing sectors that anyone can easily invest in over the next five years. These sectors are currently booming and are highly talked about. Note: This post does not promote any specific company or stock to invest in. Please co

See More

Download the medial app to read full posts, comements and news.