Back

IncorpX

Your partner from St... • 7m

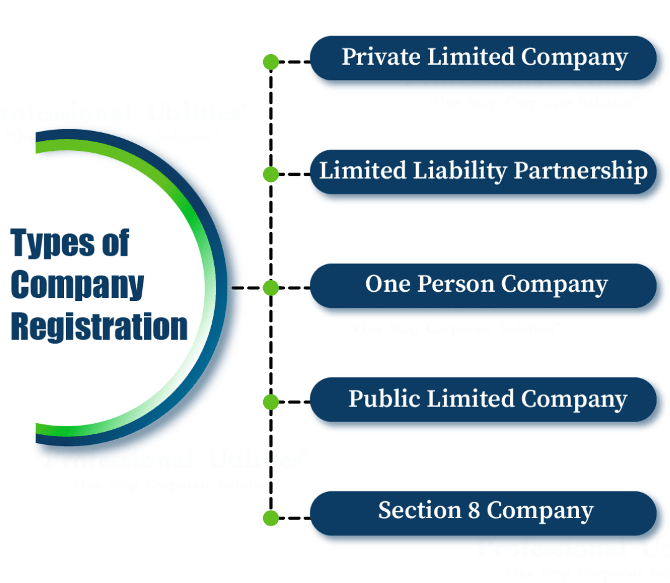

If you with a business idea which can be scaled immediately we suggest to choose private limited, reason being you can raise funds, apply for government schemes etc. For private limited you have to pay only 25% of your profits as tax. If you are at an idea stage and wants to test your product, go ahead with sole proprietorship. The tax rate will be based on income tax individiual tax slabs. Need more info or expert guidance, feel free to reach out to us. Best Regards, Team IncorpX

Replies (1)

More like this

Recommendations from Medial

Aanya Vashishtha

Drafting Airtight Ag... • 10m

"Sole Proprietorship vs. Private Limited— Imagine this: You’re launching your dream business. You’ve got the idea, the drive, and maybe even your first few clients. But then, the big question hits you— "Should I register as a Sole Proprietor or a

See More

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)