Back

Anonymous 2

Hey I am on Medial • 1y

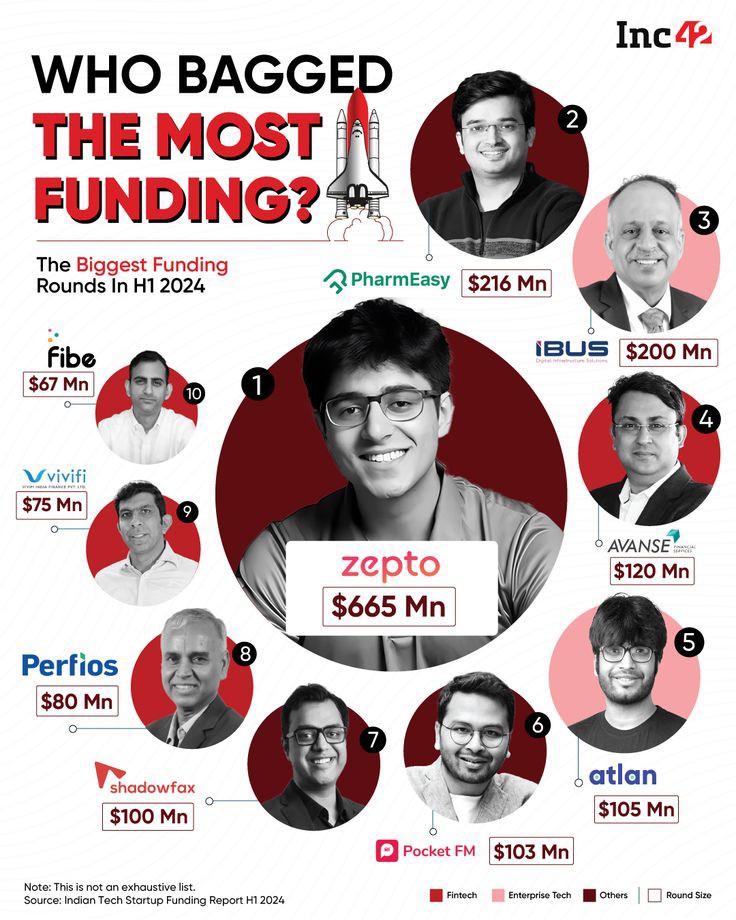

Yes. Pocket does. Their yearly revenue is 100M. They can easily scale to 1B in revenue if they get 200-300M more in funding.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

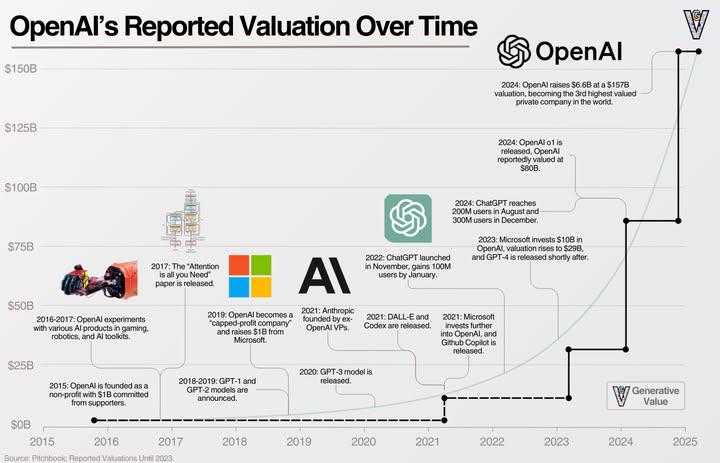

🚀 OpenAI’s valuation curve looks like a SpaceX launch From a non-profit in 2015 to a $157B AI powerhouse in 2024, Eric Flaningam's chart perfectly captures the wild trajectory. Some key moments: ▪️ 2015: Founded as a non-profit with $1B in fundin

See More

Mayur Mahale

Hey I am on Medial • 1y

we are starting startup about innovative farm technology. we have built working prototype with our own money.We are facing issue in funding to scale our startup to larger scale. we don't know how to gather any funding or loan on pre revenue business

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)