Back

More like this

Recommendations from Medial

Havish Gupta

Figuring Out • 2y

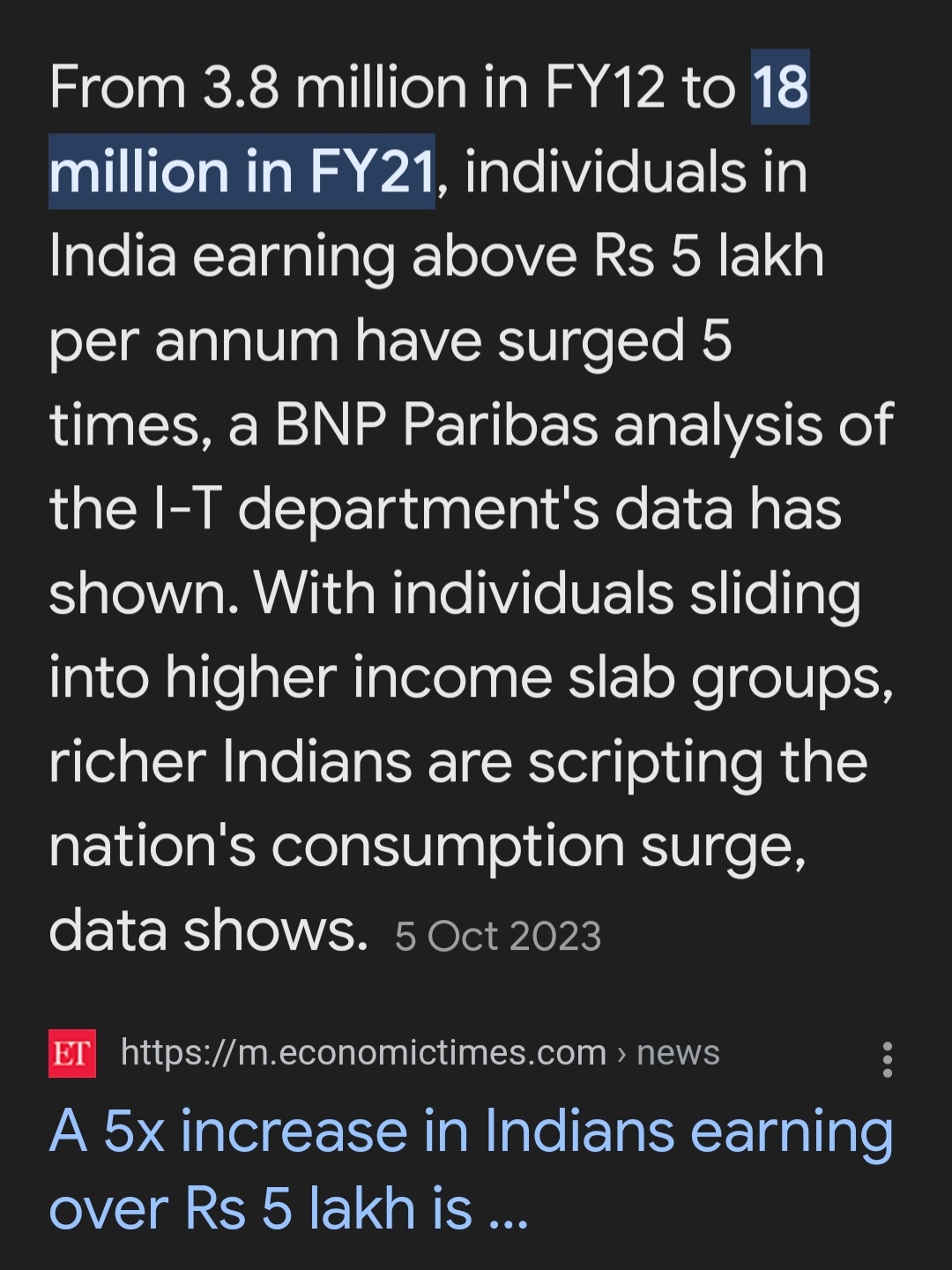

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Suman solopreneur

Exploring peace of m... • 1y

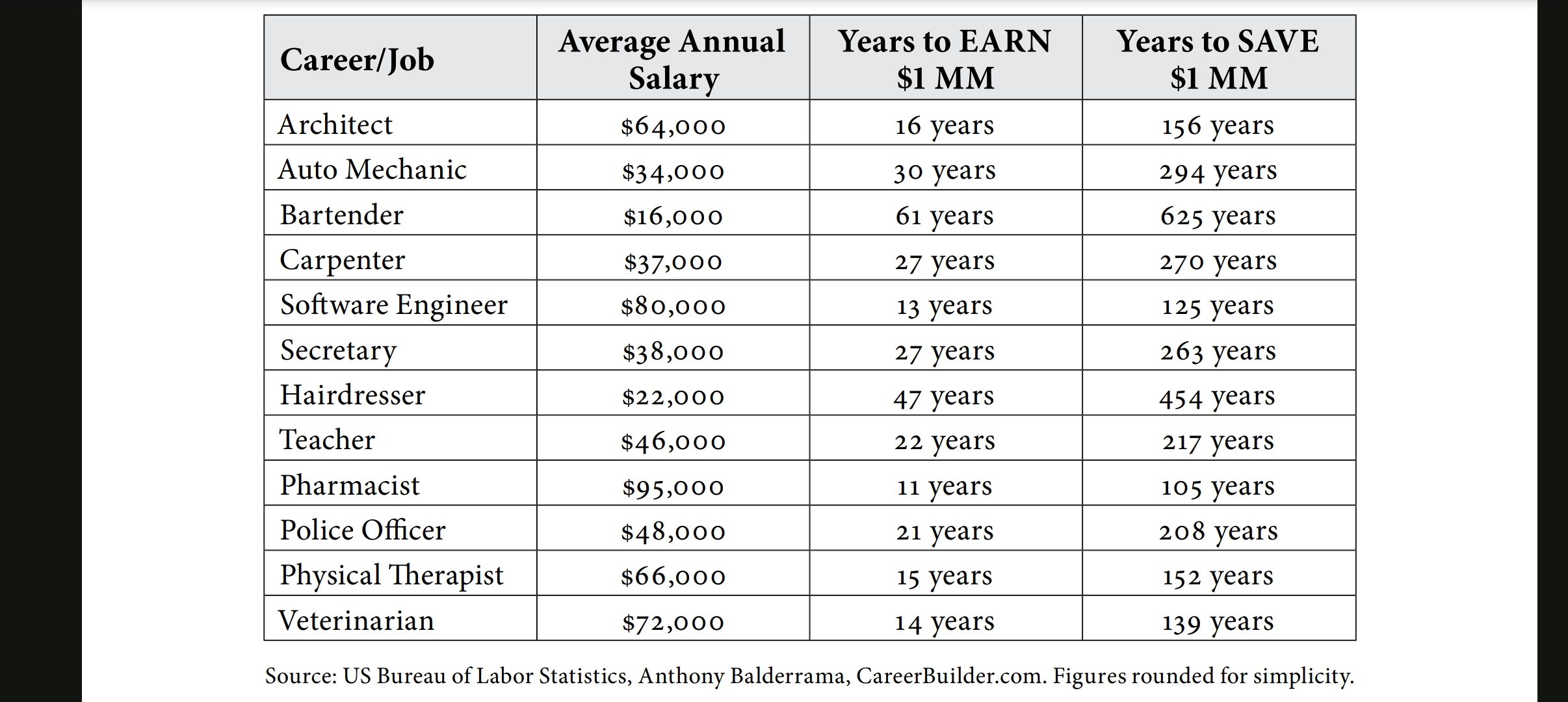

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

If your income is 12L, You pay 0 for the first 4L. From 4L - 8L i.e. next 4L, you pay 5% = 20,000. From 8L - 12 i.e. another 4L, you pay 10% = 40,000. Total Tax Payable= 60,000. Standard Deduction -75,000. So NO TAX FOR INCOME UP TO 12L. Get it?

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)