Back

Santu Saha

Finance With Fun. • 1y

Replies (2)

More like this

Recommendations from Medial

Gargi Jain

Cloud | DevOps | Ill... • 1y

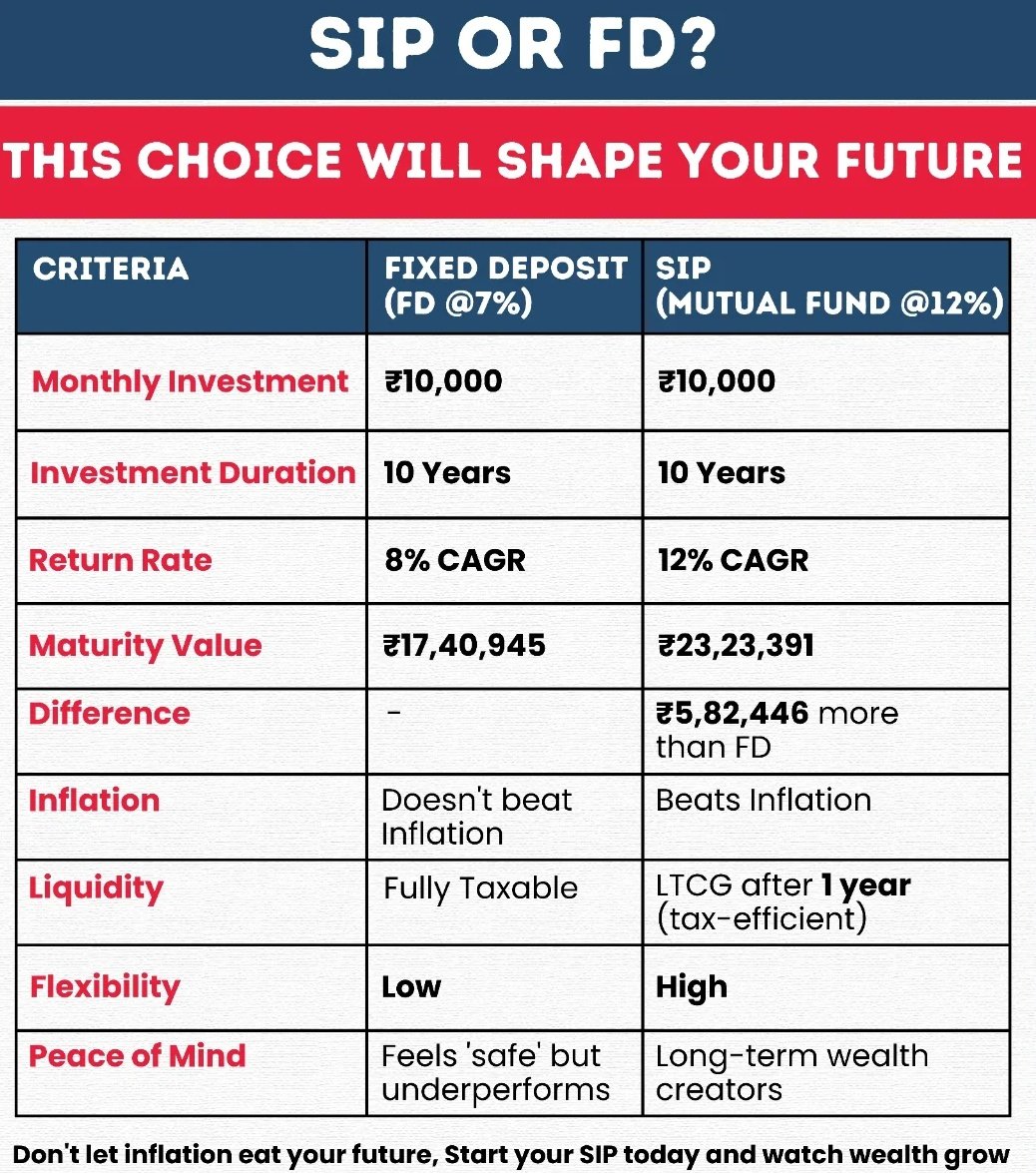

What's the best way to explain my Dad - Mutual Funds is better option than FD and MF gives higher returns. His statement is that "it is risky and might have to bare the loss sometimes and can't remove the cash whenever required (has lock in period)

See More

Anonymous

Hey I am on Medial • 1y

How much cash do you guys carry in your wallet? In this era of UPI apps, it's hard to save. Thinking about keeping cash in my wallet, but it comes with a risk of being stolen or worse. What's an acceptable/ comfortable amount of cash that you guys k

See MoreRohan Saha

Founder - Burn Inves... • 9m

Many people think that if they buy mutual funds from different platforms and keep them, it will be difficult to track them. But that's not true. There's a platform called MF Central, which is SEBI-regulated and keeps records of MF folios and manages

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)