Back

Jayant Mundhra

•

Dexter Capital Advisors • 2m

"My money in Meesho Wallet just vanished" - Someone texted me that a week back 😅😅 It sent me down a rabbit hole. I spent sizeable time dissecting the "Wallet" ecosystem, how money expires in some wallets, while it does not in others, and how the legality works here. And what I found? A hidden layer of "rented" licenses and a massive corporate loophole designed to eat your lunch. This is what everyone should know! .. See, to you and me, a wallet is a wallet. You load cash, you spend it. Simple. But to the RBI? There are two very different animals here. - The Real Deal (Full KYC PPI): Think PhonePe, Paytm, Amazon Pay. These guys take your PAN, do video KYC etc. And, this is basically SIMILAR to a bank account. Your money is yours. It cannot be forfeited - The "Gift" Trap (Gift PPI): This is where Tata Cliq, Meesho etc sit. They don't want the headache (or cost) of verifying your identity. So, they issue a "Gift Prepaid Instrument" The catch? RBI rules say "Gift" instruments MUST have an expiry date. Usually 1yr. .. But, Tata Cliq & Meesho don’t even HAVE a wallet license. - And, getting a PPI license from the RBI is a lot of hassle. So these companies use a "Rent-a-License" strategy - They partner with fintech giants like Pine Labs. When you see "Meesho Balance," you are staring at a Pine Labs Co-branded Gift PPI - Pine Labs holds the license and deals with the regulators. Meesho handles the pretty app interface And since it is legally a "Gift Card" issued by Pine Labs, it inherits that strict 1yr death clock. .. And, when your wallet balance expires, that money they owe you: It becomes pure & free profit & revenue on their balance sheet. And just so you know - Meesho isn't the only one playing this game. Pine Labs owns Qwikcilver. - These guys basically run the backend for half of Corp India. If you have used a "wallet" or "gift card" for these brands, you are likely on the same infra - Dominos (Jubilant FoodWorks), Titan & Fastrack, BookMyShow, Croma, MakeMyTrip - and many more They all operate on this "Gift PPI" architecture. .. Good news? The system is rigged, but you can beat it. While RBI says the instrument can expire, Consumer Courts have repeatedly said NOPE regarding the money. Thus, if your balance disappears, do NOT accept it. - Raise a support ticket immediately - Use this script: "I am willing to spend this money on your platform, but you cannot forfeit my funds. Please revalidate the balance or I will approach the Consumer Forum" 99% of the time? They will reactivate it as a "one-time exception." They know that sweet "Breakage" income isn't worth a legal battle they are guaranteed to lose - Many people have shared their personal experience of this. This has been a solid learning affair for me. Did you know this?

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Pine Labs is all time high 📈 • Baron Funds increased its valuation of Pine Labs to $5.8 billion, while Invesco marked the firm's value up to $4.8 billion as of December 2023. • Previously, Baron Funds had valued Pine Labs at $5.3 billion in Septem

See More

Rohan Saha

Founder - Burn Inves... • 1y

why the RBI isn't taking any action against P2P platforms for accepting lenders' money on their own balance sheets. According to RBI guidelines, P2P platforms cannot accept money on their own balance sheet or provide rapid liquidity to any lender, ye

See MoreAshish Singh

Finding my self 😶�... • 10m

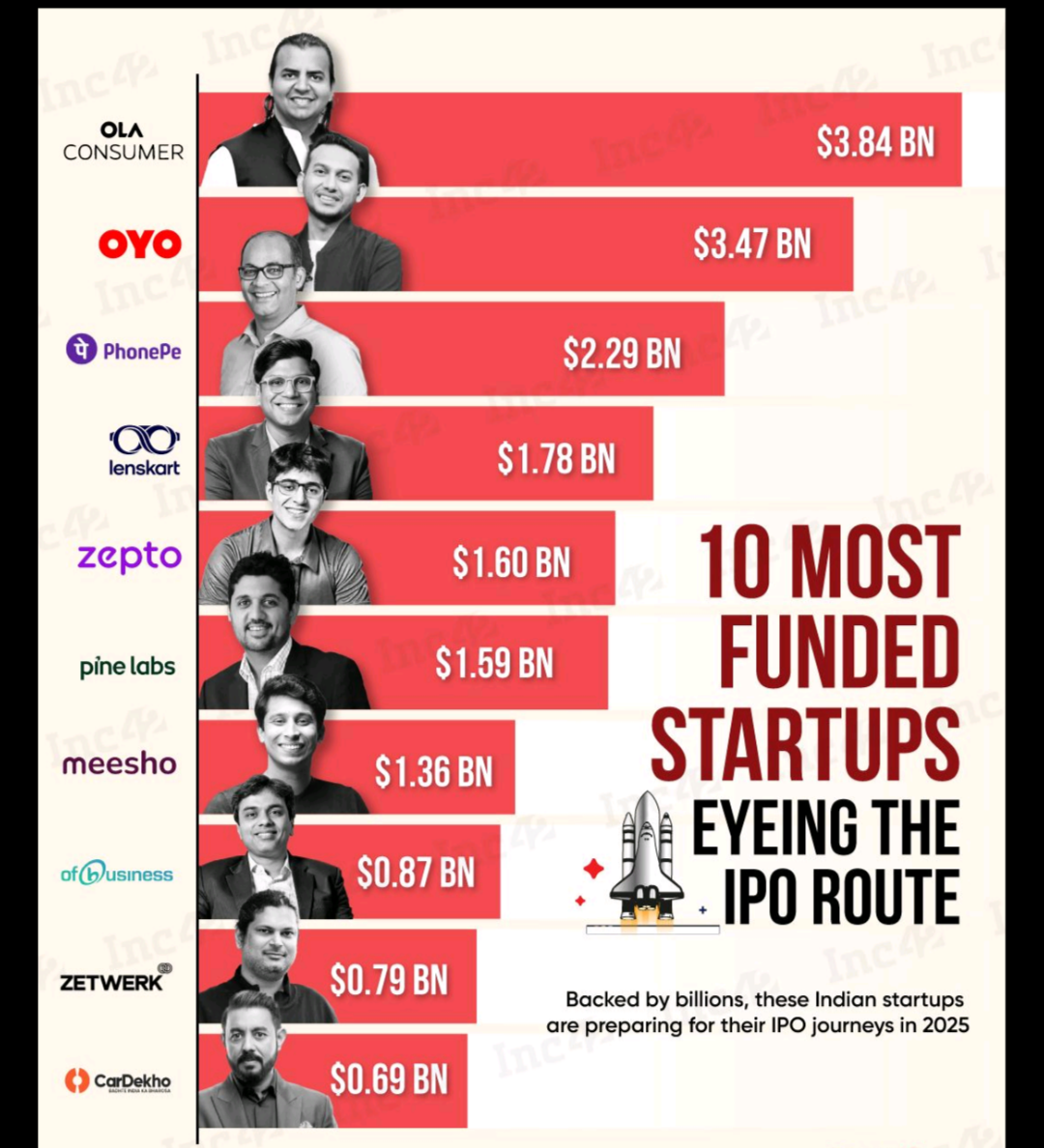

10 Most Funded Indian Startups Eyeing the IPO Route in 2025 these Indian startups are preparing for their IPO journeys in 2025: 1. Ola Consumer – $3.84 Billion 2. OYO – $3.47 Billion 3. PhonePe – $2.29 Billion 4. Lenskart – $1.78 Billion 5.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)