Back

Snehangshu Roy

Polymath • 6m

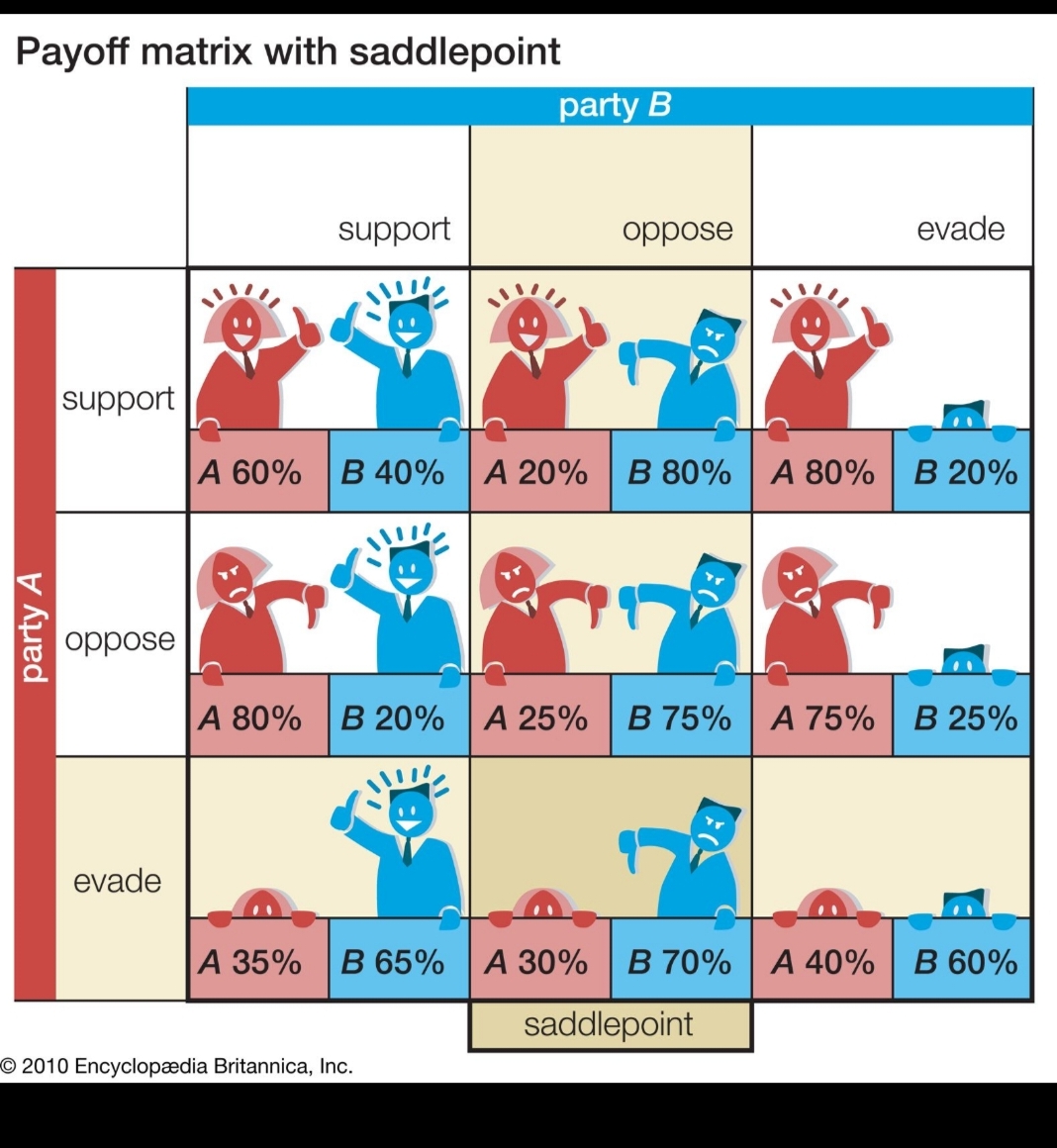

Newton cracked the laws of motion, but not the laws of markets. He lost a fortune in the South Sea Bubble. 🚨 Isaac Newton, one of history’s greatest minds, was badly burned by the South Sea Bubble—his story famously demonstrates that intellect alone can’t protect against crowd-driven market Newton initially invested in the South Sea Company and smartly sold early for a healthy profit in 1720 as the price surged. However, as the mania grew and friends grew vastly wealthier, he fell to “FOMO” (fear of missing out) and reinvested heavily at far higher prices, committing almost his entire fortune. The bubble soon collapsed, wiping out his gains and costing him approximately £20,000—worth millions today If Isaac Newton had access to quantitative finance, variance analysis, and machine learning/AI models, he could have used modern tools to detect the South Sea Bubble’s warning signs, potentially limiting his losses or even profiting. How Quant Finance and AI Could Have Helped Bubble Detection: Machine learning and mathematical models like the Log-Periodic Power Law (LPPLS), along with AI-driven statistical analysis, can spot unsustainable price surges and volatility long before a crash happens. Variance Analysis: These methods allow for real-time monitoring of historical price variance against fundamentals, flagging anomalies and increased market risk—likely alerting Newton to excessive speculation and instability. Risk Management Algorithms: AI could set dynamic stop-loss triggers, portfolio rebalancing, and automated hedging to reduce exposure during times of abnormal volatility, protecting Newton’s gains and minimizing losses. How Newton Could Have Profited Short Selling and Arbitrage: Using AI and quantitative strategies, Newton could have predicted the impending crash and positioned for profit by shorting South Sea stock or exploiting market inefficiencies that were visible to advanced models. Avoiding Emotional Bias: Algorithmic trading based on quantitative signals would replace FOMO and herd instincts, so Newton would act on data, not sentiment—avoiding ruinous reinvestment near the bubble’s peak. Early Warning: Predictive analytics could continuously scan for fraud and market manipulation, identifying risks before the broader public, letting Newton exit early or hedge Emotions, not intelligence, often drive investment decisions: Newton’s sharp analytical mind and advanced math couldn’t prevent him from following the crowd. Even though he realized the risk (“I can calculate the motions of the heavenly bodies, but not the madness of people”), he still succumbed to herd behavior and greed. His experience shows discipline and emotional control matter far more than a high IQ in investing

Replies (5)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 1y

China’s expanded undersea DC to handle 7,000 DeepSeek conversations per second. A new data module was placed in sea waters and connected to the existing underwater data center in Lingshui, south China’s Hainan Province on Tuesday, marking the offic

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30 Biggest Financial Crises, Scandals & Bubbles in History🔻 1. Tulip Financial Bubble (Tulip Mania) https://www.britannica.com/money/Tulip-Mania https://youtu.be/QL5-YbvmYLE?si=xY9W28xGSdxvFlGB 2. South Sea Bubble https://www.britannica.com/eve

See MoreCards Wala

One stop shop for ev... • 3m

In the last week, there were a lot of comments on '#AI is a bubble' from a lot of prominent figures. Not sure about those, but we have built our website using AI and from valuations perspective there could be a bubble, but definitely there is a use

See MoreAshwani Singh

Hey I am on Medial • 1y

Climate Change Impacts: Stories about the effects of climate change on weather patterns, sea levels, and temperatures might be trending. A poll could gauge public awareness of climate change issues and opinions on mitigation strategies. What you want

See MoreAditya Vikram

Hey I am on Medial • 8m

Hi I so my family has a big salt manufacturing facility but i wanted to try rose salt, basically rosé infused salt. It’s enhances the flavour, changes colour, adds antioxidants to salt and completes the nutrition profile, could be done both with pink

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)