Back

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

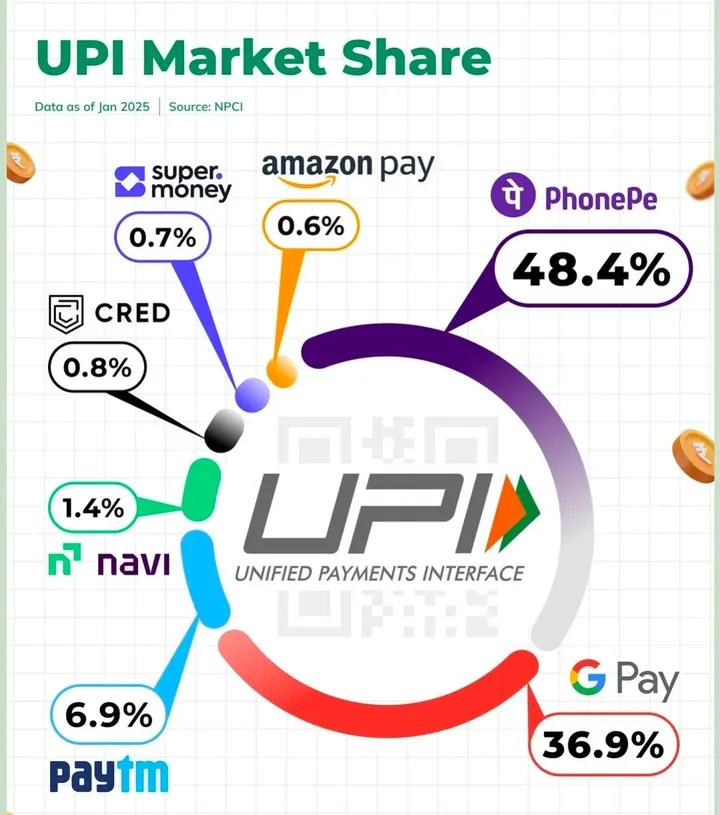

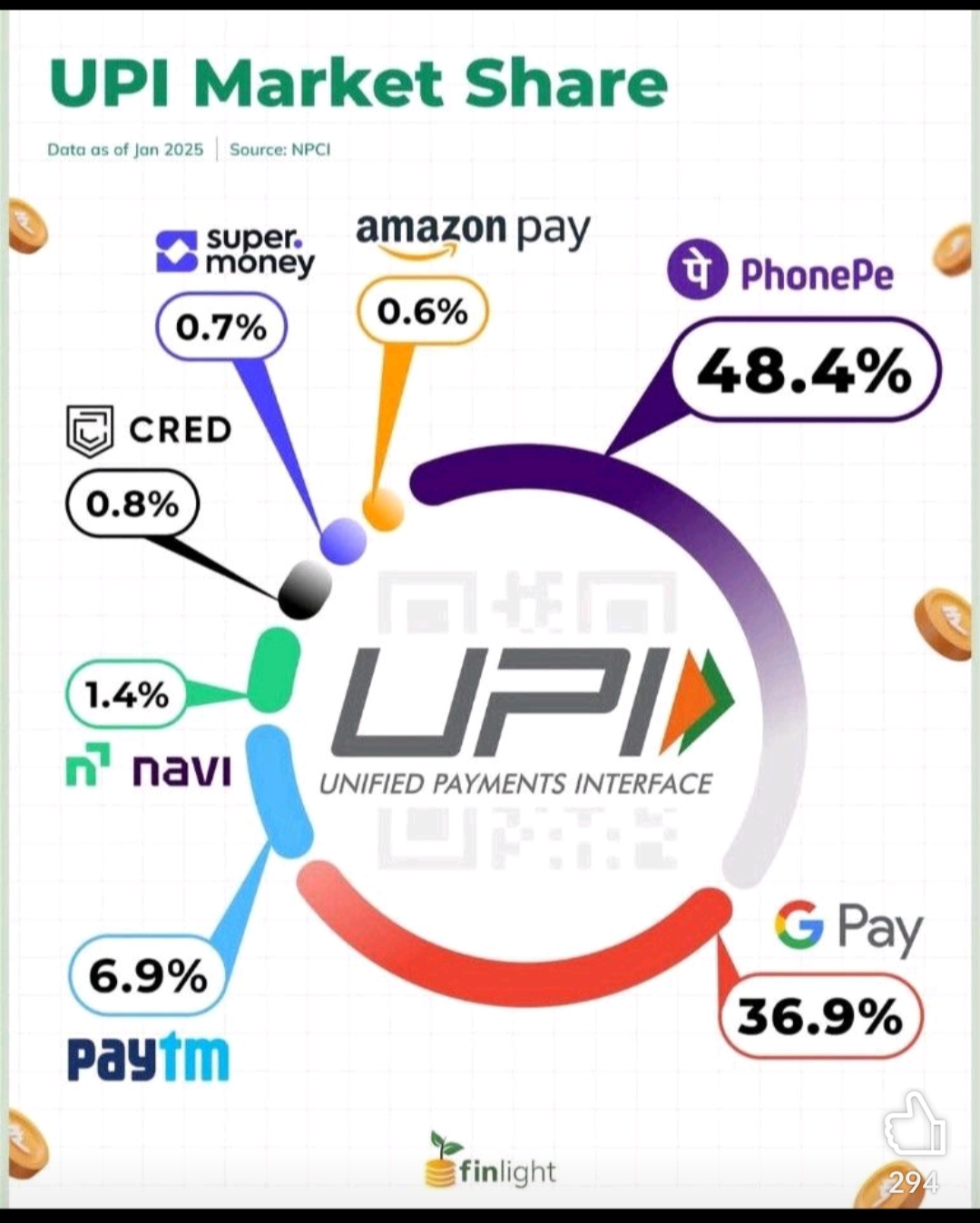

Paytm shareholders are ignoring this? 📛📛 The fintech giant was the only UPI app to be making money on UPI. And now that’s no more possible. Here's all you should know! .. The thing is, NPCI (via Govt grants) compensates the banks to up keep the

See More1 Reply

1

24

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)