Back

Bhavesh Kumar

Finance & Accounts p... • 21d

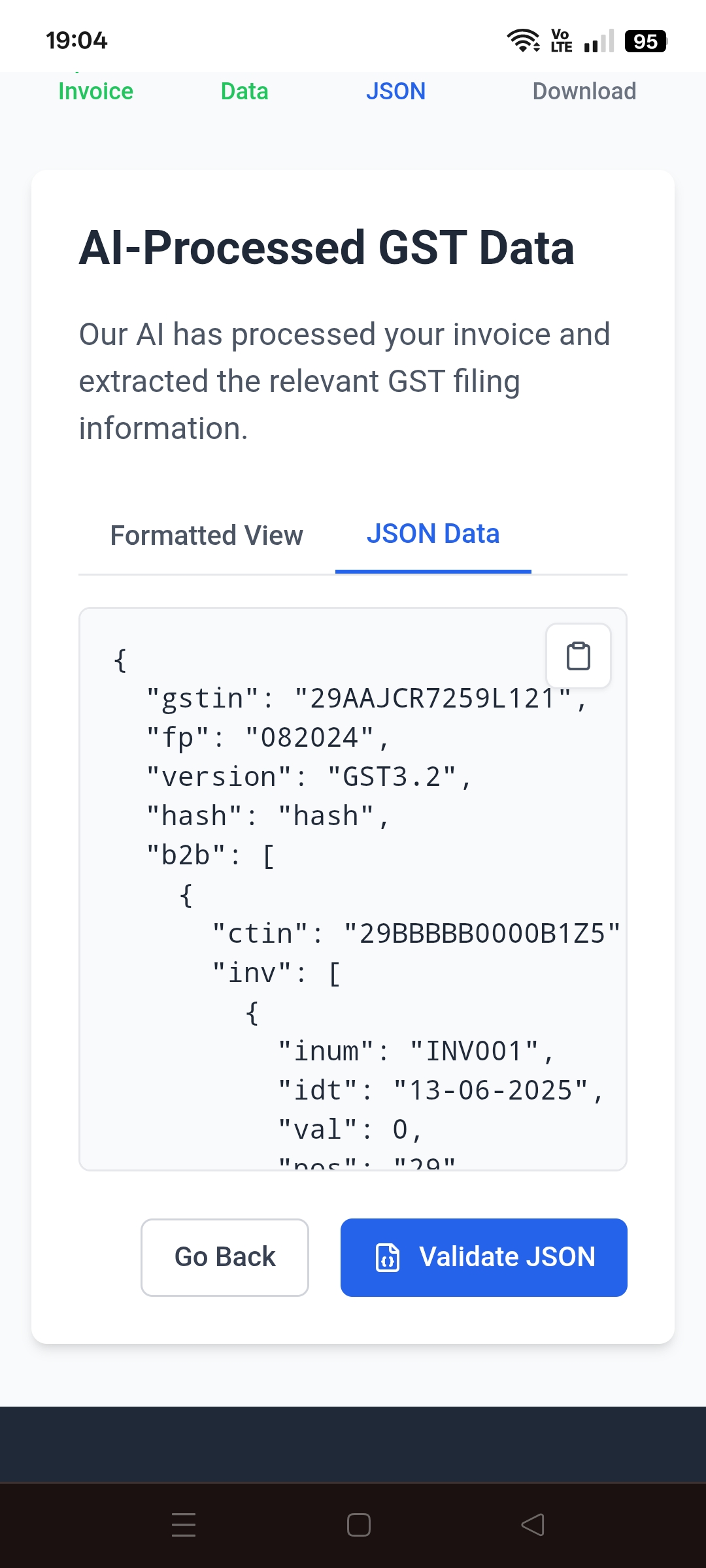

1. Sale of Goods by Seller Seller's Invoice Value (Inclusive of GST @28%) = ₹100 Breakup: Taxable Value = ₹78.12 GST @ 28% = ₹21.88 This is a sale made by the seller, and Amazon collects this ₹100 from the customer on behalf of the seller. 2. Service Charges by Amazon to Seller Amazon deducts its service charges for delivering the goods and providing platform services. Suppose the service charge is ₹15 + 18% GST = ₹2.70 → Total Deduction = ₹17.70 This is an invoice from Amazon to the seller for service provided. Final Settlement: Total Collected from Customer: ₹100 Less: Amazon’s Service Charge (incl. GST): ₹17.70 Net Amount Paid to Seller: ₹82.30 Notes: The seller will pay GST of ₹21.88 to the government (Output Tax). Sellers can claim ITC of ₹2.70 on GST charged by Amazon (Input Tax). more clarification pls connect @9873842103

More like this

Recommendations from Medial

Deepak Kumar

Founder @erizo.in • 22d

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreAshutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreDownload the medial app to read full posts, comements and news.