Back

Rishi Chavan

Inquisitive • 1y

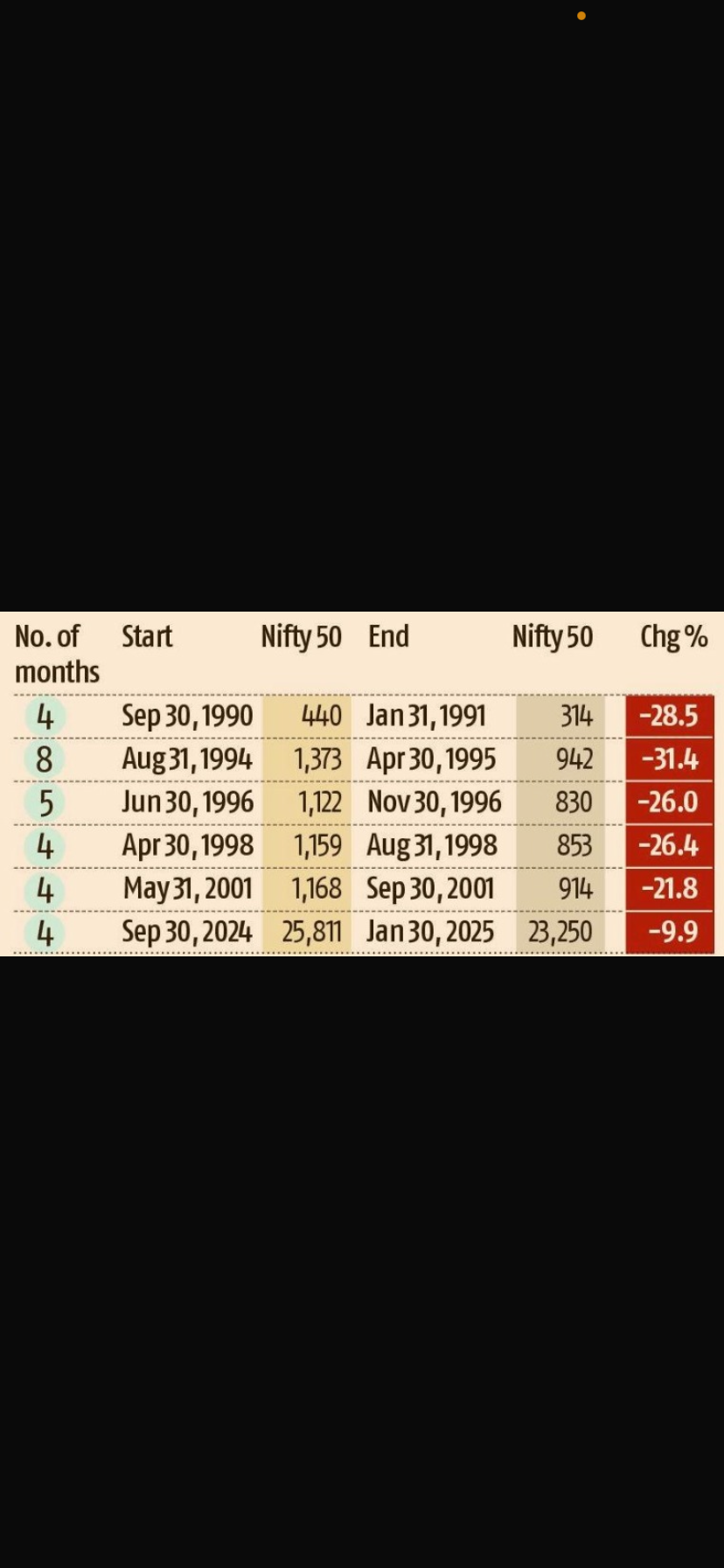

Nifty 50 will keep growing just make sure you don't enter in the end of the prosperity phase where the index gets overvalued and might face correction, but now's a good time I would say

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

Nifty 50 Index: Signs of Reversal Amid Risky Patterns The Nifty 50 index is exhibiting patterns that signal potential market volatility and a possible reversal. Recent technical indicators, such as overbought levels and resistance zone challenges, s

See Morefinancialnews

Founder And CEO Of F... • 1y

"Nifty May See Further 1,000-Point Drop, Technical Charts Indicate Potential Market Decline" "If Nifty Fails to Hold Above 24,500, Charts Signal Potential Drop to 200-DMA at 23,365" Nifty 50 May Drop Another 1,000 Points, Technical Charts Indicate

See MoreRavi Handa

Early Retiree | Fina... • 1y

"Most active funds don't beat the benchmark" - got index funds after hearing this multiple times. AND NOW: Most of the active funds I have - have beaten the index funds (Nifty 50) I have. Quite comfortably. 🥲 Hoping the story changes soon otherw

See Morefinancialnews

Founder And CEO Of F... • 1y

It is a sell-on-rise market; see Nifty@21,300 by end year Jai Bala, Chief Market Technician, predicts a downward trajectory for the Nifty and Bank Nifty indices, reaching 21,300 and 42,000 respectively by year-end. He anticipates a strengthening doll

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)