Back

Vivek Joshi

Director & CEO @ Exc... • 1m

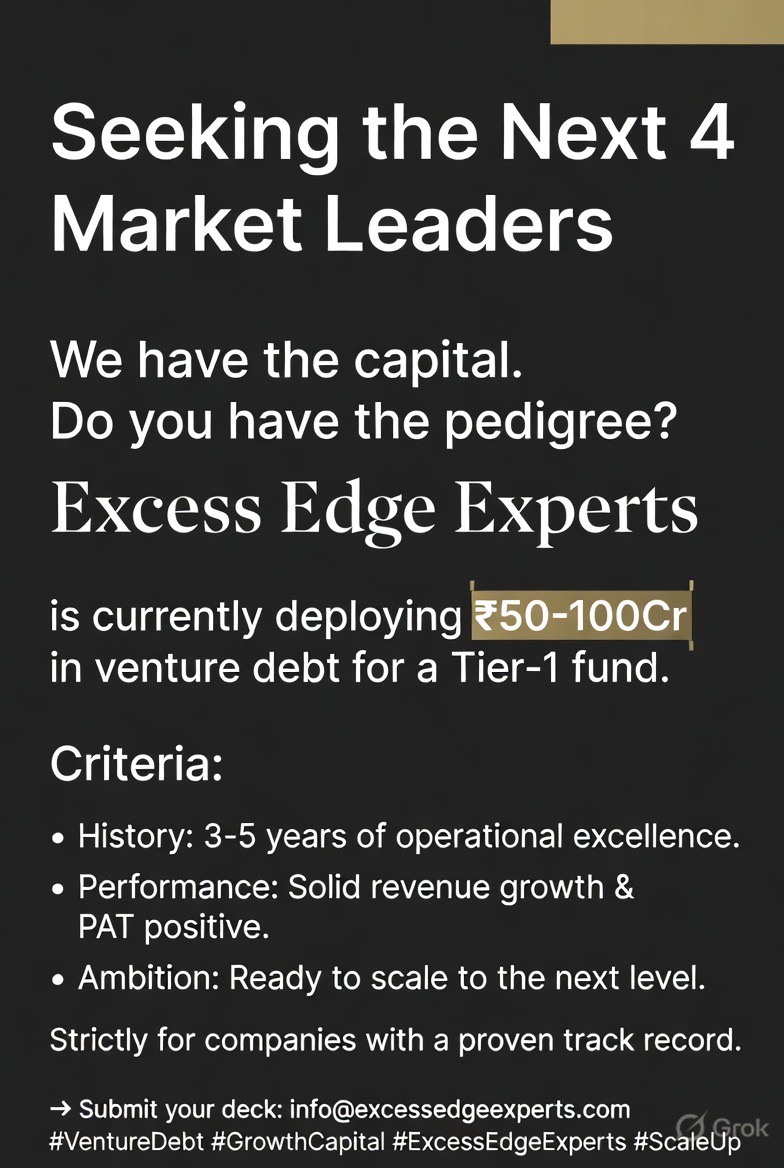

🚀 Seeking ₹50–100Cr Mandates for a Top-Tier Venture Debt Fund @Excess Edge Experts is exclusively scouting 3–4 high-impact deals for a reputed venture debt partner. We are looking for established scale, not just potential. The Criteria: * Ticket Size: INR 50 – 100 Crores. * Track Record: 3–5 years of proven operations. * Financials: Robust revenue with clear PAT positivity. 📥 Ready to scale? Send your pitch decks to: info@excessedgeexperts.com

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 3d

Target: 4 Market Leaders. Capital: ₹50–100Cr. We are placing venture debt call for a Tier-1 fund. Our "Direct & Selective" approach means we only partner with the best. Are you eligible? 1. 3–5 year track record? Check. 2. Solid revenue? Check. 3. P

See More

Vivek Joshi

Director & CEO @ Exc... • 2d

Target: 4 Market Leaders. Capital: ₹50–100Cr. We are placing venture debt for a Tier-1 fund. Our "Direct & Selective" approach means we only partner with the best. Are you eligible? 1. 3–5 year track record? Check. 2. Solid revenue? Check. 3. PAT Pos

See More

Vivek Joshi

Director & CEO @ Exc... • 2d

Target: 4 Market Leaders. Capital: ₹50–100Cr. We are placing venture debt for a Tier-1 fund. Our "Direct & Selective" approach means we only partner with the best. Are you eligible? 1. 3–5 year track record? Check. 2. Solid revenue? Check. 3. PAT Pos

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

Stop searching for capital and start closing it. 💼 Excess Edge Experts Consulting is scouting for only four institutional-grade debt projects. Requirements for Consideration: * Fundraising requirement of ₹50Cr or above. * Demonstrated profitabilit

See More

Vivek Joshi

Director & CEO @ Exc... • 1m

Stop searching for capital and start closing it. 💼 Excess Edge Experts Consulting is scouting for only four institutional-grade debt projects. Requirements for Consideration: * Fundraising requirement of ₹50Cr or above. * Demonstrated profitabilit

See More

atul pingle

Your Tailor designer... • 1y

We planning to start new venture for all those who willing to start Men's Online/offline fashion brand.. Need investment 20 lakhs with 10%equity.. with this venture we are the only one who offering such services.. any one interested can connect. su

See MoreVamshi Yadav

•

SucSEED Ventures • 10m

The Falsehood of Distributions of Founders at Distress Exits: A Lesson for BluSmart Worth ₹850Cr Let's dispel one myth: "Founders make money in acquisitions. Reality Check of BluSmart Raised: ~₹1,300Cr | Last Val: ₹2,700Cr | Exit Val: ~₹850Cr Outs

See MoreNikhil Chaudhari

Venture Partner • 13d

*✅ Needs Funds To Grow Your Business in India & UAE* *Scale up with Unsecured debt funding up to ₹20 crore in < 5 days.* *#Business loan* *#Working capital loan* *#Home loan* *#Private debt funding* *#Loan against property* *🛑We also do large pr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)