Back

Anirudh Gupta

CA Aspirant|Content ... • 2m

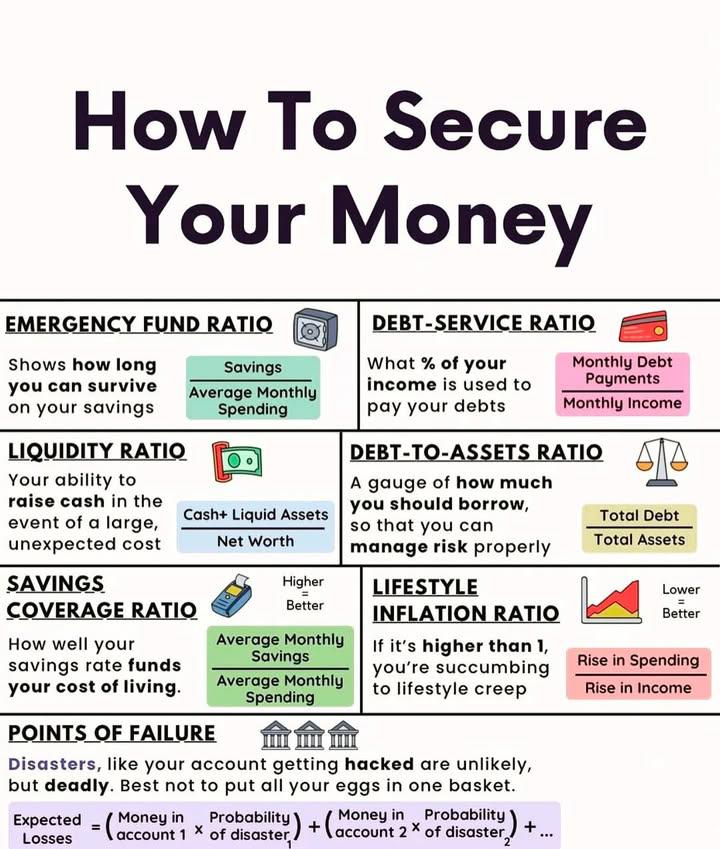

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Creditors can understand whether -the company is financially stable and -to evaluate the company’s ability to repay debts and cover their interest expenses. Investors can decide -whether the start-up is either more debt funded or equity funded. -(Investors are always willing to put their money in a equity funded company) Ideal Ratio: Less than or upto 1, -is a preferable financial ratio -Investors and creditors=Mein khush hun bhaai,achase dhandha karo😄 More than 1, -not preferable ratio -High risk, indicates more debt is being used to maintain operations -Investors and creditors=Who are you bhaai🏃🏻♂️🏃🏻♂️ -May cast their doubts on the company’s well being and consider pulling back their money. Learning Each ratio a day, makes you financially brave. Follow for more!

Replies (13)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 2m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 4m

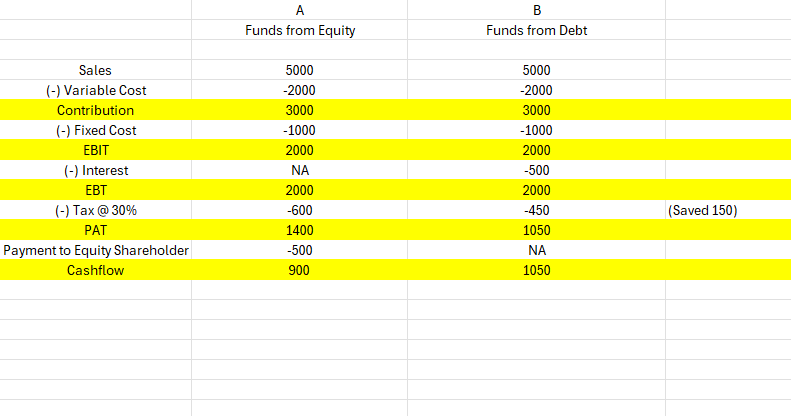

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Gangesh Rameshkumar

Figure it out • 2m

Today's term of the day: Equity Equity, in simple terms, is the money that is returned to all the shareholders of a company, if all the company's assets are liquidated and liablities are paid off. It is also a measure of the financial health of a c

See MoreDownload the medial app to read full posts, comements and news.