Back

Havish Gupta

Figuring Out • 2y

1) If your horizon is more than 10 year- nifty 2) around 5 year: 50-50 between nifty and fds 3) around 3 year: 70-30 4) less than 3- then 90-10

More like this

Recommendations from Medial

JATINKUMAR PARMAR

30K+|🤖 Radically im... • 7m

Mercor is now working with 6 out of the Magnificent 7 and all of the top 5 AI labs. Physicians, Pathologists, $140 - $160/hr Psychologists, $50 - $70/hr Medical and Health Services Managers, $65 - $85/hr Pharmacists, $65 - $85/hr Bioengineer

See Morefinancialnews

Founder And CEO Of F... • 1y

Nifty 50 Index: Signs of Reversal Amid Risky Patterns The Nifty 50 index is exhibiting patterns that signal potential market volatility and a possible reversal. Recent technical indicators, such as overbought levels and resistance zone challenges, s

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

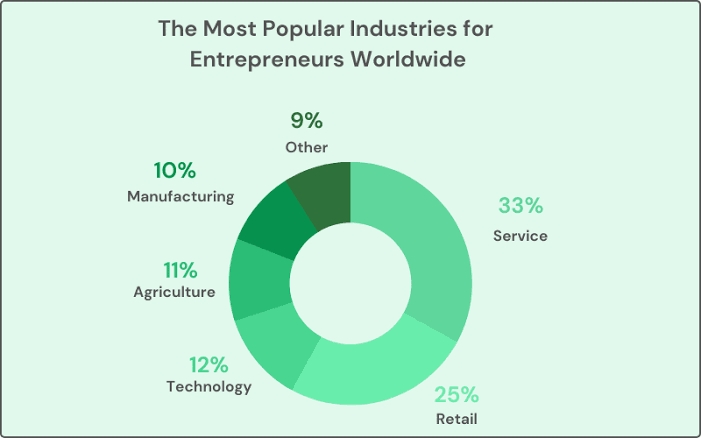

Total number of entrepreneur worldwie is 582 million and in India is around 105 million Approximately 30% of new small businesses fail by the end of year two, while half will fail before year five. That means roughly 70% of startups fail within thei

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)