Back

SamCtrlPlusAltMan

•

OpenAI • 1m

The Startup Fundraising Roadmap: A Complete Guide by Hissa Fundraising isn’t just about raising money, it’s about building momentum, choosing the right path, and navigating complexity without losing sight of what matters. Hissa’s guide breaks it down, I'll unpack the roadmap with more context: 1. Preparing for a Funding Round Priced vs. Non-Priced Rounds Priced Rounds: You and investors agree on company valuation upfront, then issue shares accordingly. Non-Priced Rounds: Valuation is deferred, often linked to triggers like milestones or future priced rounds. Both have trade-offs: priced gives clarity but risks overvaluation; non-priced offers flexibility but can cause ambiguity about terms. Choose based on your growth stage and negotiation leverage. Types of Financing: Equity, Debt, Hybrid Equity: Dilutes ownership, but ideal for high-growth bets. Debt: You repay without dilution, but only realistic with stable cash flows. Hybrid (e.g., convertible notes): Flexible, founder-friendly, bridges between equity and debt before you nail valuation. 2. The Art of the Pitch & LOI Treat your pitch deck as a storytelling vehicle, not a spreadsheet dump. Focus on problem, team, differentiation, and traction. Think why you, not what you. Letter of Intent (LOI) isn’t just formality. It outlines the high-level terms and creates momentum before legal deep-dives begin. Nail this, and you signal seriousness and clarity. 3. Term Sheet → Due Diligence → Negotiation Term Sheet This document defines valuation, equity, rights, and governance. Don’t sign blind..understand implications like liquidation preference, control, and board composition. It becomes your company’s operating compass. Due Diligence Founders, this is your vulnerability test. Investors will inspect financials, incorporation, compliance, IP, and more. Be proactive, organize everything beforehand. Clarity builds trust. Negotiating Terms Yes, you’re raising money..but what do you gain? Negotiate not just valuation, but control, board rights, protective clauses. Think long-term: you’re building a company, not just closing a round. 4. Documentation & Deal Closing Prepare LEGAL AGREEMENTS: including shareholders’ agreement, investment agreement, and board governance. Do the REGULATORY LIST: statutory filings, equity issuance, KYC/POS processes. Complete the fund transfer, cap table updates, and investor onboarding. Smooth execution here builds credibility and goodwill for the next stage. Why This Roadmap Matters Most guides end with “raise → succeed.” Hissa does better, it maps out how to raise. That structure saves time, avoids chaos, and aligns founders with investor thinking. Ultimately, fundraising is more than money. It’s about creating signal..clarity, trust, focus, and alignment with partners who'll stick with you.

Replies (3)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Interesting News From OYO 🤔🤯 • India’s Oyo, once valued at $10B, seeks new funding at 70% discount. • Oyo, an Indian startup, seeks new funding at a $3 billion valuation, down from $10 billion. • Negotiating with investors like Malaysia's Khazan

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Anirudh Gupta

CA Aspirant|Content ... • 3m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 4m

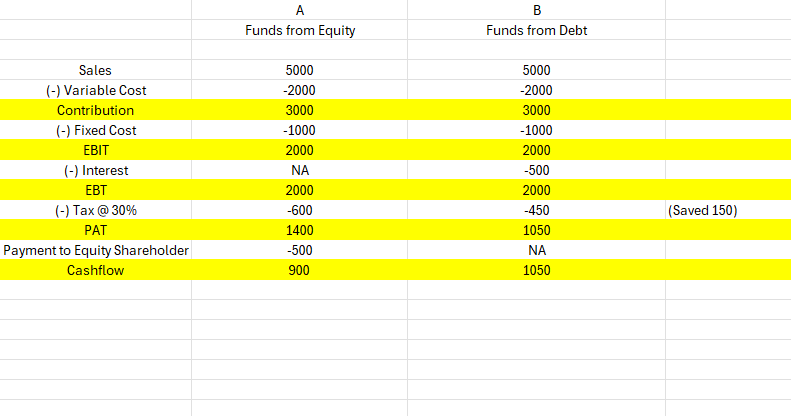

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 8m

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.