Back

Poosarla Sai Karthik

Tech guy with a busi... • 7m

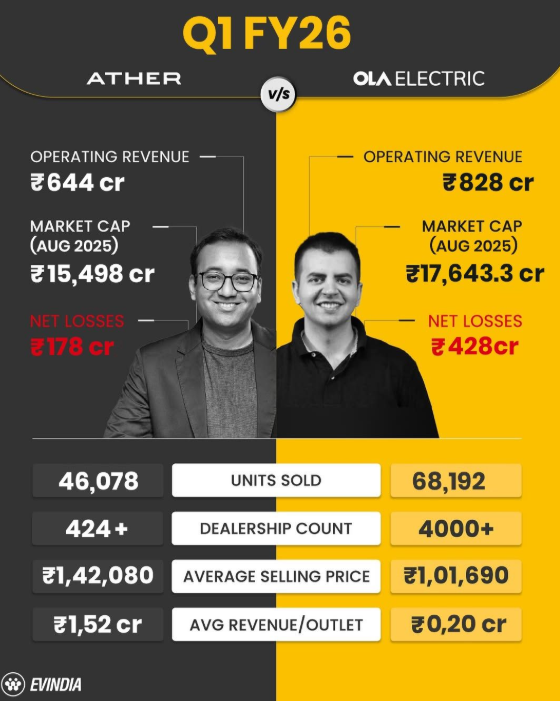

Ola’s Q1 FY26 Ola Electric reported a net loss of ₹428 crore in Q1 FY26, up from ₹345 crore the same time last year. That might sound like a setback, but what actually stands out is the shift happening beneath the surface. For the first time ever, Ola’s auto segment turned EBITDA positive in June. This single milestone signals that the core business can start to sustain itself. Auto segment expenses dropped from ₹178 crore to ₹105 crore per month. At the group level, total operating costs are now ₹150 crore monthly with a target to bring it down to ₹130 crore by the end of FY26. Free cash flow saw a sharp jump, improving from minus ₹455 crore to minus ₹107 crore. That kind of operational discipline has been missing in the past but now it is taking shape. About 80 percent of total deliveries this quarter came from the Gen 3 lineup. These scooters not only carry better margins but have also shown fewer warranty claims. Roadster X is now available in 200 stores and over half of the new buyers are opting for software upgrades. These numbers suggest that Ola’s tech stack and product upgrades are sticking with consumers. Ola has started manufacturing its own 4680 battery cells. The company is aiming for a commercial launch during Navratri and full capacity of 5 GWh by FY27. In addition to cells, Ola is producing its own motors, ABS systems and running its MoveOS software stack. The goal is simple—reduce dependency, lower cost, increase control and protect margin. The shareholder letter this quarter was unusually transparent. Ola laid out targets and progress across margins, costs, products and operations. Bhavish Aggarwal said the update was intentionally detailed so investors could model the business more clearly. That kind of clarity has helped keep long-term investors engaged. Despite the headline loss, Ola’s stock gained around 15 to 20 percent post results. That does not happen unless the market sees signals of future stability. Profitability is not around the corner yet. But for the first time in a while, it looks possible.

More like this

Recommendations from Medial

Mahendra Lochhab

Content creator • 1y

Ola Electric reported consolidated loss of ₹564 crore for the Q3Fy25 as compared to ₹376 crore posted in the year-ago period. The company's revenue from operations stood at ₹1,045 crore, down from ₹1,296 crore reported in the corresponding quarter of

See More

Yash Barnwal

Gareeb Investor • 1y

A tweet criticizing Ola Electric led to a 6.18% drop in its shares, wiping out ₹3,625 crore from its market value within two hours. This followed a public spat between Ola's CEO Bhavish Aggarwal and comedian Kunal Kamra, who criticized Ola’s scooters

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)