Back

Rohan Saha

Founder - Burn Inves... • 7m

Alternative Investing: The New Scam in a Suit? Once upon a time, scams looked shady. They came with fake calls, suspicious emails, and too good to be true promises. But today, things have changed. Now scams wear suits speak perfect English and come with glowing websites and influencer shoutouts. They look professional they look modern and they are calling it the future of investing. This new face of money is being sold to people as alternative investing a smarter way to grow your money a fresh option outside the boring world of mutual funds and FDs. You open the app, and suddenly, you can invest in everything from preIPO shares to office laptops, luxury villas, and startup loans. It feels exciting you feel early It feels like you are doing something smart but pause for a second and look closely. Most of these platforms are not backed by regulators. There is no safety net if things go wrong no SEBI, No RBI, Just legal terms buried in fine print and a lot of smooth marketing that makes it sound safer than it really is. There are real stories behind this a young professional put her savings into a property deal where she thought she owned a part of a villa, months passed No rental income when she tried to exit, she found out she didn’t legally own anything at all just a document with big promises. Another person invested in a startup loan deal through a platform that promised twelve percent returns. The company defaulted the platform said they are not responsible and the money Gone. These platforms don’t lose when you lose they make money when you invest their goal is not to grow your wealth. It’s to grow their business, and your money is just the fuel. So what should you do Slow down, Ask simple questions, Who runs this platform, Is it registered, Where is the money going, What if the deal fails, Can you get your money back, Are you investing because it feels safe or because it looks cool. The truth is, not every new thing is good And not every good thing is right for everyone.

Replies (4)

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See More

Anonymous

Hey I am on Medial • 1y

My mom has an unhealthy obsession for SIPs! We recently taught her how to use PhonePe. They opened an SIP. Next we know whatever little money she gets hold of she ends up putting in the SIP ☹️ When I encountered her she said that she had profited

See MoreRavi Handa

Early Retiree | Fina... • 6m

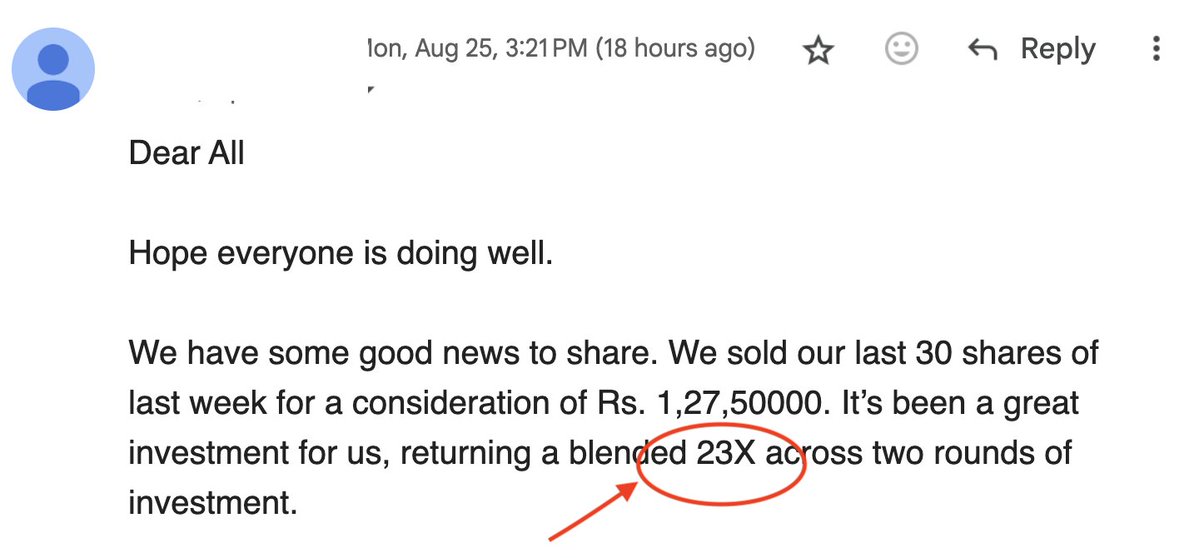

nvesting in Indian startups doesn't work often. But when it does - it gives 23X returns 😁 To learn more about Angel Investing join my Rs 2300 angel investing masterclass. Read Below. . . . . . You dumb idiot! You will get scammed one day. This

See More

Three Commas Gang

Building Bharat • 1y

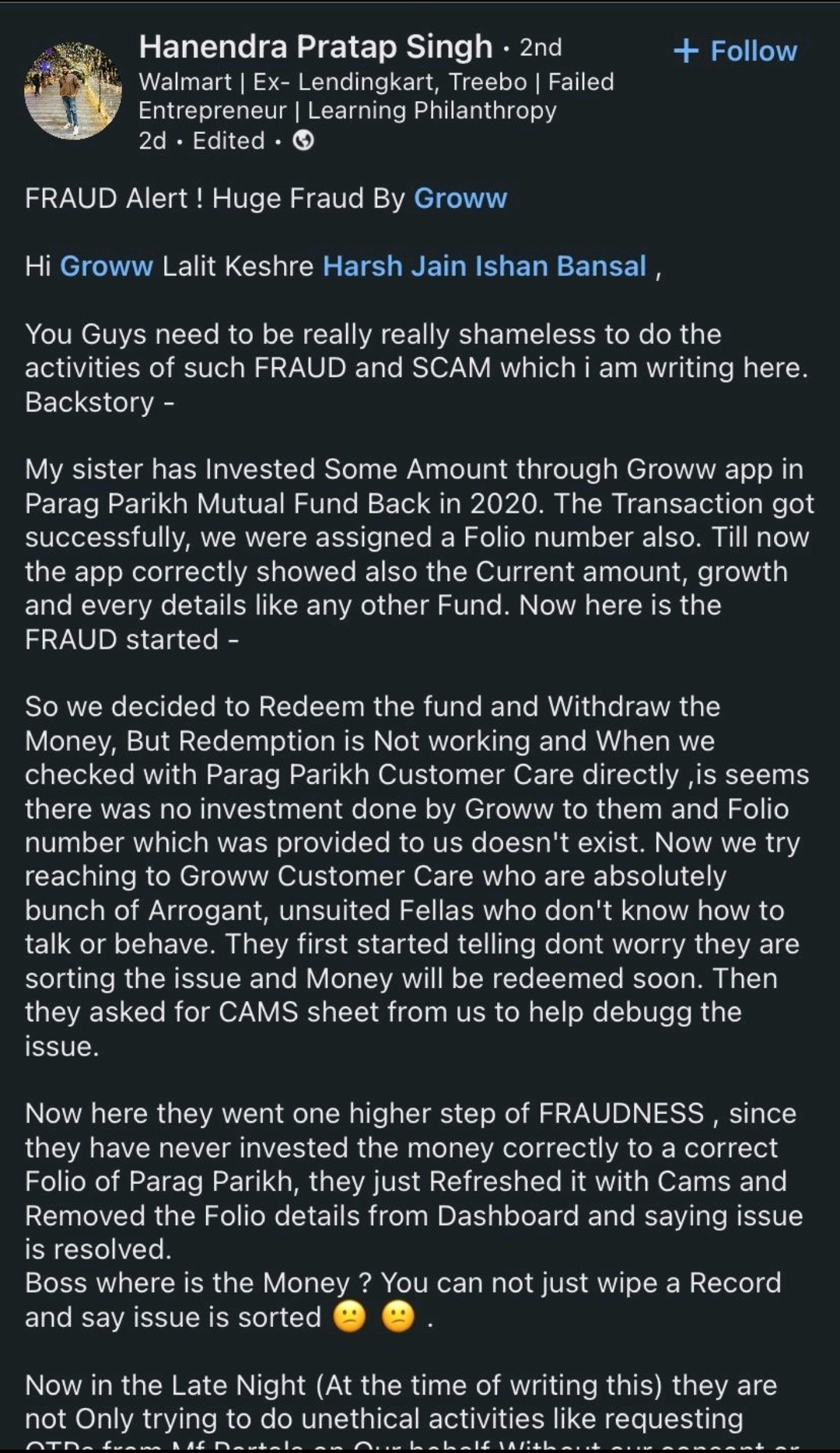

Groww just made a mess! Instead of investing the money apparently they created a fake folio! This is scary. And worst of all, it is alleged that instead of issuing an apology, they are demanding the post to be deleted. Did this give the necessary n

See More

Himesh Jain

Chasing for infinity • 1y

Story from " One thousand ways to make 1000 dollars" book The story is about a woman who was trying to earn some extra money and noticed that there's a demand of hatpins in the market but the price in the market is high. So she found a opportunity

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)