Back

Rohan Saha

Founder - Burn Inves... • 1m

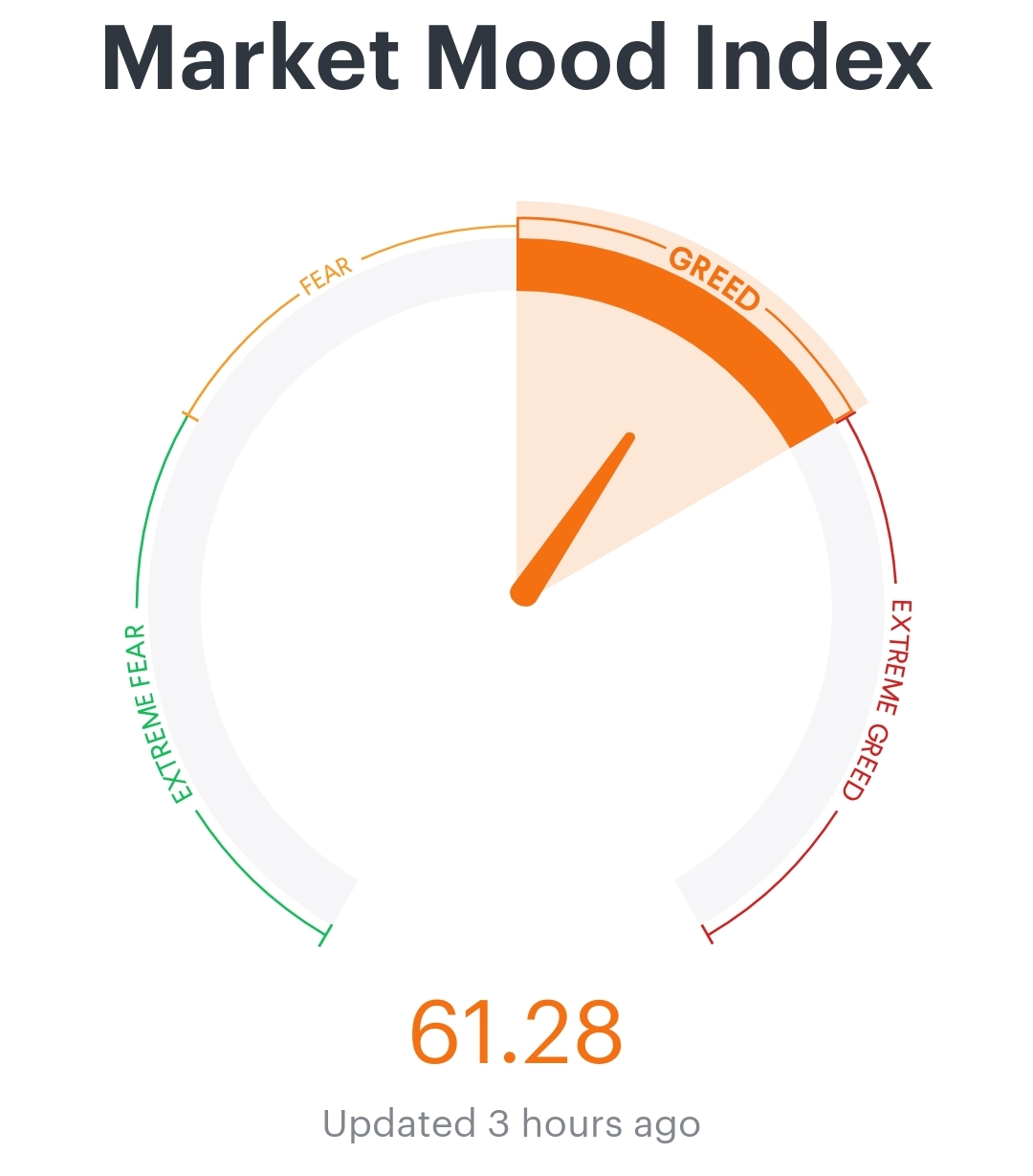

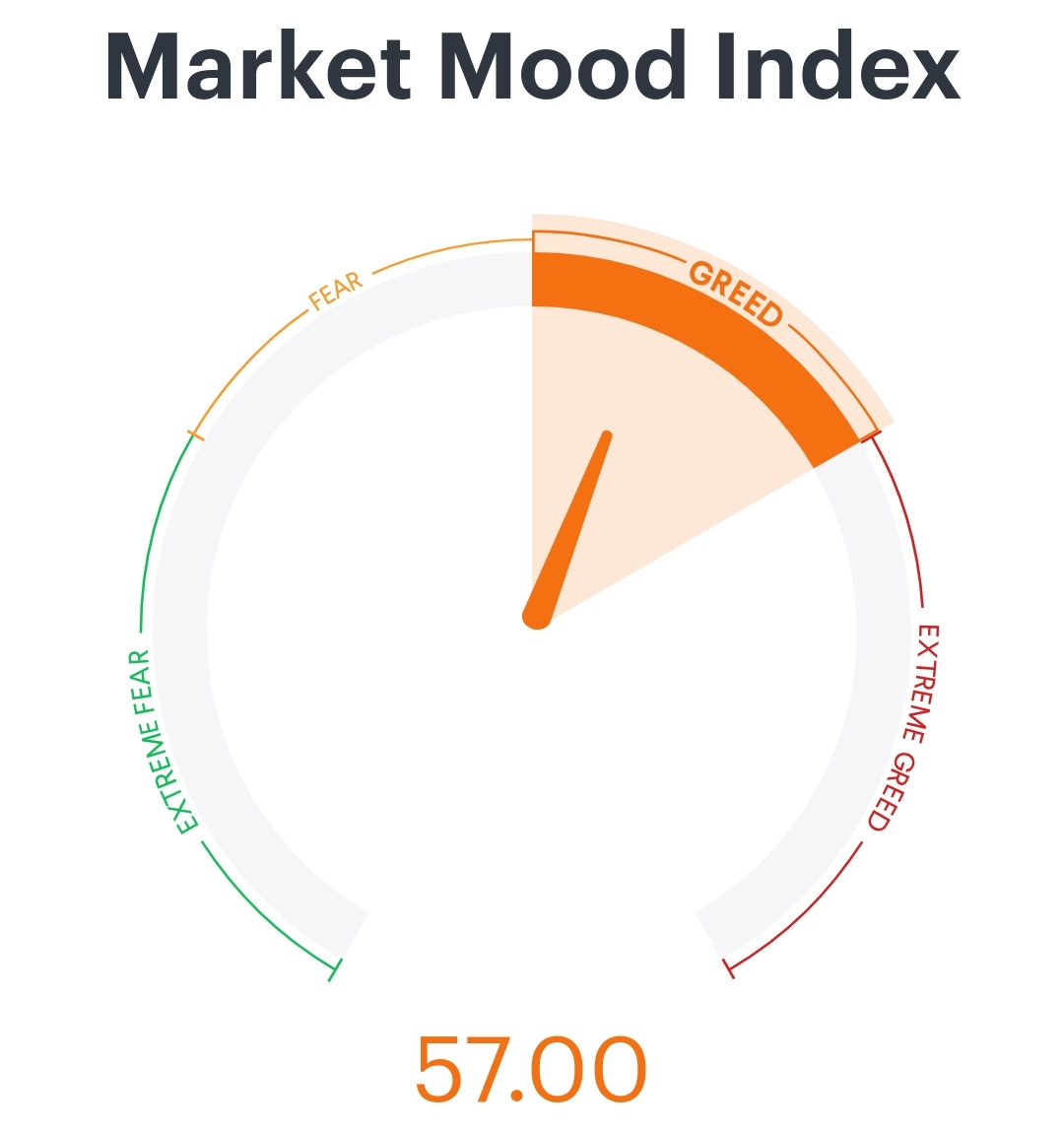

Based on the MMI index and PE ratio of the Indian market, the ongoing war hasn't had a significant impact on our market. This is mostly some profit booking happening right now by FIIs and especially domestic investors. I was waiting for the weekend to get a clearer picture, and things seem to be improving slightly on the geopolitical front. On May 13, 2025, India's inflation rate data is set to be released, which is also something to watch. If the rate comes in around the expected 3.1% or even lower, we might see another rate cut from the RBI.

Replies (4)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.