Back

Harsh Gupta

Digital Marketer (Me... • 1y

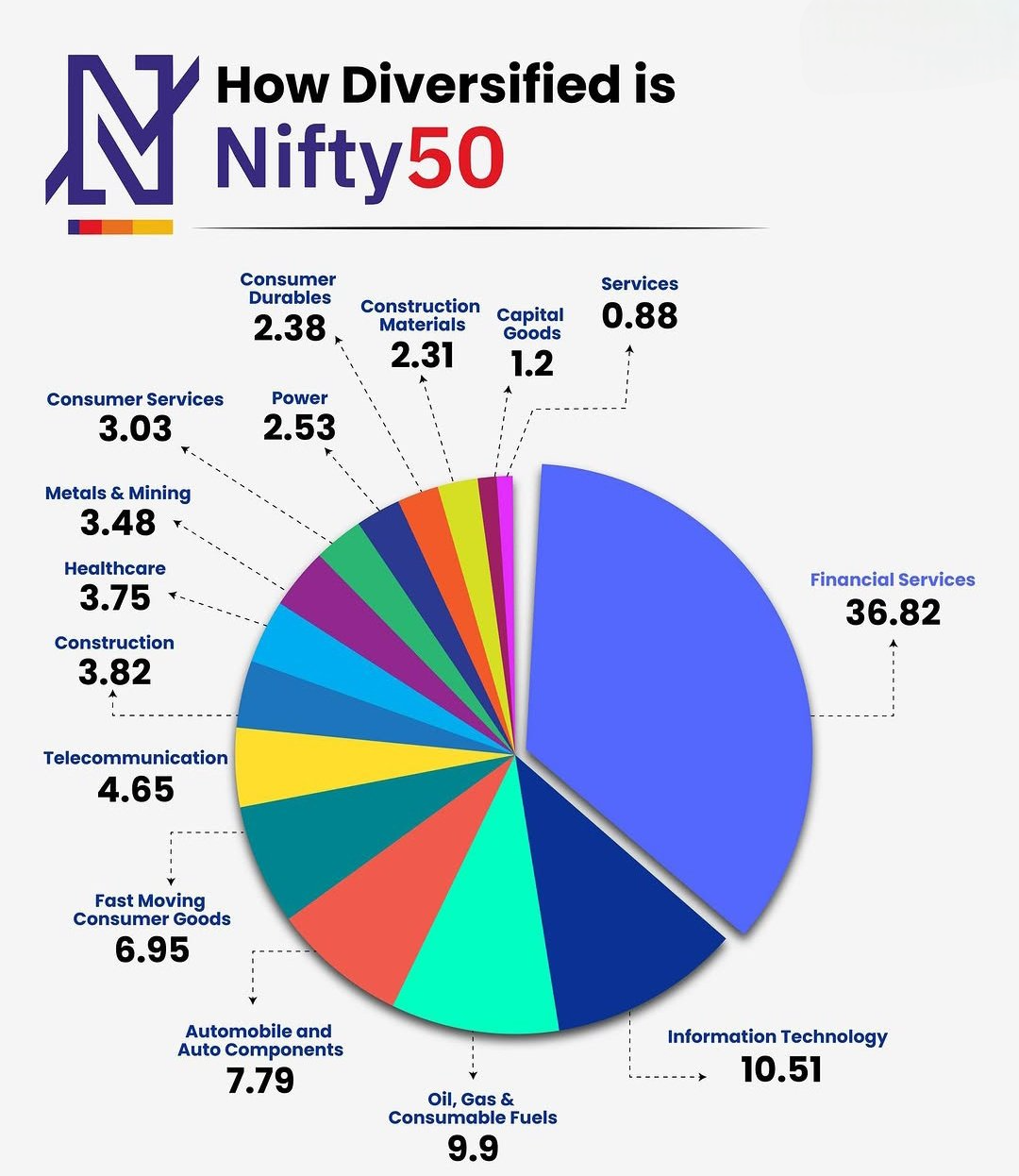

Bro , if you are capable of taking slightly higher risk and also you are young so , you are capable to taking slightly risk . So just put your all money in stock market then diversify it large cap and mid cap and small cap . Don't need to do fancy diversification. Choose one passive index fund (note : Passive) and a actively managed FLEXI CAP fund , I am assuming you know what is PASSIVE INDEX FUND AND FLEXI CAP FUND I hope this will help you

More like this

Recommendations from Medial

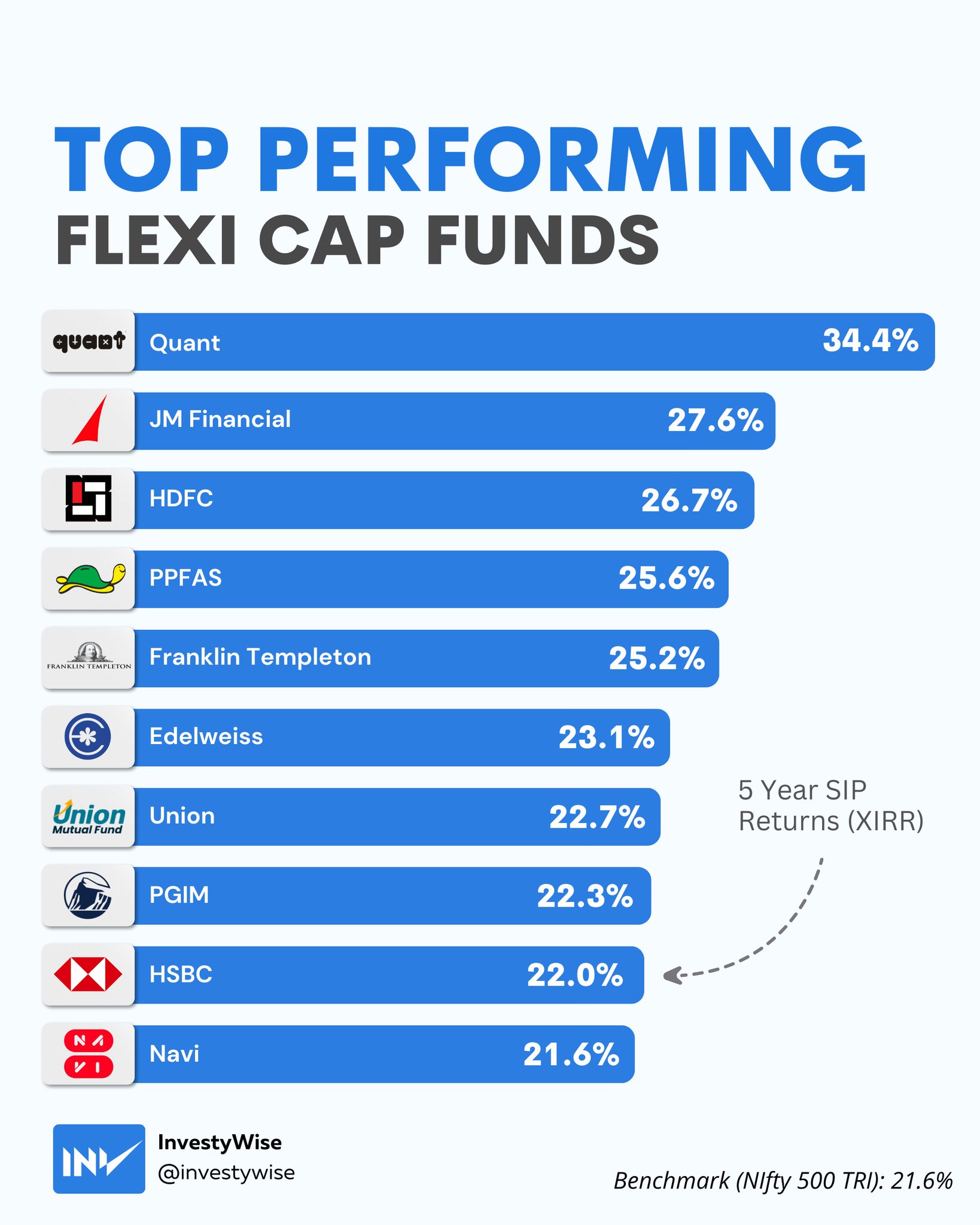

VIJAY PANJWANI

Learning is a key to... • 3m

How Diversified is Nifty 50? Did you know that Financial Services alone make up 36.82% of the Nifty 50 Index? 💼 IT, Oil & Gas, and Auto sectors also play a major role — but true diversification lies in balance! 📈 Top Sectors in Nifty 50: 1️⃣ F

See More

Dhandho Marwadi

Welcome to the possi... • 9m

Parag Parikh Financial Advisory Services Limited, incorporated on October 12, 1992, is based in Mumbai. The company specializes in Portfolio Management Services, integrating investment analysis with Behavioral Finance principles. Additionally, PPFAS

See MoreSaksham Arora doda

DREAM BIG, BECAUSE D... • 1y

I always think! why everyone says that "risk hai toh ishk hai" ok! we know that we have to take risk but it's correct to go all in one thing like take all risk in one project or something it's not true! actually taking calculated risk and that risk

See MoreAbhishek Mahto

Software Developer |... • 1y

Hey, What do you think about failures in life? Yeah! They teach us priceless learnings but I think if you're ready to Try, Fail and Learn it's also very important to be ready to handle it because we don't know what all effects that failure will brin

See MoreAryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreDownload the medial app to read full posts, comements and news.