Back

spectar

the best closer • 3m

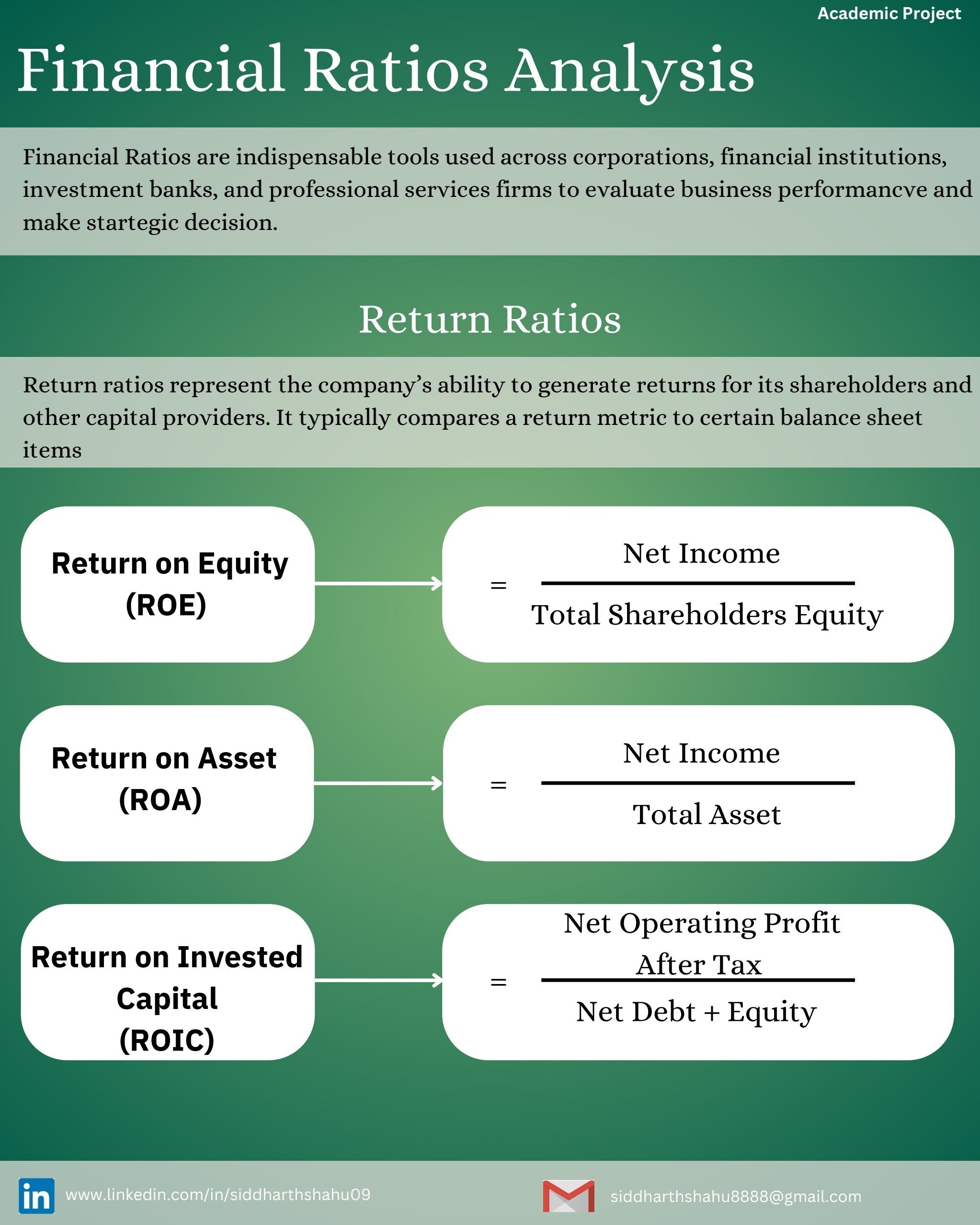

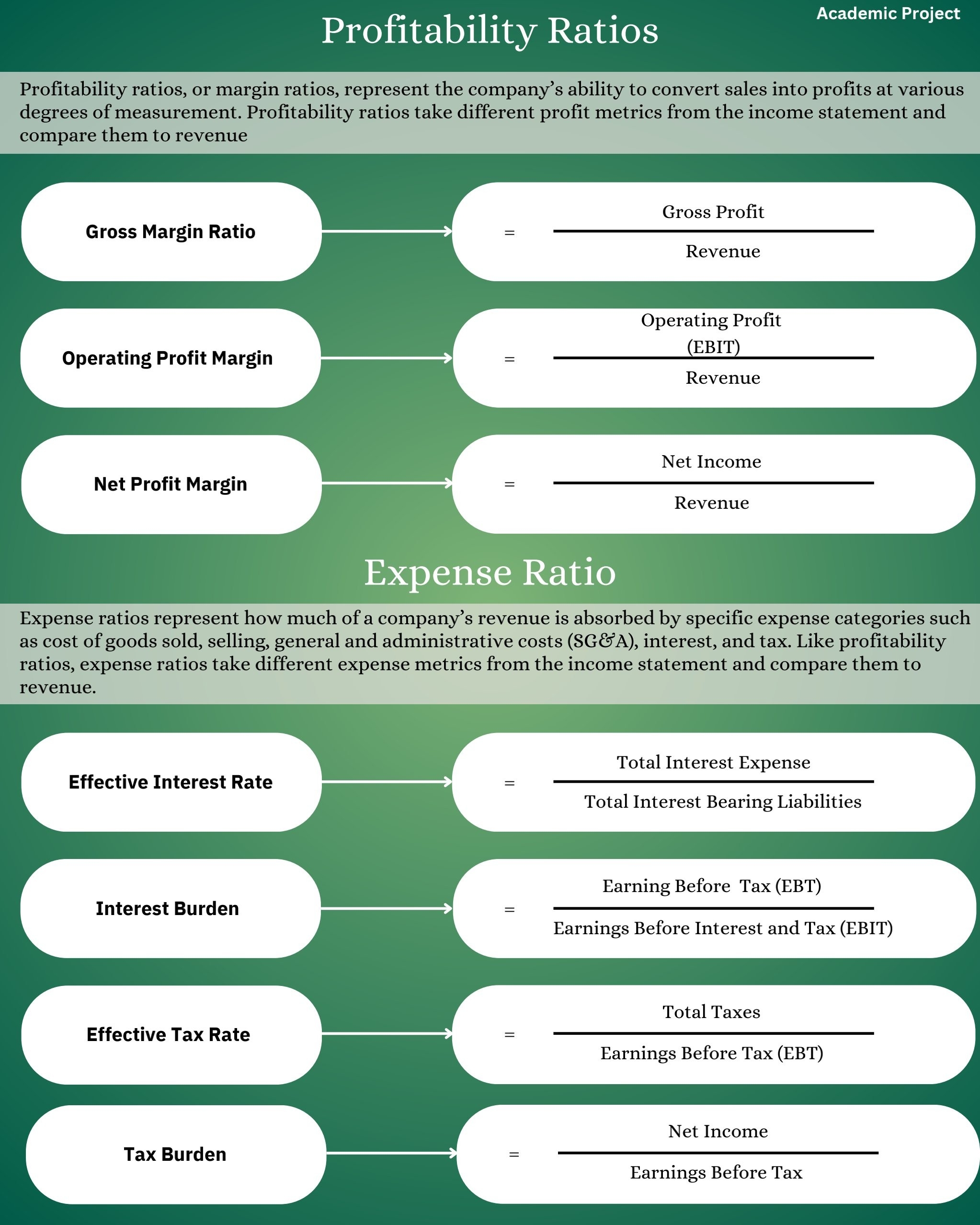

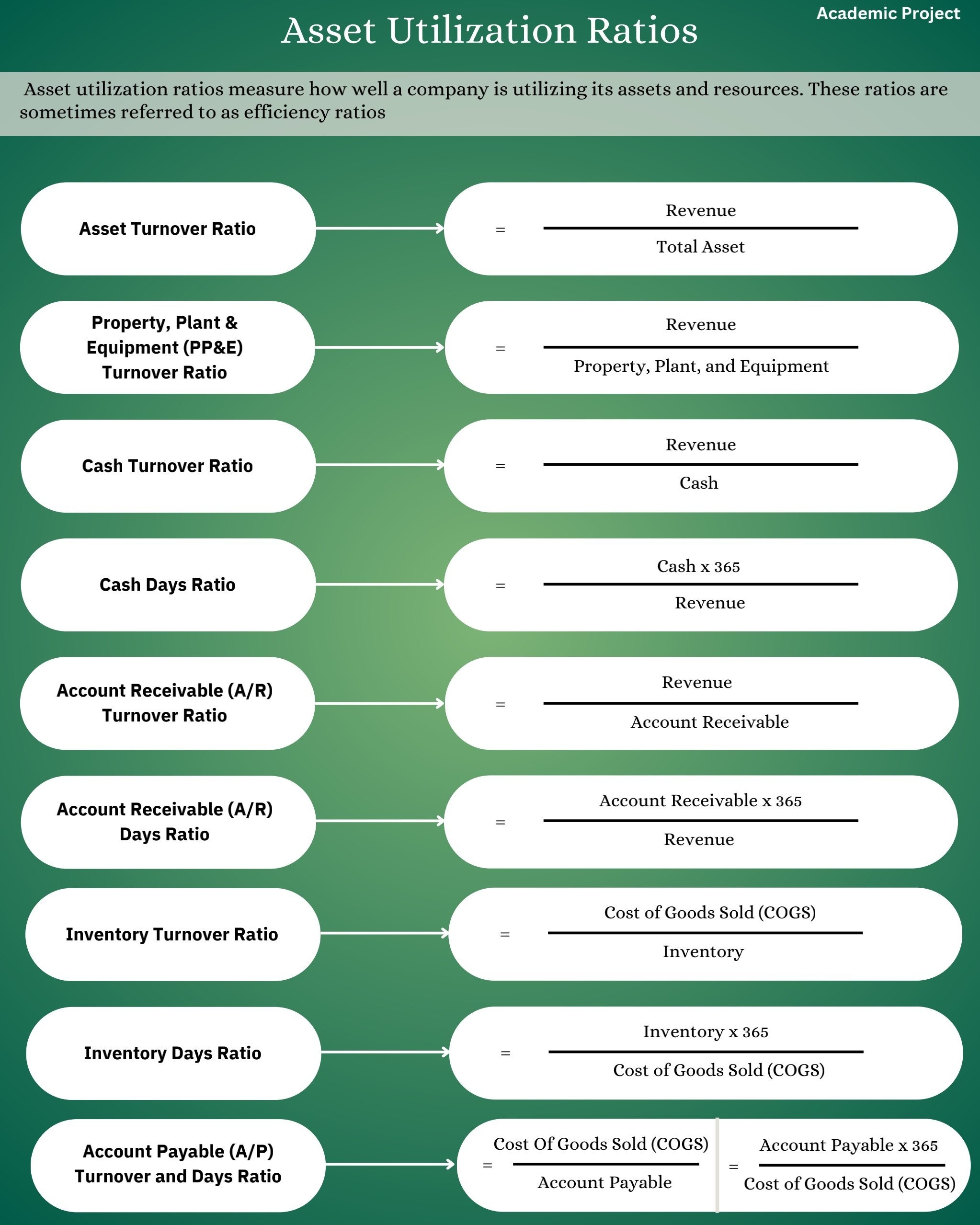

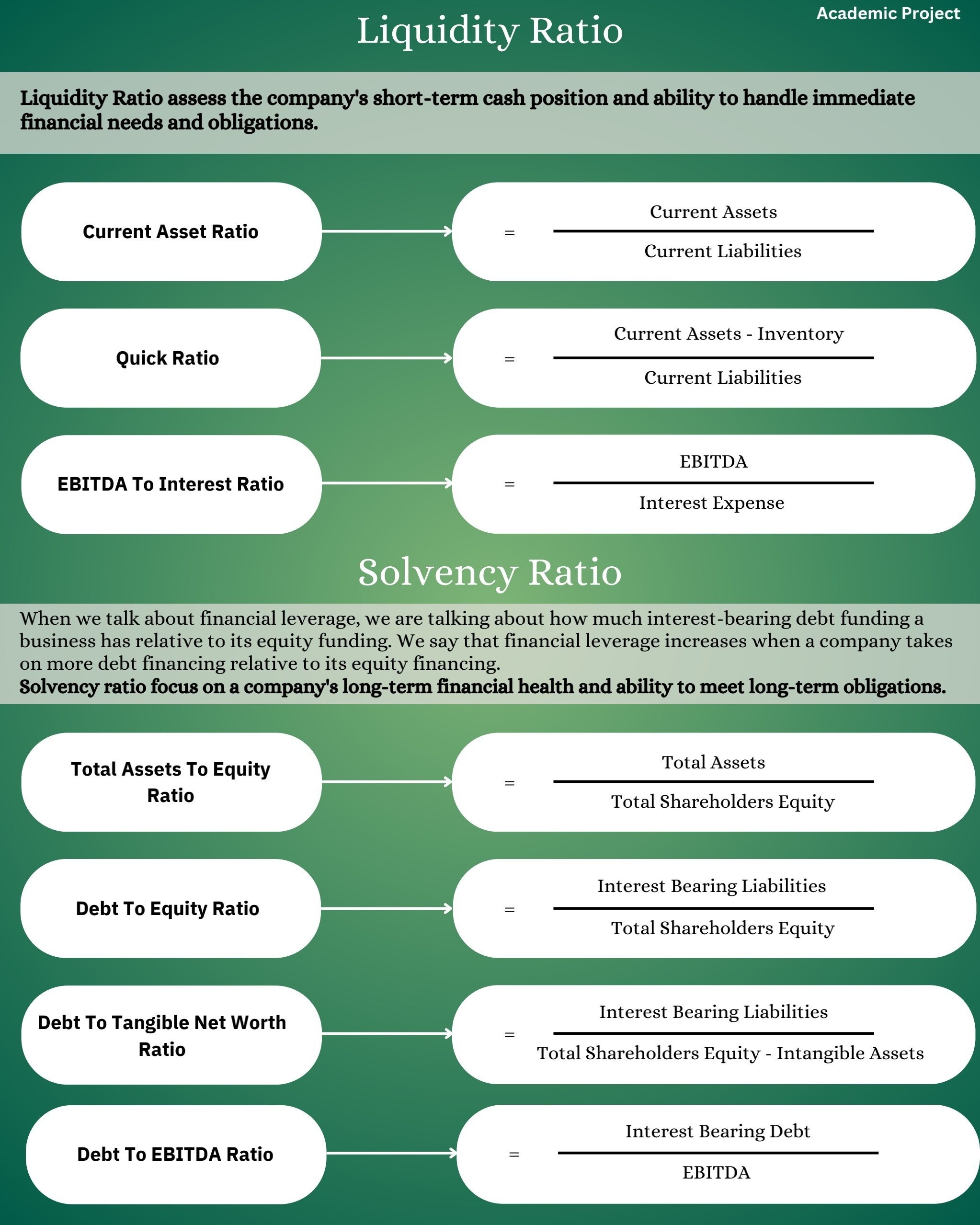

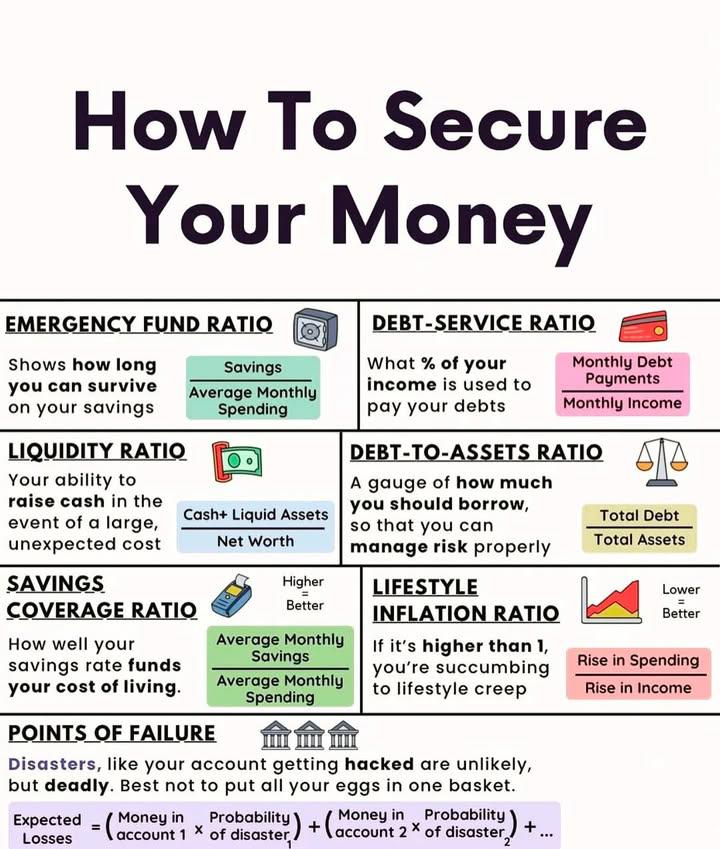

𝑮𝒐𝒕 𝒕𝒉𝒆 𝒘𝒐𝒏𝒅𝒆𝒓𝒇𝒖𝒍 𝒍𝒆𝒔𝒔𝒐𝒏𝒔 𝒓𝒆𝒍𝒂𝒕𝒆𝒅 𝒕𝒐 𝒓𝒂𝒕𝒊𝒐𝒔 𝒇𝒓𝒐𝒎 𝒕𝒉𝒊𝒔 𝒃𝒐𝒐𝒌 : "Boring Numbers or Money Magnets? The Financial Ratios That Matter" Ever wondered why some companies get all the investor love while others get swiped left? 🤔 It's all in the ratios! 1. Liquidity Ratios: The "How Quickly Can You Pay for Dinner" Test * **Current Ratio** = Current Assets ÷ Current Liabilities When it's above 1, you can pay your bills. Below 1? You're that friend who always "forgot their wallet." * **Quick Ratio** = (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities Same concept but stricter - like asking if you can pay right NOW, not after selling your old laptop on OLX! 2. Profitability Ratios: The "Are You Worth Dating" Test * **Net Profit Margin** = Net Profit ÷ Revenue The higher this is, the more efficient you are at turning sales into actual profit. Like converting leads into actual sales - not just collecting phone numbers! * **Return on Equity (ROE)** = Net Income ÷ Shareholder's Equity This shows how much profit a company generates with shareholders' money. Low ROE? Like telling investors "I took your ₹100 and turned it into ₹102." Not impressive! 3. Solvency Ratios: The "Will You Still Be Around Next Diwali" Test * **Debt-to-Equity** = Total Debt ÷ Total Equity Too high and you're one bad quarter away from calling up Sharma Uncle for a loan! 4. Efficiency Ratios: The "How Hard Is Your Money Working" Test * **Inventory Turnover** = Cost of Goods Sold ÷ Average Inventory Low turnover? You're basically running a museum, not a business! 📦 5. Valuation Ratios: The "Are You Worth All That Attention" Test * **P/E Ratio** = Share Price ÷ Earnings Per Share High P/E means either great expectations or you're the financial equivalent of that overpriced café in South Delhi! ☕ What's your favorite financial ratio? Drop it in the comments! 👇 #FinancialLiteracy #InvestingTips #FinanceSimplified #IndianMarkets #StockMarketIndia

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 1m

Daily(irregular 😅) dose of financial ratios by Anirudh Gupta Lets learn these two ratios 1.Capital turnover ratio: =Sales or Cost of goods sold/Capital employed Capital employed=Shareholders funds+ Non-current liabilities Purpose: -To understa

See MoreAnirudh Gupta

CA Aspirant|Content ... • 1m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreAkash Koli

Experienced Financia... • 1y

Understanding Return Ratios: Measuring Your Business Performance 📊💡 Hello VittArena Network! Return ratios are key to assessing how well your business is performing. Here’s a quick guide: # ROI (Return on Investment): Measures the gain or loss f

See MoreTushar Aher Patil

Trying to do better • 9m

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

Anirudh Gupta

CA Aspirant|Content ... • 1m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreTushar Aher Patil

Trying to do better • 9m

Day 8 About Basic Finance and Accounting Concepts Here's Some New Concepts In finance, Liabilities represent obligations or debts that an individual or organization owes to others. They indicate an outflow of resources, either cash or services, that

See More

Anirudh Gupta

CA Aspirant|Content ... • 1m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreDownload the medial app to read full posts, comements and news.