Back

Account Deleted

Hey I am on Medial • 4m

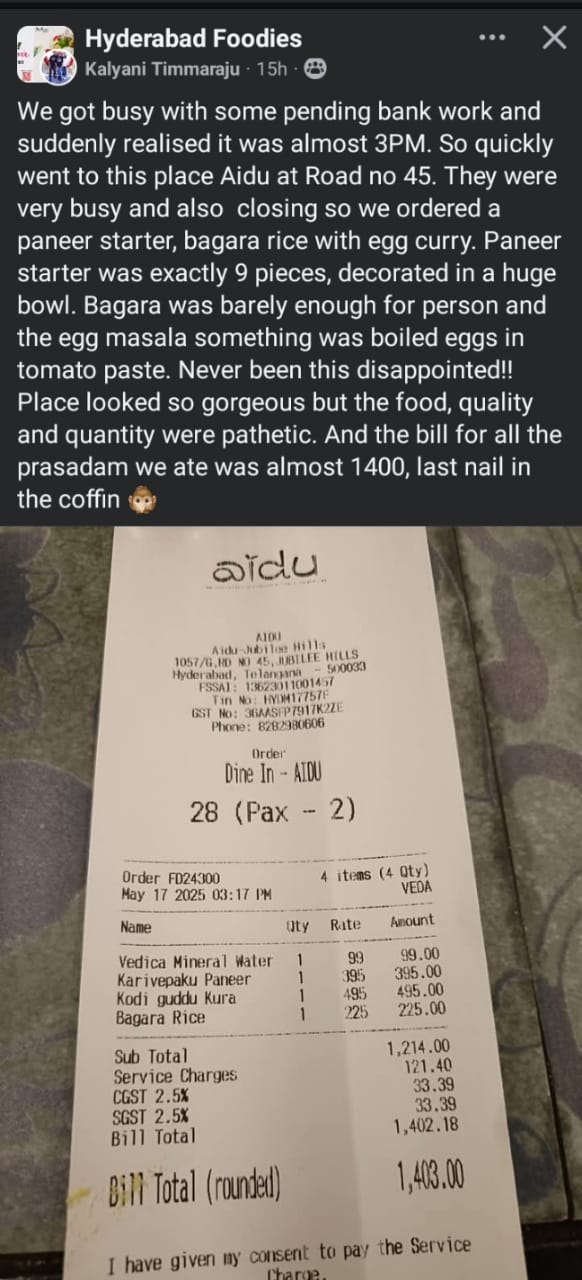

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service charge as well. On total bill round off for .18 they collected 1 rupee over all they charged 7 + 121 = 128 rupees additional.. which means they earn 4500 to 8000 per day additionally without any service

Replies (7)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MoreRahul Sharma

Turning Hello into Y... • 1m

SHOCKING NEWS 🚨 Copies of the 130th Constitution Amendment Bill, UT Amendment Bill, & J&K Reorganisation Bill torn and hurled towards HM Amit Shah 😱 Om Birla forced to adjourn the house. HM Amit Shah has introduced a bill to ensure the removal of

See MoreKishan Kabra

•

Guava Trees Softech Pvt • 1y

For all those E-commerce folks. Let's discuss on this: Digibuddy is new venture their offering to sellers is exceptional, They are offering no commission/charges from sellers, choose your return or exchange policy on own, no gst required for selling,

See MoreCA Kakul Gupta

Chartered Accountant... • 7d

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See MoreDownload the medial app to read full posts, comements and news.