Back

Anonymous 1

Hey I am on Medial • 1y

Whatever you earn dont save it, but don’t trade it all in at once, I’d suggest you keep a cushion for you, say 50-50 your income from trading, reinvest 50% and invest the rest in traditional stocks which give consistent returns.

Replies (1)

More like this

Recommendations from Medial

Soumya Ranjan Dash

Hit & Trial • 1y

When I started investing in stock markets, I cared about: 100x returns Multibagger stocks Sharing profit screenshots What peers thought about me After getting grilled in the Market, I care about: Risk per investment Overall consistent annual retur

See MoreVIJAY PANJWANI

Learning is a key to... • 4m

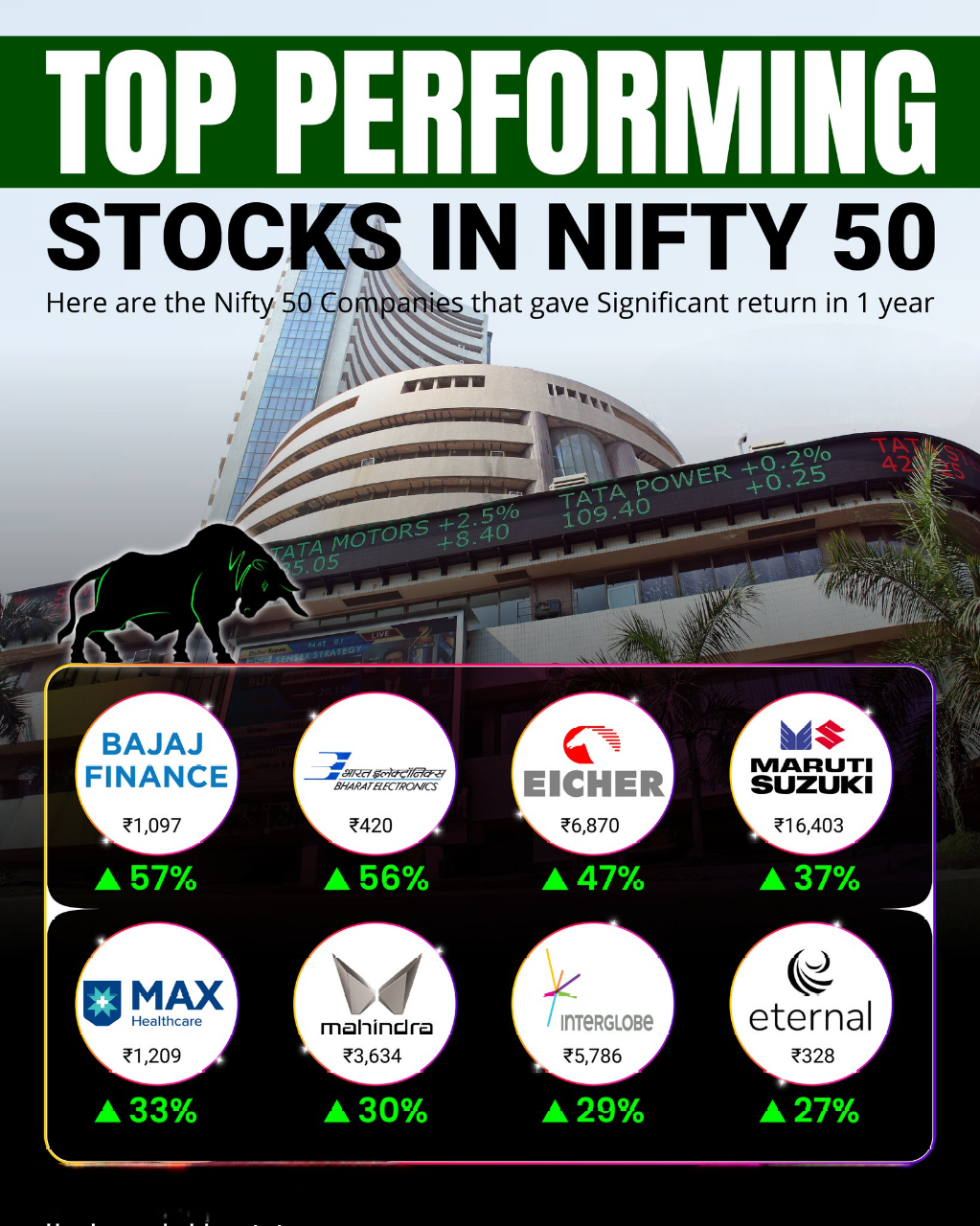

TOP PERFORMING STOCKS IN NIFTY 50! 💥 These are the companies that delivered massive returns in just 1 year! 🚀 From Bajaj Finance to Eicher Motors, the bulls are roaring loud in the market! 🐂💹 💰 Who’s your favorite pick for the next rally? 👇 Com

See More

financialnews

Founder And CEO Of F... • 1y

Equities Projected to Deliver 8%-12% Returns in 2025 The year 2025 brings a mixed bag of challenges and opportunities, marked by macroeconomic turbulence, global trade uncertainties, and policy changes. Investors can benefit from well-planned asset

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)