Back

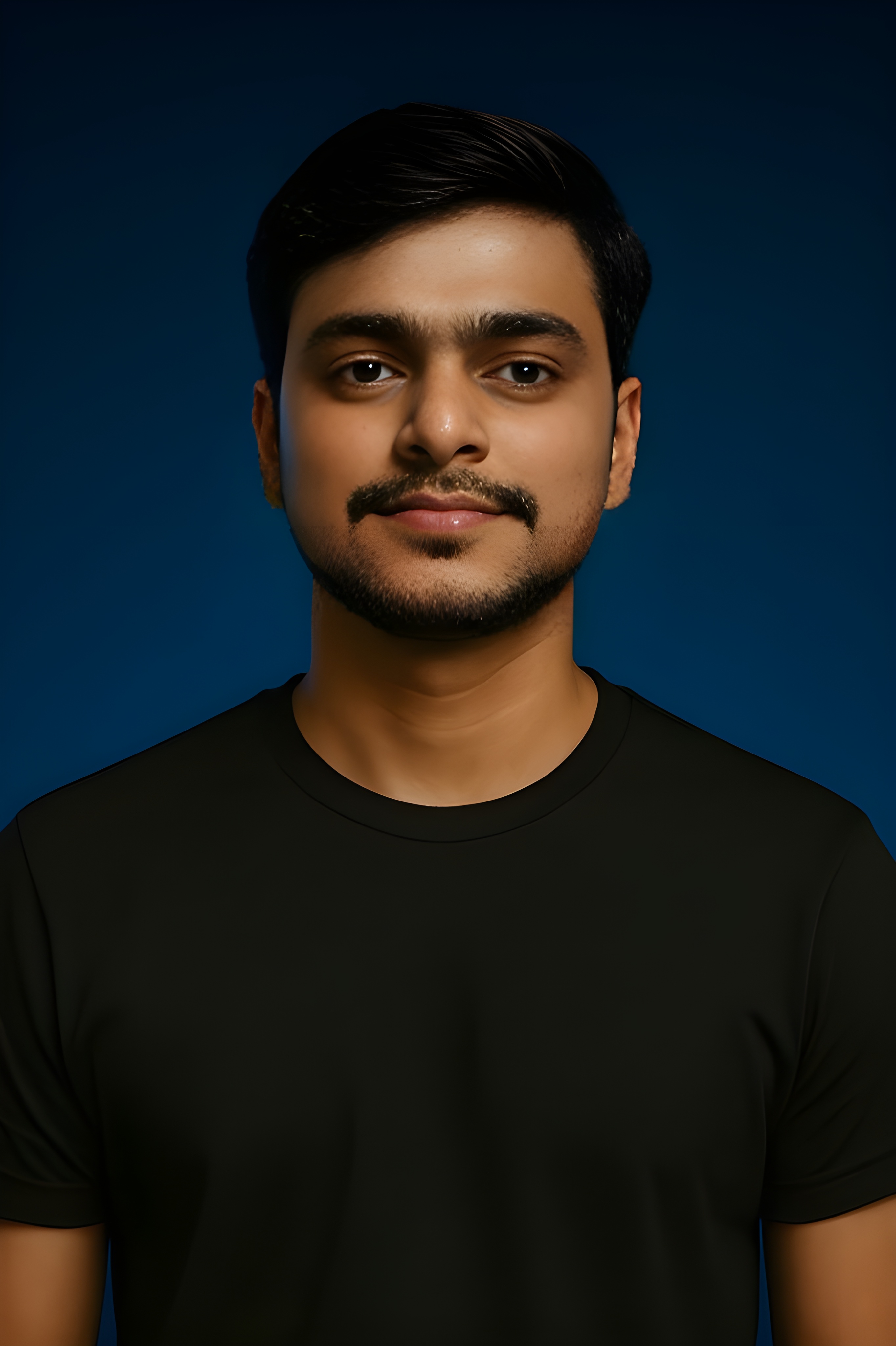

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

Any Idea on why online gambling has 28% GST? Those sectors are being killed in the name of taxes.Would You do a startup in such sectors with higher taxes?

Replies (9)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Tax and Accounting Compliance within the Online Gaming Sphere!! How it Started in CGST ACT ➡SCHEDULE III of the CGST Act contains “Activities or Transactions which shall be treated neither as a Supply of Goods nor a Supply of Services” #Old Para 6

See MoreDeepak Kumar

Founder @Dillikirana... • 7d

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreVamshi Yadav

•

SucSEED Ventures • 4m

Between 2022 and 2024, the Indian government banned 1,298 online gaming platforms due to concerns regarding addiction, financial hazards, and non-payment of taxes. The Ministry of Electronics and Information Technology (MeitY) imposed stricter contro

See MoreDownload the medial app to read full posts, comements and news.