Back

Anonymous 2

Hey I am on Medial • 2y

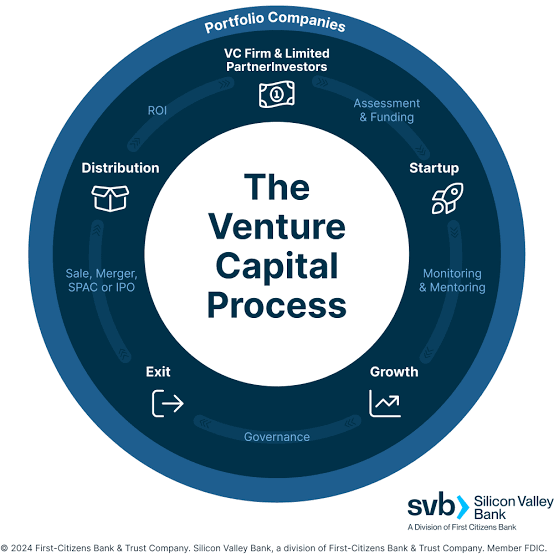

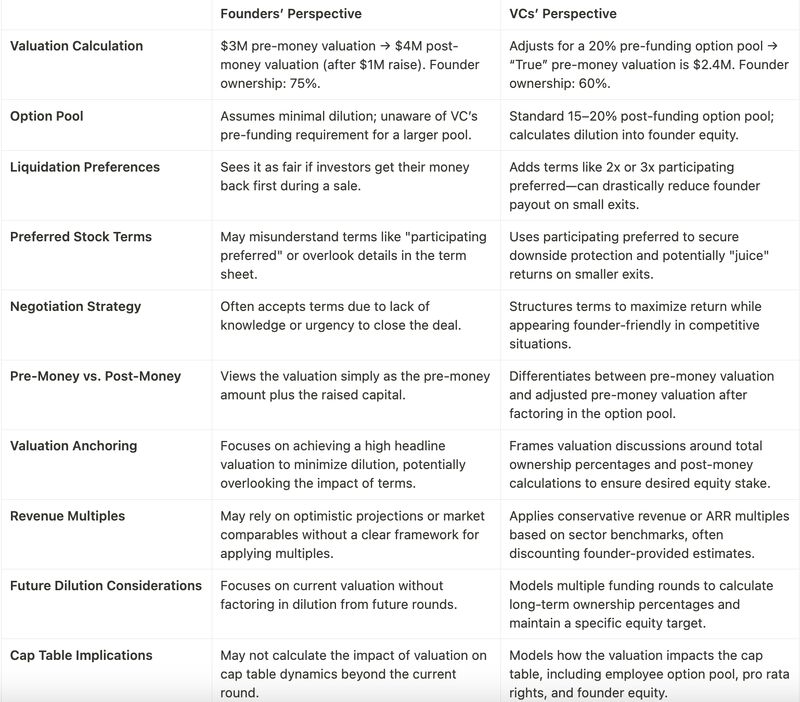

Unfortunately there’s no right way of doing a valuation evaluation for a pre-revenue company. If the valuation is being set with the future being in mind, VCs and founders often get it wrong.

More like this

Recommendations from Medial

Adithya Pappala

250Tn Global Impact Ventures • 3m

Most founders can't raise funds not because.... -bad product -bad sales -bad team but because they go to wrong dates. Yes! they meet wrong VCs. If you are a pre-revenue startup,Read this! "Pitching 25 seed-VCs is much more better than pitching t

See MorePrince Yadav

Co -founder at Trade... • 1y

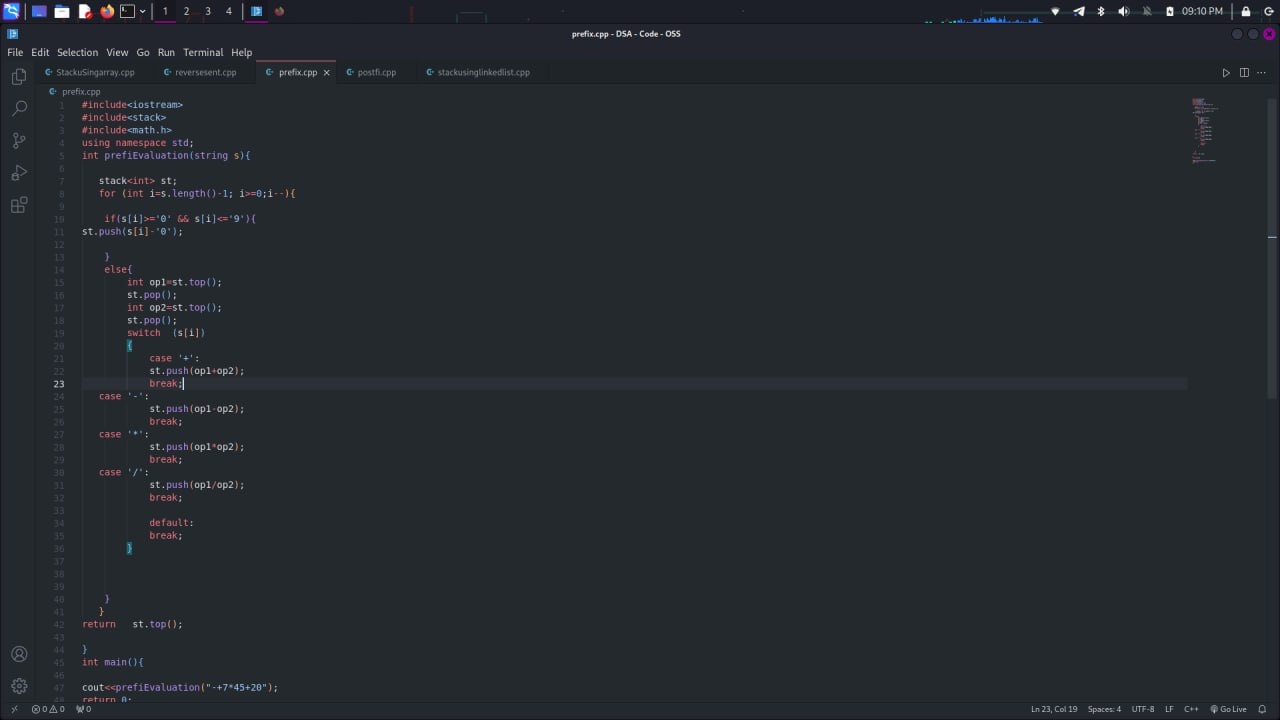

Prefix data structure, often referred to as a trie, is a tree-like data structure used for storing and retrieving a dynamic set of strings efficiently, particularly when dealing with prefix-based operations. #Datastructure #codingjourney Prefix Expr

See More

Nikhil Raj Singh

Entrepreneur | Build... • 6m

Have you watched Silicon Valley or not this is one of the BEST scenes ever. Richard: We could charge a subscription and actually make money. Russ Hanneman: “NO. You say you're pre-revenue. Because when you say you have revenue, people ask: “How m

See More

CA Vamshi

Practicing Chartered... • 9m

90% of startup founders overestimate their valuation. The other 10%? They raise smart, retain more equity, and stay investor-ready at every stage. Valuation isn’t just about numbers — it’s about narrative, traction, and timing. It reflects how well

See MoreMahesh chhanga

Neha enterprise • 12m

A VC is showing strong interest in our transport & logistics biz at a 40Cr valuation. We've got 1.5Cr revenue, 13% net profit, and a clear path to scale in an untapped market. Strong family biz background. Considering a pre-seed round. Thoughts on th

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

15 Startup Ideas VCs Are Betting On (Pre-Revenue!) in 2025–2026 The bar for traction is rising—but some ideas are still fundable on vision alone. Here’s what top VCs are chasing before revenue: 1. AI Agents for Enterprises 2. Synthetic Biology Pla

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)