Feed Post

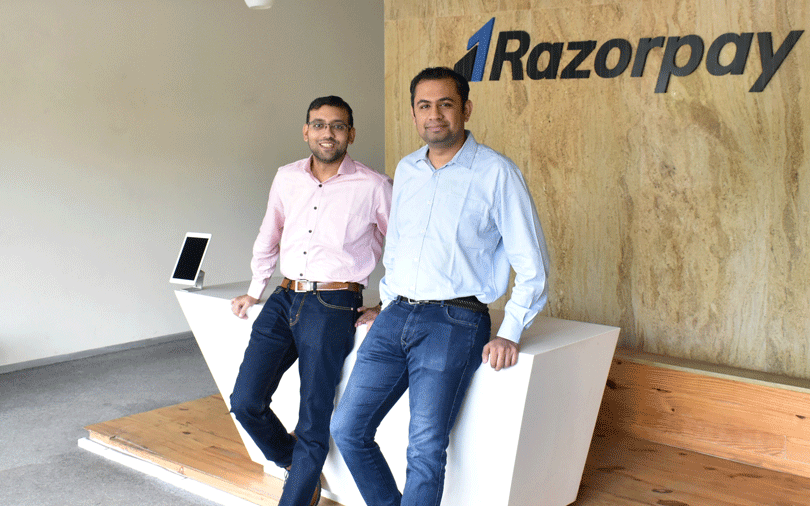

1. Key Startup Funding Highlights Of The Week - Indian startups cumulatively raised $185.8 Mn across 21 deals, a 49% increase from $125 Mn secured via 18 deals in the preceding week - Lightspeed, Peak XV and Elevation Capital backed multiple startups this week - Enterprise tech sector saw the highest number of seven deals materialise this week via which startups raised $46.7 Mn in the week - Despite a windfall of funding at early stages, the Indian startup ecosystem saw one deal materialise at the late stage level. Fintech startup SarvaGram raised the biggest cheque this week, bagging $67 Mn in its Series D round. - While SarvaGram’s fundraise solely took fintech to the top of funding trends at a sectoral level, enterprisetech saw the most number of deals materialise this week. Startups in the sector raised $46.7 Mn across seven deals in the week. - The most active investor this week was Lightspeed, backing edtech Bhanzu, agritech Wheelocity and deeptech Airbound this week. Peak XV and Elevation Capital also backed two startups apiece. - Seed funding remained flat in the week, rising 10% to $5.9 Mn from last week’s $5.4 Mn 2. Updates On Indian Startup IPOs - Swiggy made its public market debut on Tuesday ((November 13), with its shares listing at INR 420 on the NSE, a premium of nearly 8% from its IPO issue price of INR 390 per share. - Shortly after its portfolio company Swiggy made a positive market debut, its largest stakeholder Prosus said that it is exploring an IPO for PayU in India in 2025. - Amid the ongoing IPO boom, B2B marketplace Zetworks is looking to get listed by 2025 in an IPO that will see it raise over $1 Bn. - D2C electronics major bOAt has reportedly finalised ICICI Securities, Goldman Sachs and Nomura as bankers for its $300-$500 Mn IPO slated for next year. - Ahead of market close on Friday, BlackBuck’s IPO saw a muted subscription of 32% for its IPO. The issue will close on November 18. 3. Other Developments Of The Week -Venture capital (VC) firm Pavestone VC marked the final close of its Pavestone Technology Fund at $97 Mn. It is looking to back 8-10 growth stage startups with an average ticket size of $5-10 Mn. - Sandiip Bhammer-led VC firm Green Frontier Capital launched its Green Frontier Capital India Climate Opportunities Fund with a target corpus of INR 1,500 Cr. - Orios Venture Partners’ managing partners Anup Jain and Rajeev Suri launched VC firm BlueGreen Ventures with a $75 Mn fund. The firm will back early-stage and IPO bound startups. - Reliance Consumer Product is acquiring D2C snacking startup TagZ Foods for INR 28 Cr ($3.5 Mn). - Fintech unicorn Razorpay joined forces with Peak XV Partners and Lightspeed to launch a venture investment programme. With this, the trio will be looking to back early stage B2B startups across sectors. - Sanjeev Bhikchandani-led Info Edge will be investing INR 4 Cr in its portfolio company LegitQuest via its wholly owned subsidiary Startup Investments (Holdings) Ltd. - Nazara Technologies and Nikhil Kamath’s WTFund will jointly invest INR 2 Cr in two gaming startups, Norian Games and Xigma Games. - Zomato plans to launch its INR 8,500 Cr qualified institutional placement (QIP) in December, depending on market conditions. - Proptech startup bought 11% stake of Mumbai-based real estate advisory Guardians for $12 Mn. It intends to increase its stakeholding to 50% in the coming three years. - Unicommerce acquired 42.7% stake in Shipway for INR 68.4 Cr and plans on acquiring the remaining stake in Shipway within a year via a merger or stock swap. - Coimbatore based SaaS startup Kovai.co announced the acquisition of US based Floik to enhance its Document360 knowledge management platform. - Online travel aggregator EaseMyTrip’s board approved the acquisition of 49% stake in Planet Education Australia for INR 39.20 Cr and a 50% stake in Jeewani Hospitality Private Limited for INR 100 Cr. Stay Updated. Stay Informed. Stay Ahead. Share the Medial App with your network, colleagues, and friends. Let's brainstorm, discuss together and help each other achieve our goals. And don't forget to rate us on the iOS App Store and Google Play Store to help us reach even more amazing people like you.

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.