Back

Anonymous 1

Hey I am on Medial • 9m

This is exactly how small businesses get destroyed by IT raids. Company revenue MUST flow through company accounts. GST and income tax are legal obligations, not optional expenses. Your partner's "competitive pricing" logic will land you both in serious legal trouble.

More like this

Recommendations from Medial

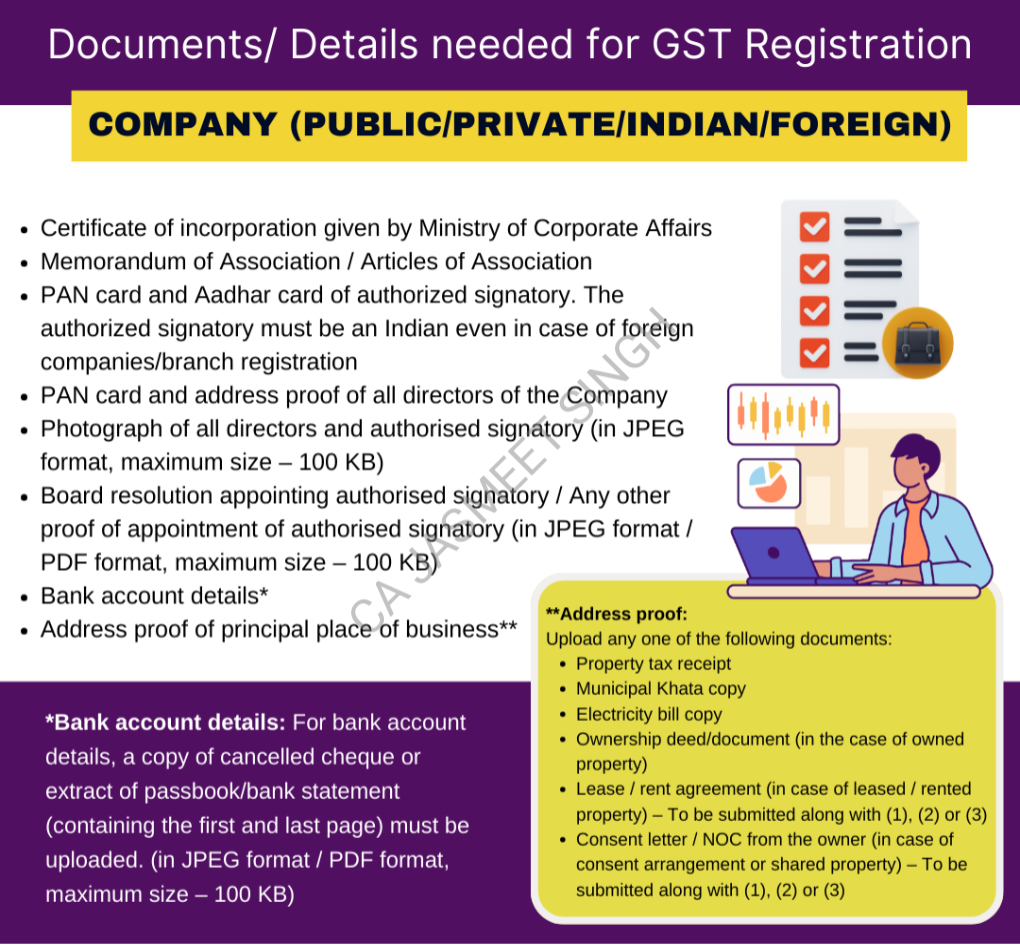

CA Jasmeet Singh

In God We Trust, The... • 11m

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Account Deleted

Hey I am on Medial • 1y

Italy Fines OpenAI €15.58M for GDPR Violations, first major GDPR penalty against a AI company in Europe. Key Violations : - Processing users' personal data for ChatGPT training without adequate legal basis -Violating transparency principles and i

See More

Tushar Aher Patil

Trying to do better • 1y

Day 8 About Basic Finance and Accounting Concepts Here's Some New Concepts In finance, Liabilities represent obligations or debts that an individual or organization owes to others. They indicate an outflow of resources, either cash or services, that

See More

shubham kaushal

Building EveOut • 1y

Preparing My Tech Startup for Production Release – Need Guidance I'm gearing up for the production release of my tech startup and need some guidance on a few key areas: Company Registration: How did you get your company registered? What steps did y

See MoreSantanu Bej

🚀Innovative Softwar... • 9m

I'm seeking advice from the professional community. My 50:50 partner and I have a registered private limited IT services company with a company account. We're having a disagreement on where to store our revenue. My partner suggests storing revenue i

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreTushar Aher Patil

Trying to do better • 1y

Day 10 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Contingent Liabilities Contingent liabilities are potential obligations that may arise depending on the outcome of a future event. These liabilities are not always guar

See More

richa joshi

Startup Legal Strate... • 5m

Startups rarely die because of competition. Most die because of avoidable financial mistakes. The worst one I have seen- 👉 Mixing personal & buisness money 👉 Ignoring Taxes 👉 Burning cash on vanity expenses 👉 Bad or missing contracts 👉 Legal c

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)