Back

Pulakit Bararia

Founder Snippetz Lab... • 6m

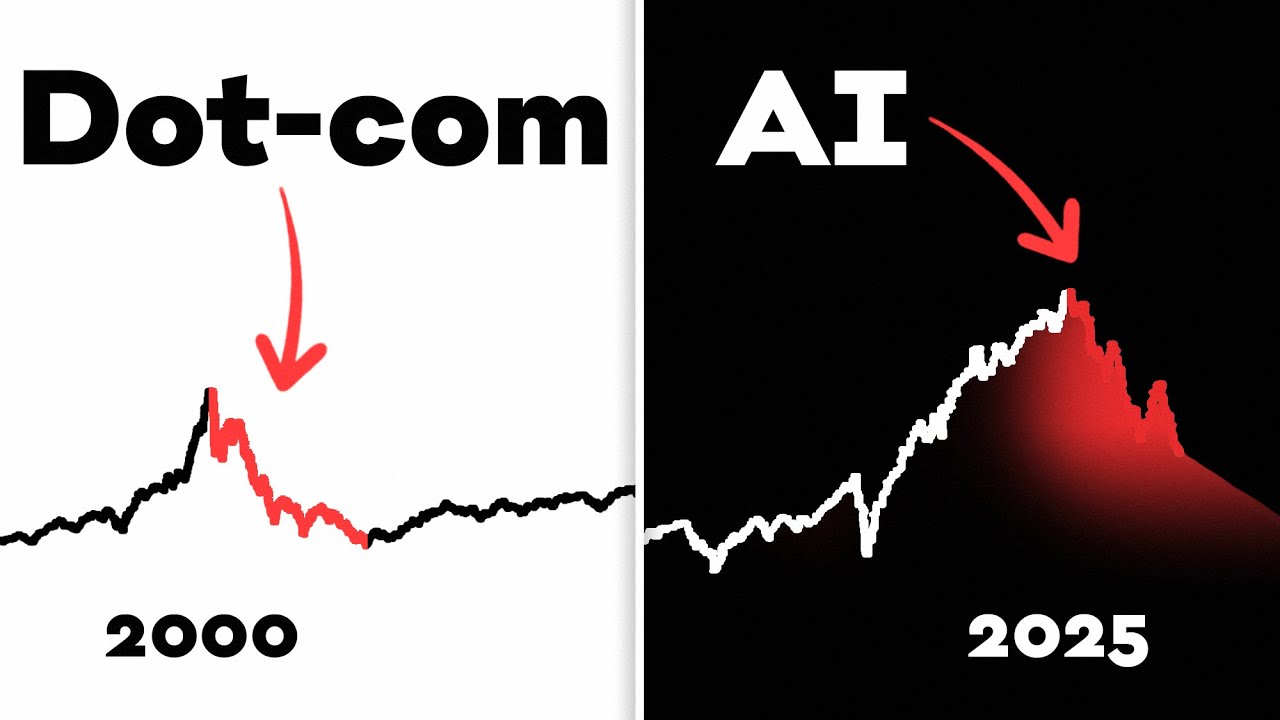

64% of all US venture capital in 2025 has gone to AI startups. Let that sink in for a moment. We're witnessing an investment frenzy that makes the dot-com bubble look measured by comparison. 70% of these funded AI startups still don't generate real revenue, burning through billions in speculative capital. Since ChatGPT's release in late 2022, we've entered an arms race reminiscent of the internet gold rush. But here's what's different about this AI era compared to the dot-com bubble: the capital is primarily private, not retail. Venture capitalists are writing checks to companies with little more than landing pages and AI in their names. This concentration of capital in unproven business models is creating a disconnect between futuristic promises and tangible results. The reality is that generative AI has proven more effective at supporting repetitive tasks than disrupting entire industries. Yet valuations continue to soar based on speculative future revenue that has yet to materialize. Are we building the future or inflating another bubble? The AI era is undoubtedly transformative, but the sustainability of current investment levels raises serious questions about whether we're witnessing innovation or speculation.

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

The dot-com Crisis The .com crisis, or dot-com bubble, was a period of excessive speculation in internet-related companies from 1995 to 2000. Investors poured money into startups with inflated valuations despite many lacking solid business models. Th

See MorePRATHAM

Experimenting On lea... • 5m

The U.S. market is overvalued, with a Buffett Indicator at 217% and P/E near 37–38, close to dot-com bubble levels (P/E - 44). Global markets ( India or China) may outperform the U.S. in the next 5–10 years. FIIs should flow some cash in India as we

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)