Back

Aditya Avhad

•

UrbanWrk • 1y

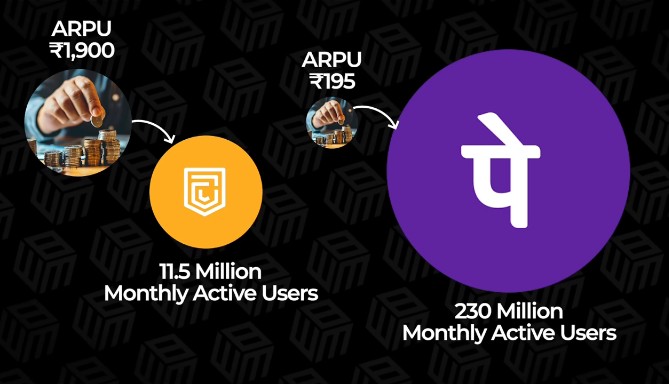

I'm not sure why Cred hasn't done it, but AI or human based personal finance advisor , they already have data on all my spending , income and insurance. Getting users betting at finance can be their goal, so many ways to upsell financial products and services. MFcentral can pull their existing data. People can enter what they want the target networth to be in set time, cred can just keep selling them something. Probably that might be the play with buying kuvera.

Replies (1)

More like this

Recommendations from Medial

Satvik Kumar

Think Make Earn Repe... • 1y

Thinking about a personal finance management service based platform with AI chatbot as a personal financial advisor and many more features than an ordinary finance management platform with an integrated Twitter like platform where we can find entrepr

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 9m

🧲 Push vs Pull — Why CRED Didn’t Chase Customers 🌝 Most startups follow the default playbook: Find a problem → Build a solution → Push it out through marketing, sales, and ads. This is called a push strategy. You identify a pain point and push yo

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)