Back

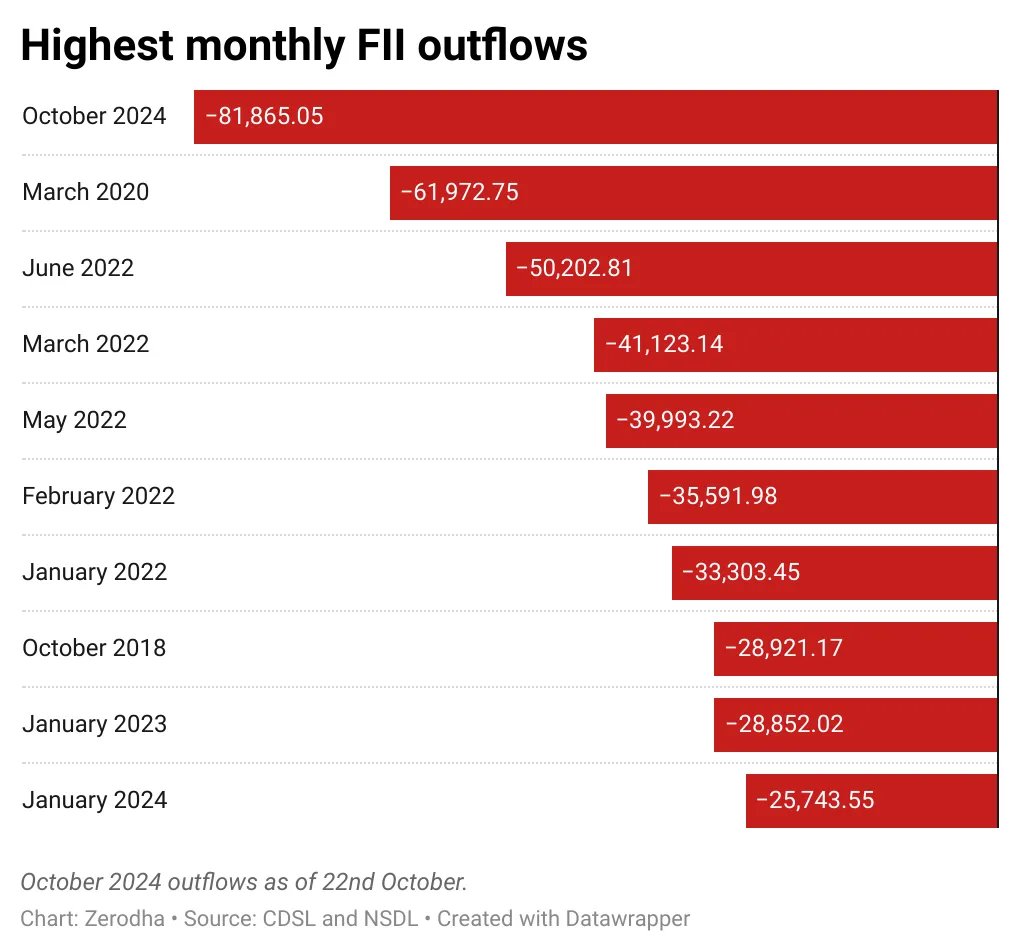

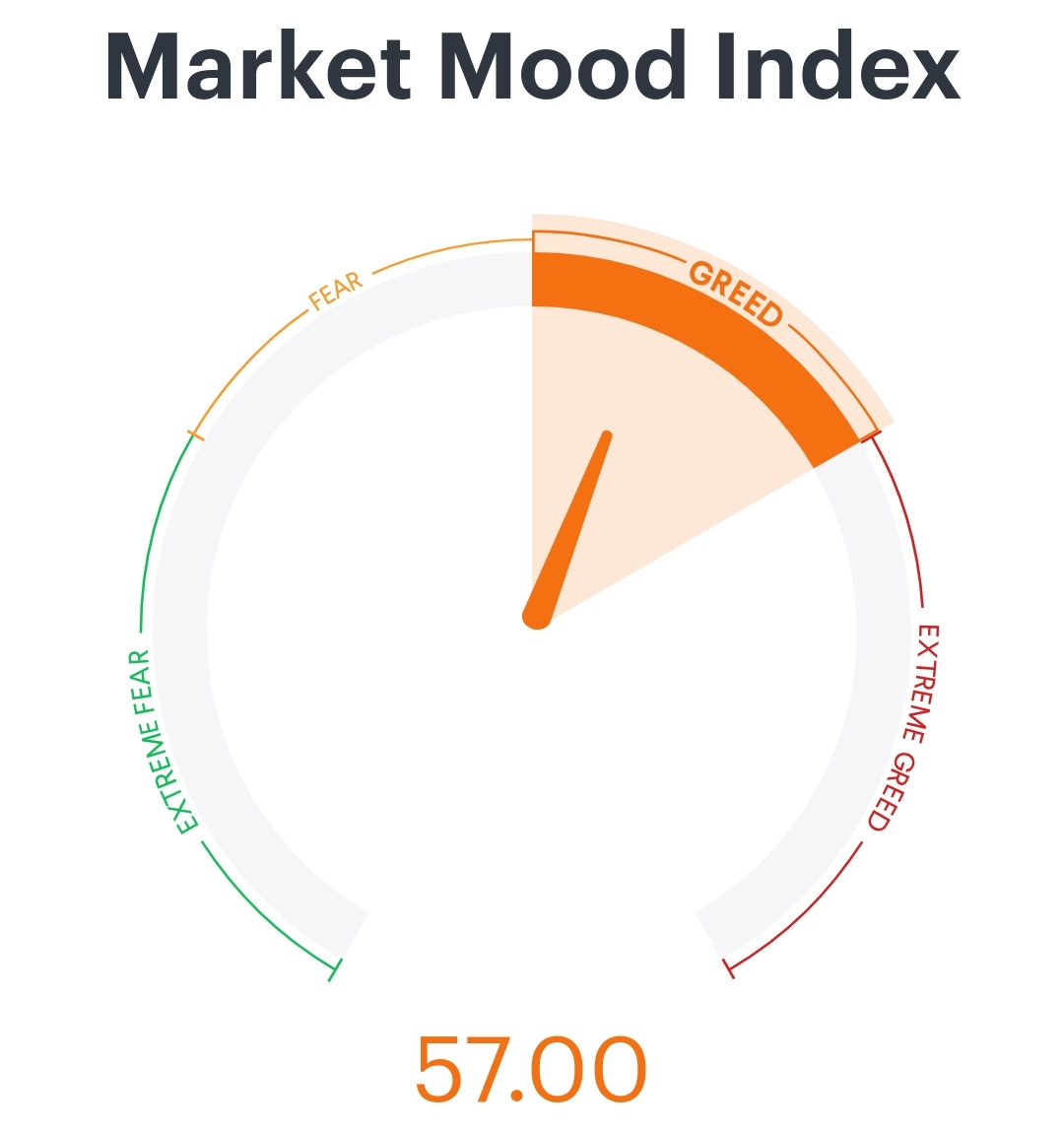

The Market Mood Index (MMI) is currently hovering around 57, which usually points to a bullish setup and potential for some decent upside. But we can't ignore the bigger picture global markets are still full of uncertainties. The US job data didn’t really impress, and there’s still no clear update on the tariff situation. In times like these, it might be tough for the markets to hold on to higher levels for long, especially with FIIs likely to book profits and play it safe.

Replies (4)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.