Back

Kishan Kabra

Founder & CEO • 1y

No harsh F&O is not only for quick money it's for big money as well with less capital but I've seen people trading in F&O patiently main problem is exiting before target because impatience, that's the prob.

More like this

Recommendations from Medial

Shuvodip Ray

•

Arizona State University • 2m

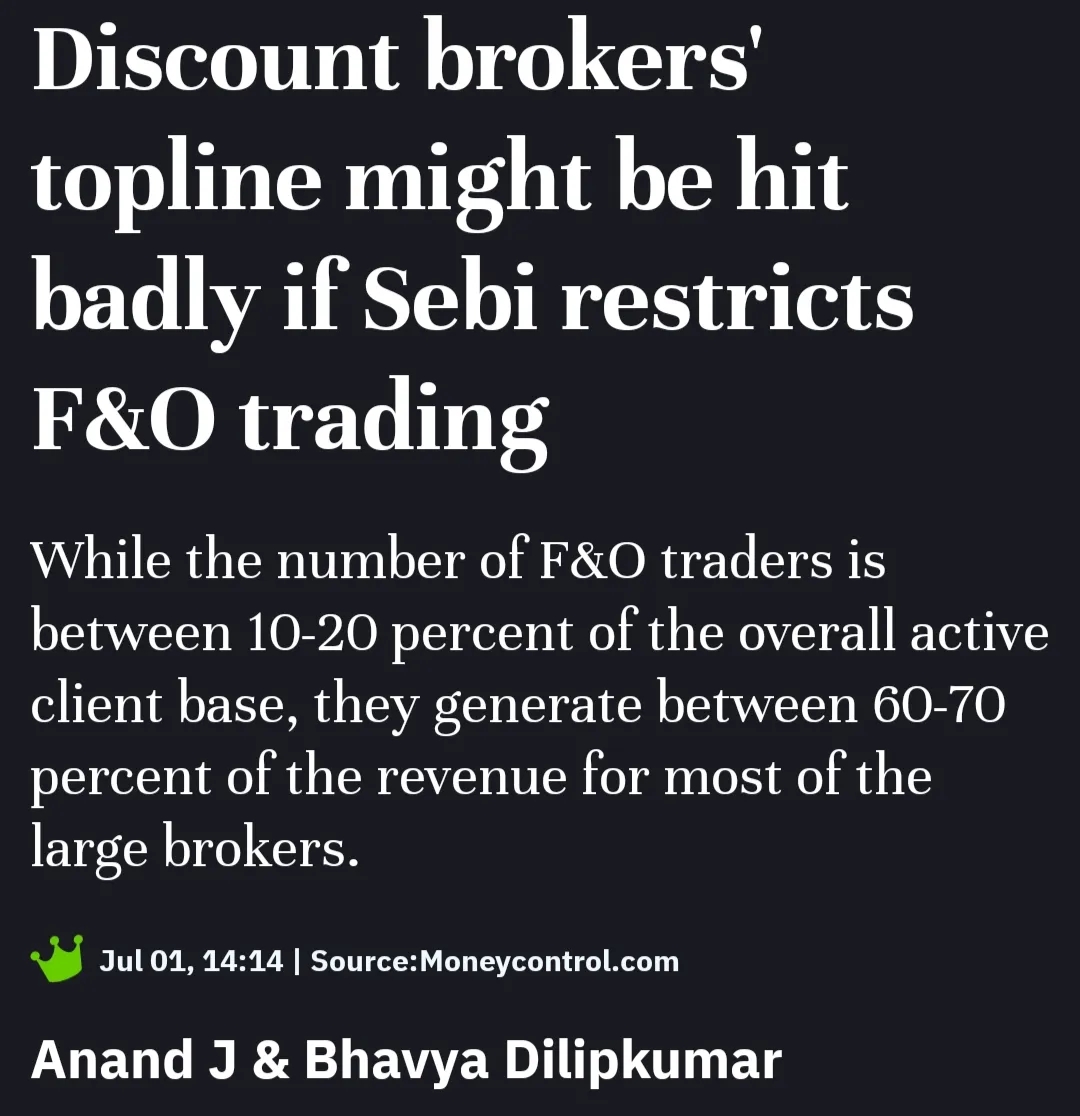

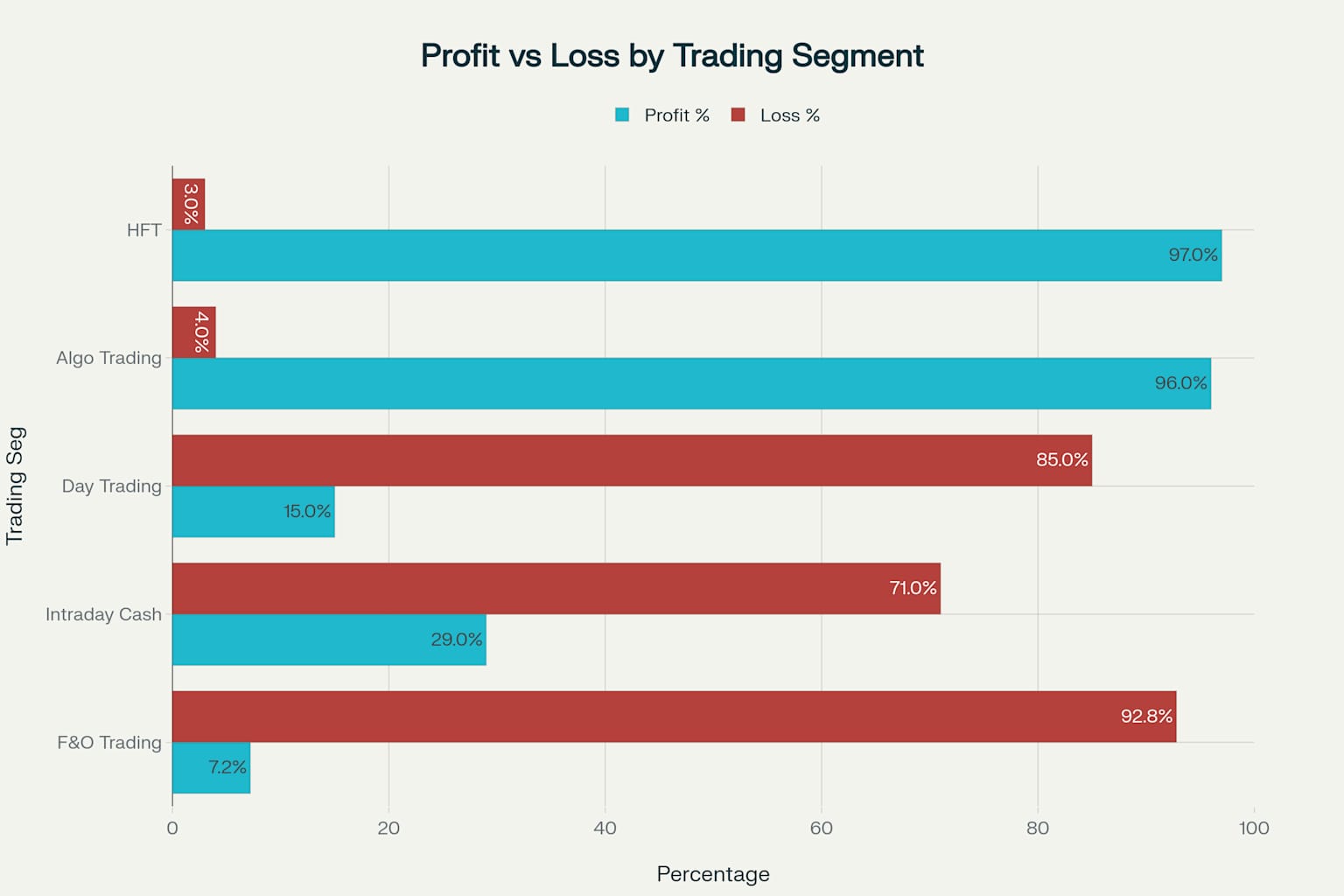

📈Over 90% of retail traders in India lose money, especially in futures & options (F&O) and day trading. >> Who Actually Makes Money? ✅Institutional Traders: Banks, hedge funds, and big firms using algorithms and high-frequency trading. ✅Algorithmic

See More

Shubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See MoreAshish Tiwari

Try again, Fail agai... • 3m

Hi, I'm building SM-Arth — Bharat's first platform focused on responsible and informed Futures & Options and Crypto trading. Here's the problem: According to SEBI, 89% of Indian retail traders lose money. Why? Because they trade without education,

See MoreDownload the medial app to read full posts, comements and news.