Back

ReepinderGoyal

Hungry? DM me • 1y

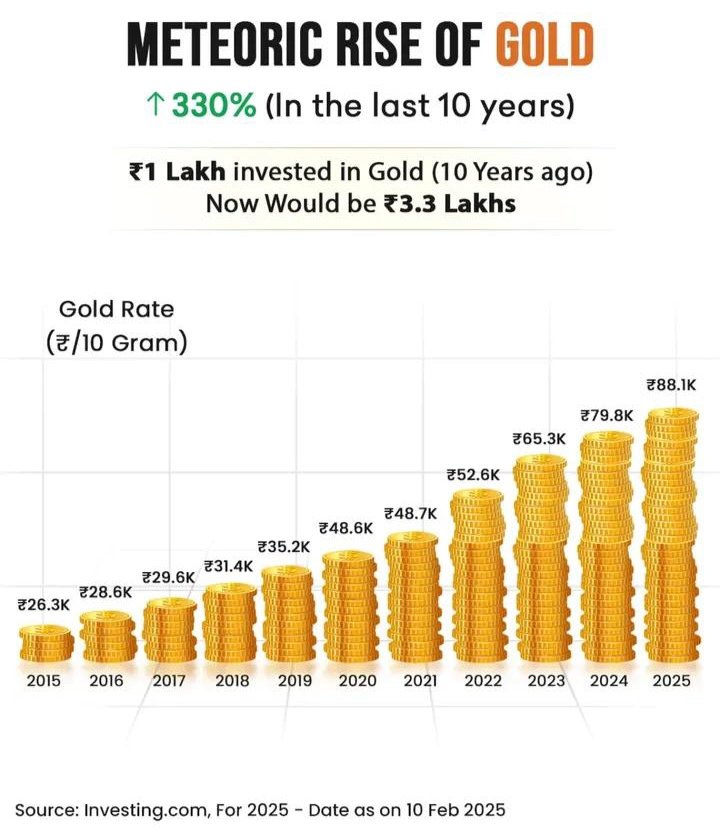

We do, old is gold ✨

Replies (1)

More like this

Recommendations from Medial

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See Morevijay gondliya

Hey I am on Medial • 1y

we have diamond and jewelry business we see with time gold loan and banking system is good to make money we want to start nidhi company for gold loan or nbfc for business expansion anybody come and investment with us 100 % profitable business patel

See MoreMadhavsingh Rajput

Founder & CEO at Fin... • 1y

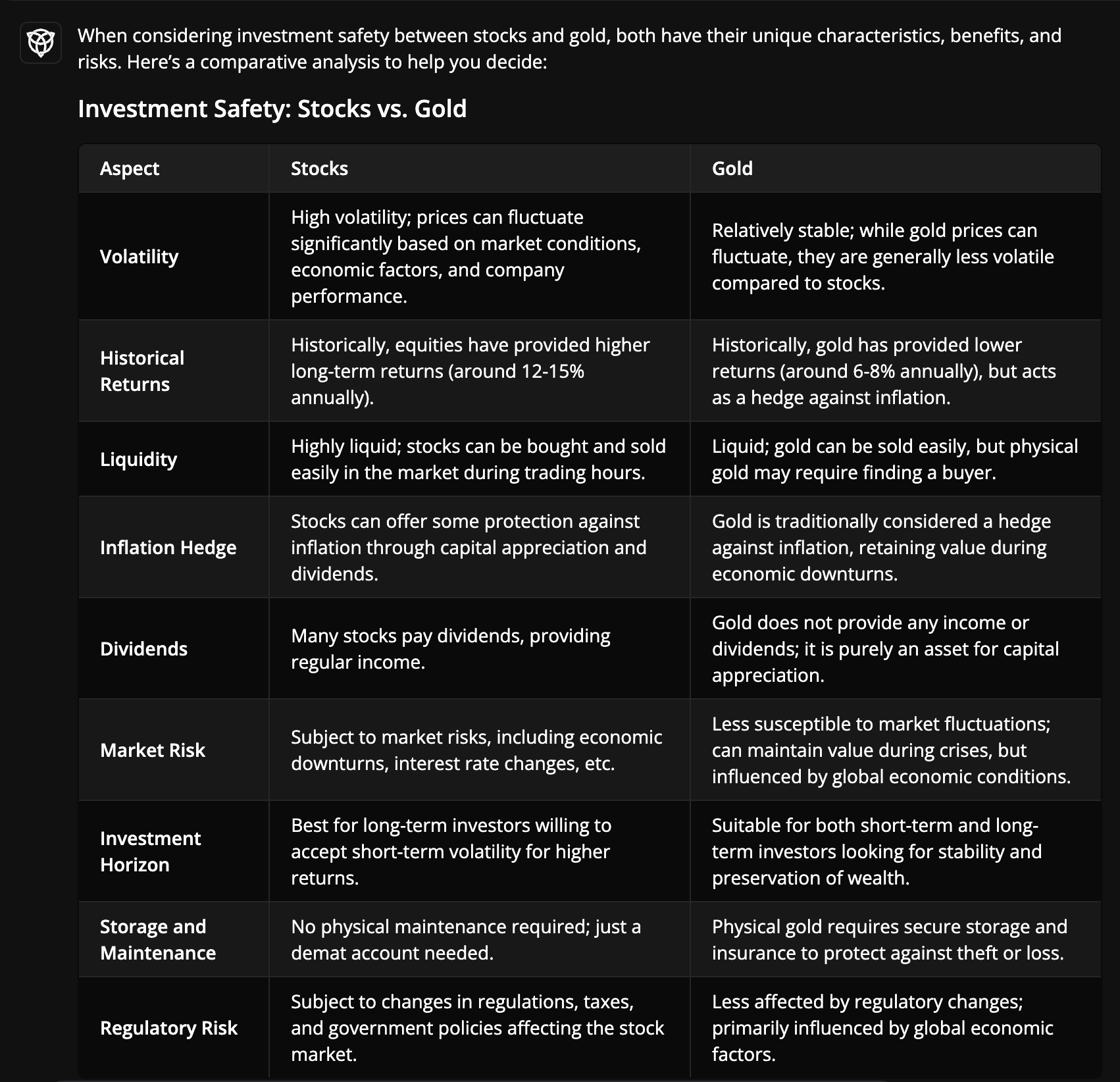

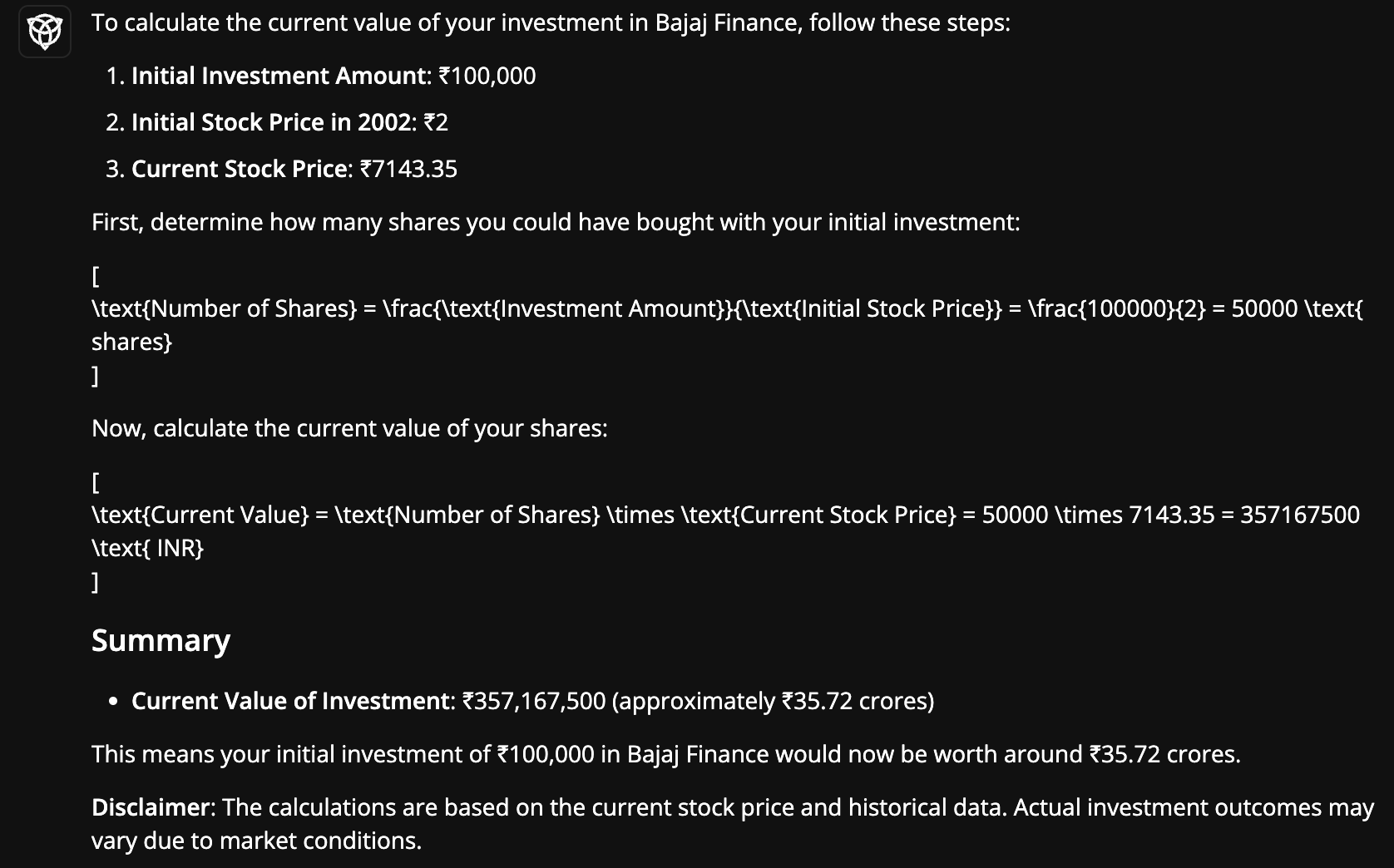

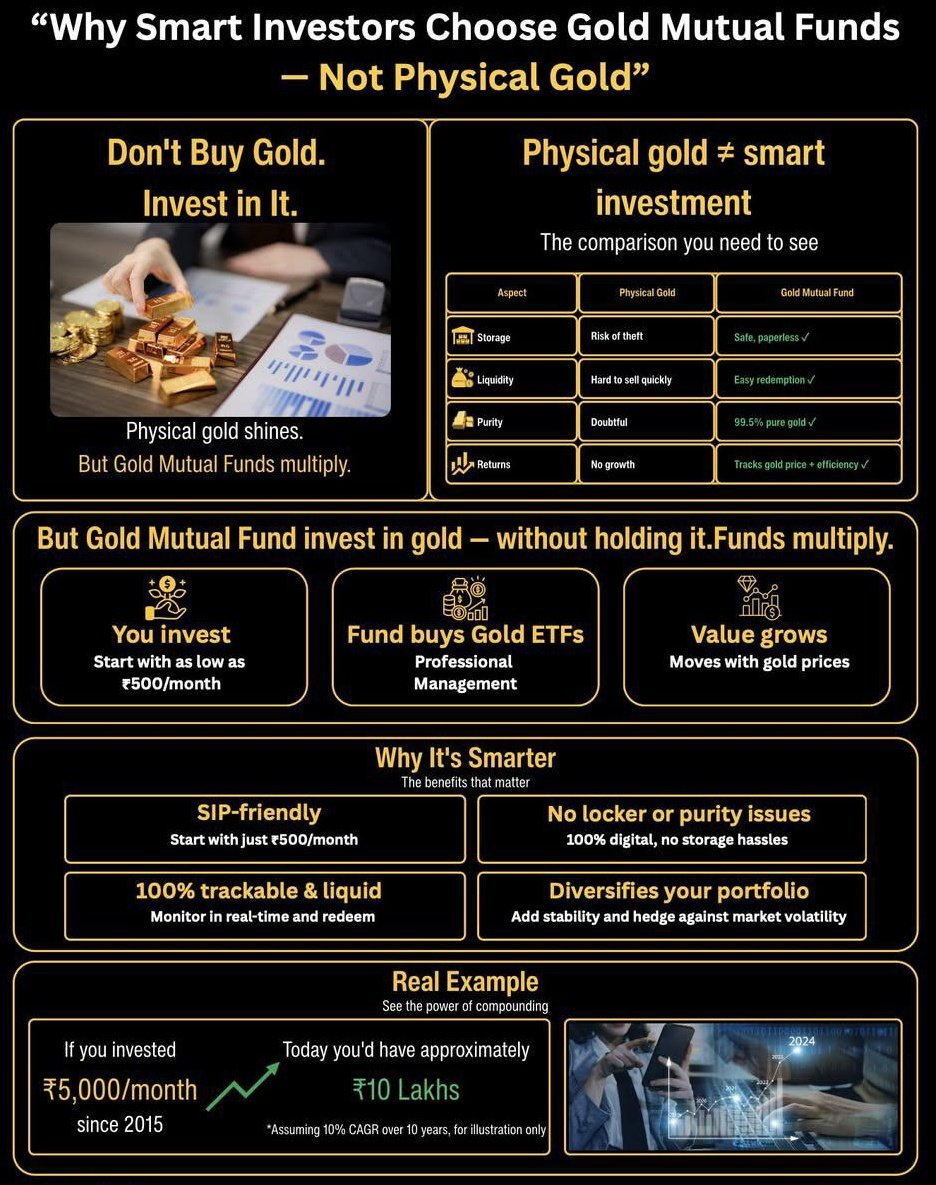

Gold or Stocks: Which is the better investment? 🤔 To make it simple, Finstreets' AI has prepared an easy to understand comparison table highlighting key aspects like: 1️⃣ Volatility: Stocks have high fluctuation, while gold is more stable. 2️⃣ Retur

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)