Back

Chayan Das

•

ZeroBizz • 6m

🚨 D-Mart vs Reliance Retail: The Ultimate Showdown! 🚨 Stores: D-Mart (415) vs Reliance (19,340) Revenue (Q1FY26): ₹16,359 Cr vs ₹84,171 Cr Net Profit (Q1FY26): ₹772.9 Cr vs ₹3,271 Cr Avg Store Size: 40,000 sqft vs 4,000 sqft Employees: 18,000 vs 207,552 Footfall: 34 Cr vs 140 Cr annually Who’s winning the retail race?

1 Reply

6

Replies (1)

More like this

Recommendations from Medial

DAMALLA PIYUSH NARAYAN

"Building products, ... • 17d

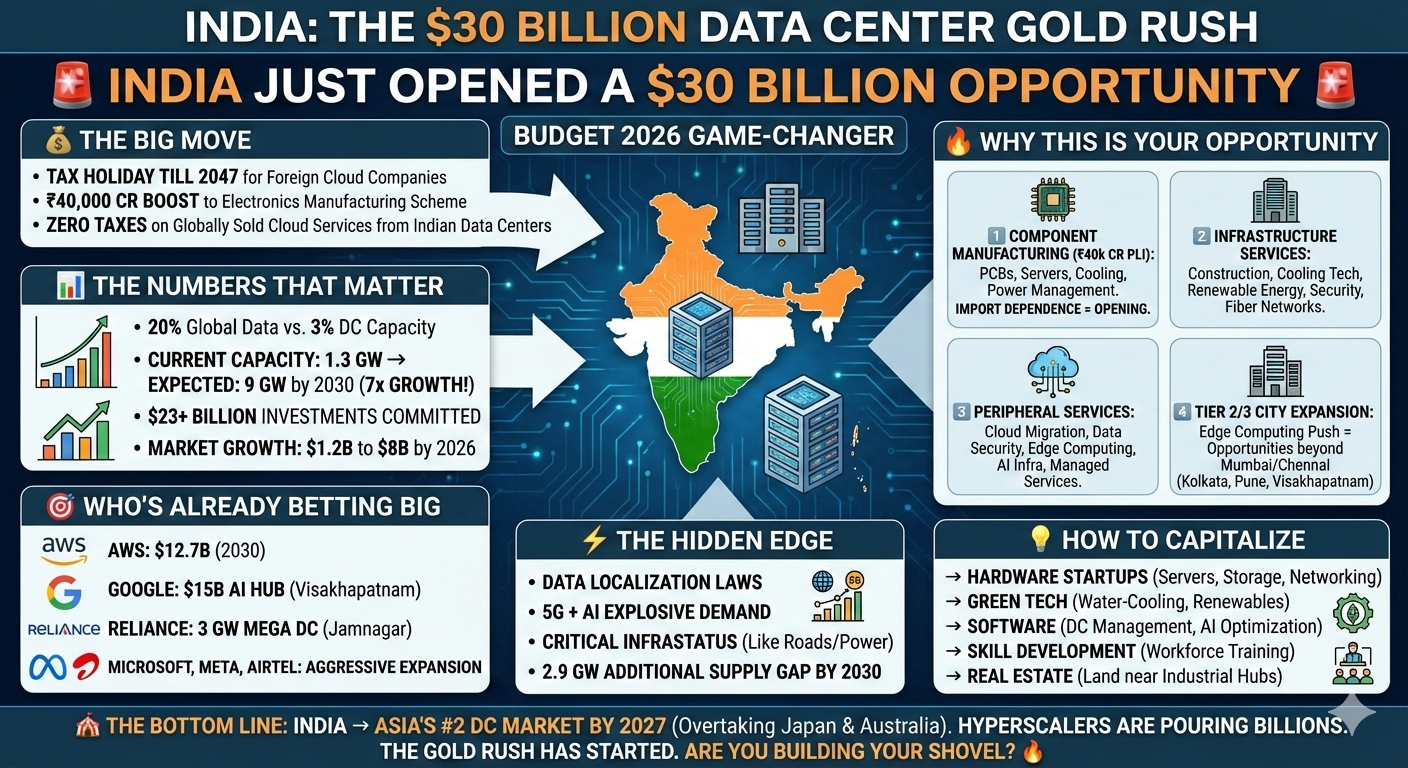

🚨 INDIA'S $30B DATA CENTER GOLD RUSH 🚨 Budget 2026 just dropped a GAME-CHANGER: 💰 THE BIG MOVE: • Tax holiday till 2047 for cloud companies • ₹40,000 cr Electronics Manufacturing boost • Zero tax on global cloud services from India 📊 THE GAP:

See More

Reply

1

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)